US Jobs Keeping the USD and Economy Afloat

The US jobs numbers have been quite strong, indicating that the labor market is strong while unemployment remains low, which supports USD

The US jobs numbers have been quite strong, indicating that the labour market is strong. This sector has been one of the strongest for the US economy which has been helping to keep it from falling into recession in a period when prices and interest rates have been increasing at an incredible pace.

The unemployment claims report released yesterday beat expectations of 218K, coming at 201K, down from 213K in December. The US Dollar was retreating lower during the European session, but made a reversal after the Unemployment claims report and gained around 50 pips, indicating that employment is a strong factor for the USD.

Weekly US initial and continuing jobless claims data

- Initial jobless claims 201K versus 218K expected

- Prior was 212K (revised to 213K)

- Four-week moving average 212.25K vs 218.5K prior

- Continuing claims 1.862m vs 1.895m prior

The argument that laid-off workers are less inclined to file for jobless benefits due to historically low payments and relatively abundant job opportunities suggests underlying resilience in the labor market. This sentiment is reinforced by the upcoming non-farm payrolls survey, which is anticipated to reflect strength. As a result, the US dollar has gained further support, reflecting optimism about the health of the economy and potentially influencing market expectations regarding future monetary policy actions.

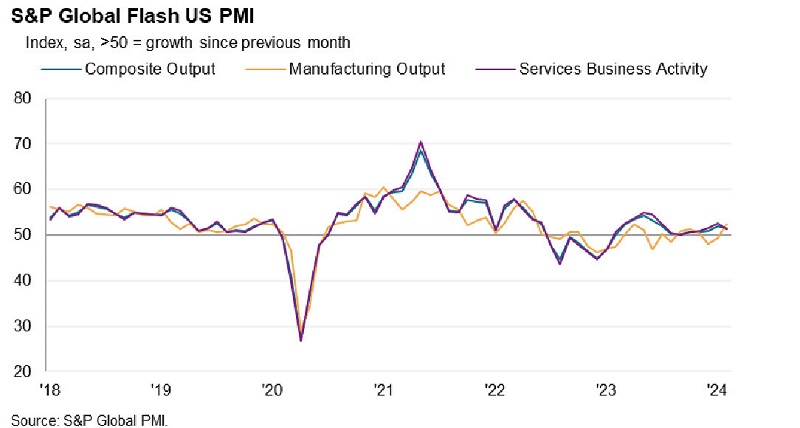

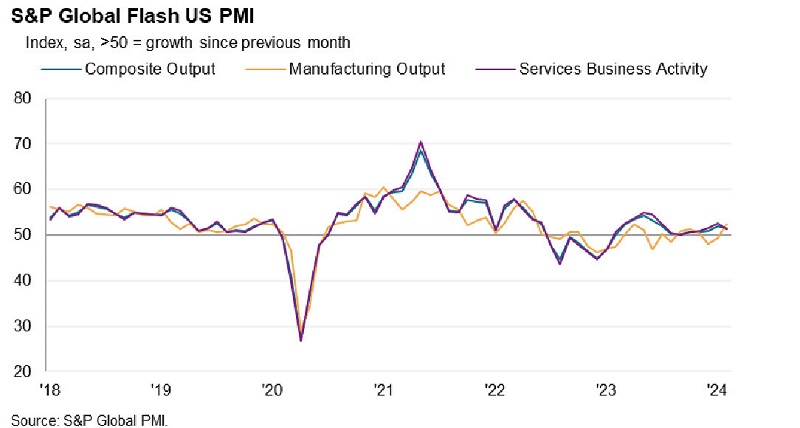

S&P Global Services and Manufacturing PMI Report for February 2024

- The final S&P Global services PMI for February 2024 came in at 51.3, slightly below the expected value of 52.0. However, it showed improvement compared to the preliminary reading of 50.7 from last month.

- Manufacturing, the final PMI for February was 51.5, surpassing the expected value of 50.5. This indicates expansion in the manufacturing sector, with an improvement from the prior reading of 50.7.

- Composite PMI, which combines both services and manufacturing data, stood at 51.4, slightly lower than the previous figure of 52.0. Input prices experienced a rise, albeit at the weakest pace since October 2020.

- The rate of cost inflation slowed down for both manufacturers and service providers. Additionally, the overall increase in output charges was historically subdued, marking the second-slowest rate since June 2020.

Despite the lower-than-expected readings, the fact that both the industrial and service sectors are still above the 50 point threshold indicates expansion in this sector, albeit at a slower pace. However, the dovish remarks on the inflation outlook from the survey could impact the US dollar, as they suggest a cautious approach by policymakers towards potential inflationary pressures. This could influence market expectations regarding future monetary policy decisions by the central bank.

EUR/USD LIVE Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account