PCE Inflation Ticks Down, USD/CHF Heads Up

The US core and headline PCE data meeting expectations has provided relief to the market, weakening CHF to USD. The Swiss Franc moved higher

It seems that the US core and headline PCE data meeting expectations has provided a sense of relief to the market, weakening CHF to USD. The Swiss Franc seems badly hit by the inflation numbers, having gained around 60 pips so far and is pushing higher with strength right now.

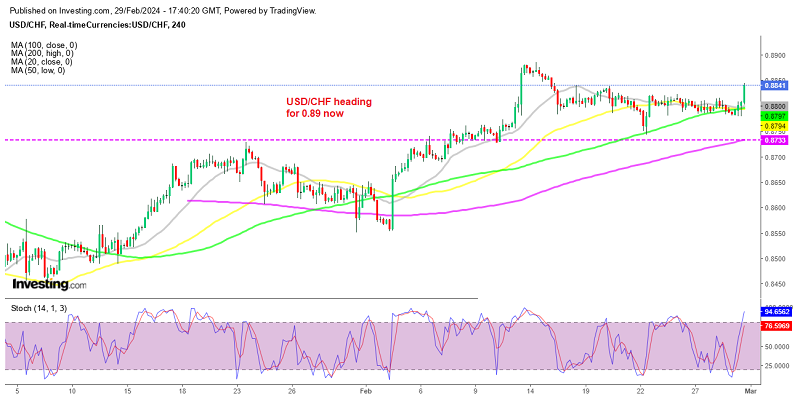

USD/CHF H4 Chart – Breaking Above the Range

Bonds are higher, while Treasury yields have decreased, contributing to a positive opening for US stock indices. The USD tumbled lower initially after the inflation numbers were released, but then reversed course quickly, turning bullish. USD/CHF was trading in a range for a week as shown on the H4 chart, but made a break today after the bounce. This price action suggests that investors are uncertain about the inflation figures reported.

FED PCE Core (personal consumption expenditure) Report for January 2024![Core PCE]()

- PCE Core (Year-over-Year): 2.8%, in line with expectations. Previous month’s figure was 2.9%.

- PCE Core (Month-over-Month): 0.4%, matching expectations. Previous month’s figure was revised from 0.2% to +0.1%.

- Headline PCE (Year-over-Year): 2.4%, in line with expectations. Previous month’s figure was 2.6%.

- Headline PCE (Month-over-Month): 0.3%, matching expectations.

- 3-month annualized rate: 2.8%.

- 6-month annualized rate: 2.6%.

- Full report click here

In January, the US Personal Consumption Expenditures (PCE) core inflation, which excludes volatile food and energy prices, came in at 2.8% year-over-year (YoY), meeting expectations. This figure marks a slight decrease from the previous month’s reading of 2.9%. On a month-over-month (MoM) basis, the PCE core inflation also stood at 0.4%, in line with expectations and higher than the previous month’s revised figure of +0.1% (originally reported as +0.2%). The headline PCE inflation, which includes all goods and services, was reported at 2.4% YoY, matching expectations and lower than the previous month’s reading of 2.6%. On a MoM basis, the headline PCE inflation also met expectations, with a 0.3% increase. Overall, while both core and headline PCE inflation remained elevated, the slight moderation compared to the previous month may alleviate some concerns about the pace of inflation. However, these figures are closely watched by the Federal Reserve as they inform monetary policy decisions and their implications for the broader economy.

USD/CHF Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account