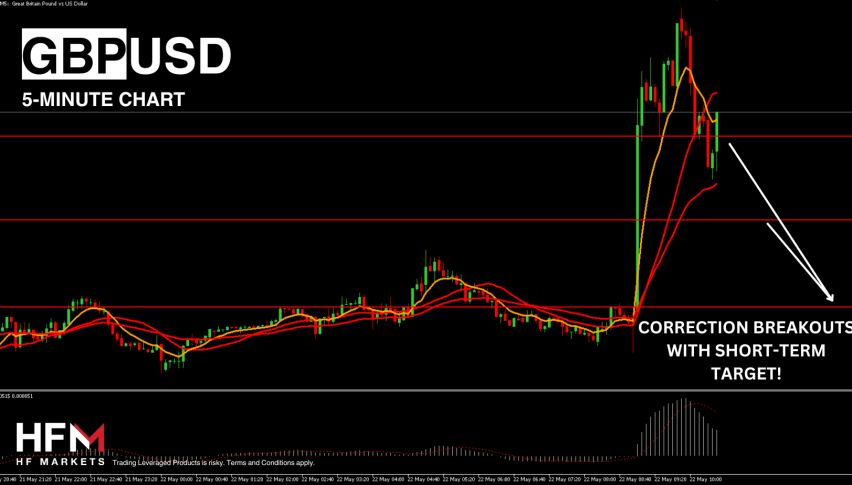

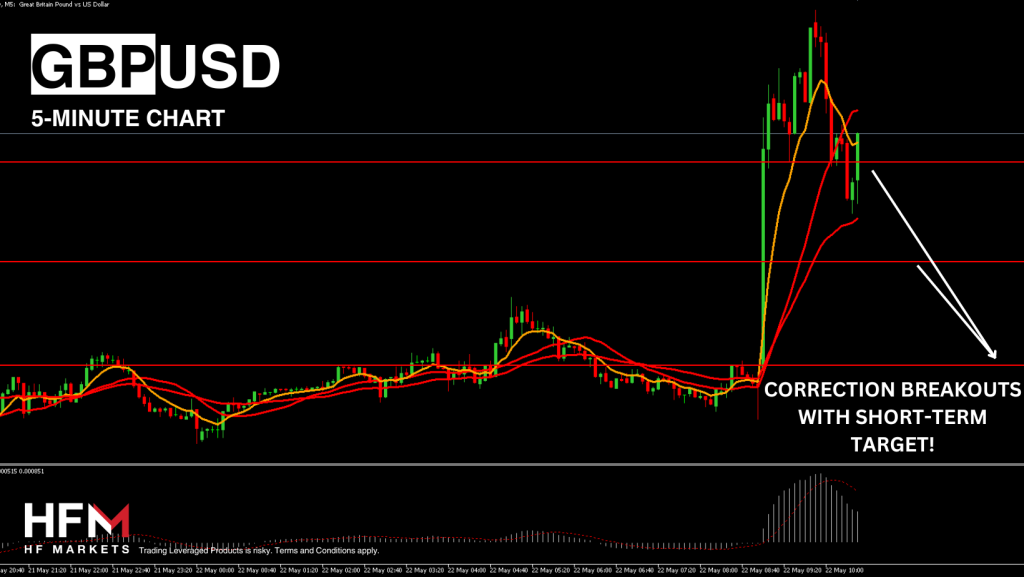

GBPUSD Rises on UK Inflation Drop, But Resistance Levels Signal Caution

The GBPUSD is trading 0.30% higher following the release of April’s UK inflation figures. The US Dollar and Japanese Yen are the day’s worst-performing currencies. Traders speculating on a rising Pound may benefit from these weakening currencies, with GBPJPY trading 0.47% higher. However, investors should be cautious of potential price action changes as the European market opens.

UK inflation dropped from 3.2% to 2.3%, the largest decline in 2024, bringing the Bank of England closer to its target. Typically, this would pressure the currency, but several factors have triggered a bullish Pound. These include the Core Consumer Price Index falling from 4.2% to 3.9% instead of the expected 3.6%, and certain sectors not seeing a decline in inflation in April. Consequently, investors have increased their exposure to the Pound, supporting the currency. Economists also suggest that weakening inflation can boost investment demand, further supporting the economy and the currency.

Additionally, investors must consider the US Dollar’s price condition. Dollar traders will focus on tonight’s Federal Open Market Committee’s Meeting Minutes, seeking clarity on potential rate adjustments in 2024. They are particularly interested in the timing of any adjustments, whether in July, September, or later in the year. If the report suggests fewer cuts and delays, the US Dollar could see increased demand and a trend change, as seen in April 2024.

The GBPUSD is forming a bullish trend, with most trend-based indicators signaling a higher price. However, signs indicate the price may correct back to the previous range. For example, the 4-hour chart shows a divergence signal, and the price is trading at significant resistance levels from November, December, and January. For the resistance level to become active, the Dollar will likely need support from the upcoming Meeting Minutes. In the short term, sell signals may materialize after crossing 1.27400 and 1.27268.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account