The New Zealand Dollar Comes Down Crashing After The RBNZ Spark Concern!

The New Zealand Dollar is witnessing the highest level of volatility in the currency market during this morning’s Asian and session. The lowest spreads and strongest price movement can be seen on the NZDUSD amongst NZD-based pairs. The exchange rate is trading at its lowest price since February 16th after the NZD collapsed. Over the past 11 hours, the NZDUSD has fallen 1.24% primarily due to the dovish tone taken by the Reserve Bank of New Zealand and its Governor. The RBNZ kept their interest rate at 5.5% for the fifth consecutive month. However, the governor advised there is still upward pressure on inflation even though the economy is weakening.

Among the top 10 most traded currencies globally, New Zealand stands out with the highest inflation rate and the weakest economic growth. The Reserve Bank of New Zealand’s dovish stance provides relief for locals and has the potential to bolster the economy. However, for the currency, this exacerbates existing pressures. The country’s economic frailty is particularly evident in the employment sector, where the unemployment rate has surged from 3.2% to 4.00%. Additionally, the Gross Domestic Product Growth Rate currently registers at -0.6%.

The Reserve Bank of New Zealand

The Reserve Bank of New Zealand (RBNZ) opted to maintain interest rates at 5.50%, yet investors’ primary focus shifted to the subsequent remarks. During the press conference, Governor Mr. Orr conveyed a message of firm consensus, stating that the current official rate is deemed adequate. Consequently, the economy persists in its unattractive state, marked by feeble data, and any prospects for another rate hike are now deemed improbable. Consequently, demand has experienced a notable decline in the interim.

The RBNZ also spoke about the mixed prospects for economic growth in China, which remains one of New Zealand’s main trading partners in the region. If the Australian and Chinese economy continue to show signs of strain, the New Zealand economy may also feel the ripple effect. The Australian economy is not yet witnessing a decline in GDP like New Zealand. However, their GDP Growth rate is dropped four consecutive quarters.

The US Dollar Index – All Eyes On The US GDP Release!

On the flip side, the Dollar is experiencing a modest uptick in demand following the release of weaker economic data on Monday. The subdued data sparked a decrease in market risk appetite, providing support for the Dollar. Investors are now apprehensive about whether the US GDP figure will indeed meet expectations of +3.3%, given the relatively weak performance of certain indicators. Durable Goods Orders plummeted by 6.1%, Core Durable Goods declined by -0.3%, and CB Consumer Confidence fell instead of remaining steady at 114.8. As the day progresses, market sentiment will continue to be swayed by commentary from the RBNZ, alongside the eagerly anticipated Preliminary GDP reading for the US.

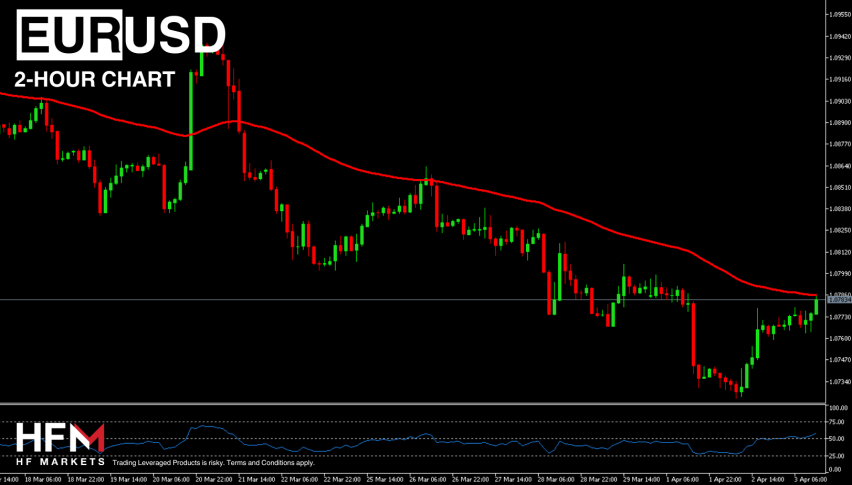

The US Dollar Index trades 0.16% higher as we approach the US session open. From a technical standpoint, the majority of indicators signal a downward price trend, aligning with the prevailing bearish momentum. However, it’s worth noting that all timeframes below the 4-hour chart currently indicate oversold conditions on the RSI. Investors should factor this into their analysis.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |