The CAD Feeling Weak Despite Lower Canada Trade Deficit

Trade deficit has been declining in Canada, and today the trend continued, but the CAD to USD rate didn't reflect much, as USD/CAD trades...

Trade deficit has been declining in Canada, and today the trend continued, but the CAD to USD rate didn’t reflect much, as USD/CAD trades around 1.3570. There was a surge earlier which sent the price above 1.36, but buyers couldn’t keep this pair above there for too long and now USD/CAD has retreated 30 pips lower.

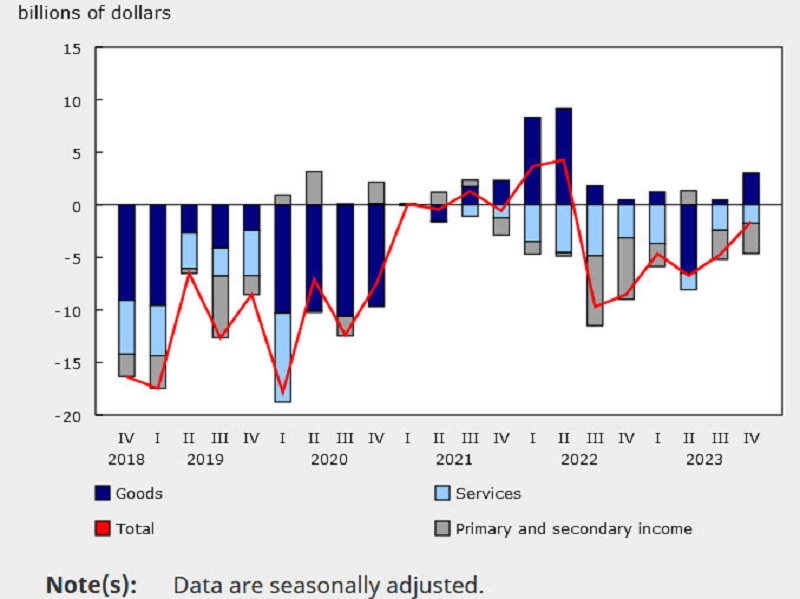

Canadian Q4 Current Account Report

- Canada’s Q4 current account deficit was reported at -1.62 billion, higher than the expected -1.25 billion. The previous figure was revised to -4.74 billion from -3.22 billion.

- The trade in goods and services balance showed a $1.2 billion surplus in the fourth quarter, a significant change from the third quarter’s deficit of $2.0 billion. Exports of goods increased by $2.9 billion to $195.0 billion, while imports rose by $0.3 billion.

- The investment income balance shifted from a slight deficit in the third quarter to a slight surplus of $112.0 million in the fourth quarter.

- Portfolio investments resulted in a net outflow of funds from the economy amounting to $21.5 billion in the fourth quarter.

- For the entirety of 2023, the current account balance registered a deficit of $17.8 billion, marking an increase of $7.4 billion compared to 2022.

Overall, the data suggests a mixed picture for Canada’s current account, with improvements in trade balances partially offset by shifts in investment income and portfolio investments. Yesterday the Canadian dollar experienced a decline and continued to weaken, which was reflected in the USD/CAD pair, as it kept rising earlier today as well. The pair surpassed the 1.3600 level, reaching as high as 1.3605 before encountering resistance from sellers. Subsequently, a move below the high price from two weeks ago at 1.3585 intensified selling pressure.

As long as USD/CAD remains above the 100-day moving average and the high of the swing area below 1.3545, buyers are expected to maintain control. However, a break below that level could disappoint buyers who entered the market following the upward breakout.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account