USD/JPY Rebounds to 150.25, Awaits US GDP and PCE Data for Direction

The USD/JPY pair saw a notable rebound on Wednesday, finding solid ground around the 150.25 mark as the U.S. dollar clawed back some of its recent losses. This recovery came in the wake of a more significant than anticipated drop in U.S. durable goods orders for January.

Market attention now turns to forthcoming U.S. economic data releases, with the Gross Domestic Product (GDP) growth figures and the Personal Consumption Expenditure Price Index (PCE) inflation data set for release on Wednesday and Thursday, respectively, poised to influence the currency pair’s trajectory.

Economic Indicators Under the Microscope

In Japan, inflation metrics showed a slight ease, albeit less than market analysts had predicted. The headline National Consumer Price Index (CPI) moderated to an annualized rate of 2.2% from the previous 2.6% for the year ending January, while the Core National CPI, which excludes volatile food prices, dipped to 2.0% from 2.3%.

These figures stood above the anticipated 1.8%, indicating sustained inflationary pressures within the Japanese economy.

Looking Forward: Key Data Releases

The U.S. economy’s spotlight is on the decline in month-on-month durable goods orders, which fell to -6.1% in January, diverging from the -4.5% forecast and adjusting the previous month’s figures downward from 0.0% to -0.3%.

Upcoming data releases include the 2023 Q4 U.S. GDP growth, expected to remain stable at 3.3%, and the PCE inflation figures, which are anticipated to reflect a minor increase at the month’s end.

Specifically, the core PCE is forecast to ascend to 0.4% from January’s 0.2%, with the annualized core rate predicted to slightly decrease to 2.8% from 2.9% for the year ended January.

Anticipated Market Impact

These forthcoming economic indicators are critical for investors and traders alike, as they provide valuable insights into the health of the U.S. economy and its potential impact on monetary policy decisions.

Additionally, Japanese industrial production and retail sales data are expected to offer further clarity on the economic landscape in Japan, contributing to the broader narrative shaping the USD/JPY exchange rate dynamics.

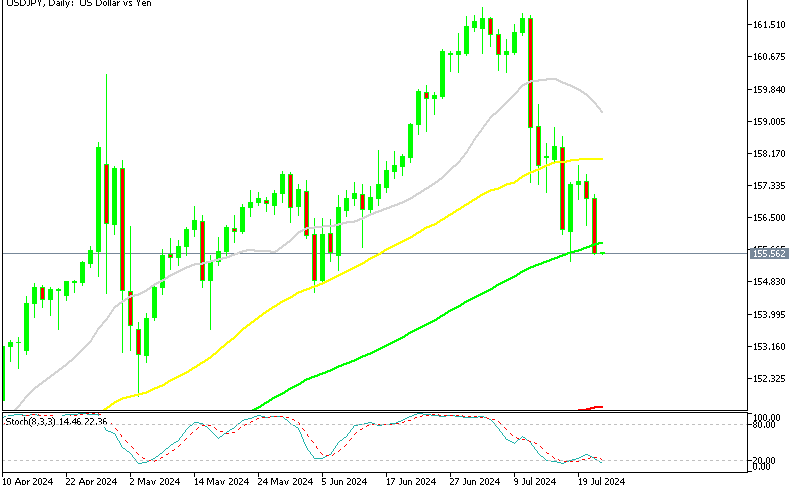

USD/JPY Price Chart: Technical Outlook

The USD/JPY pair edged slightly higher by 0.04%, reaching 150.547 on February 28, reflecting a cautious optimism among traders. Positioned just above the pivot point of 150.21, the currency pair exhibits a subtle yet definitive bullish tendency.

Key resistance levels are mapped out at 150.83, 151.22, and 151.62, serving as critical junctures for potential upward movement. Conversely, support levels at 149.88, 149.53, and 149.06 underscore areas where the pair might find footing in case of a pullback.

The Relative Strength Index (RSI) at 54 indicates a neutral market sentiment, leaning slightly towards a bullish bias. Furthermore, the 50-day Exponential Moving Average (EMA) at 150.26, closely aligned with the current price, and an ascending triangle pattern around the 150.21 level, both suggest underlying support for the yen.

These technical indicators collectively point towards a bullish outlook for the USD/JPY, provided it maintains above the pivotal 150.21 mark.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |