Q4 US GDP Revised Lower, Sends USD Retreating

Yesterday the US Dollar was trying to make a comeback, but the lower revisions of the US GDP for Q4 ended the bullish rally and the USD...

Yesterday the US Dollar was trying to make a comeback, but the lower revisions of the US GDP for Q4 ended the bullish rally and the USD turned bearish in the US session. At the end of the day, the USD finished little changed, with risk sentiment also being neutral, as shown by the consolidation in stock markets. S&P500 is still consolidating gains above 5,000 points.

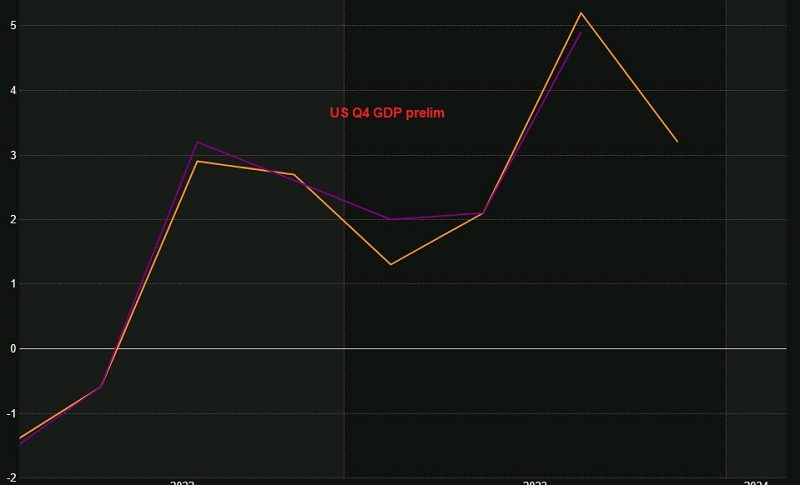

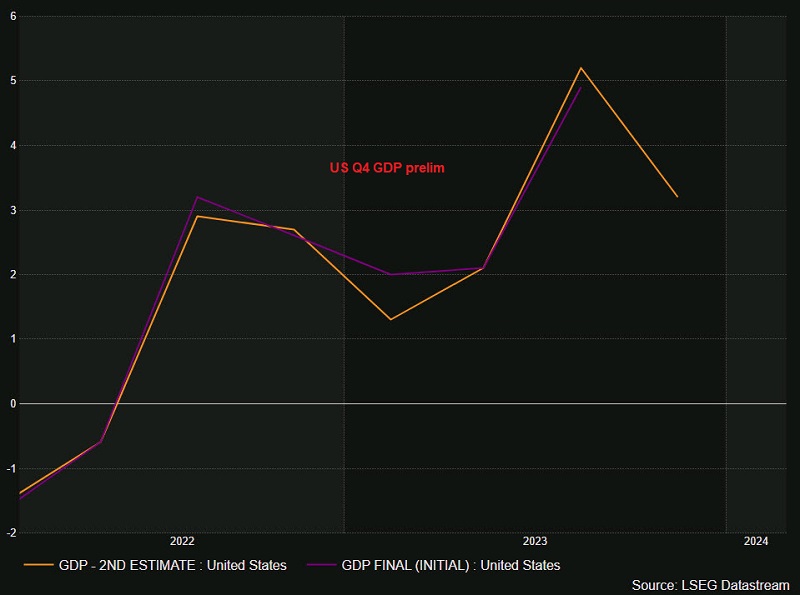

US Q4 GDP Prelim

The second look at Q4 2023 GDP in the United States showed a growth rate of 3.2%, slightly below the expected 3.3%. This reading matches the advance Q4 figure. However, compared to the final Q3 reading of 5.2% and Q2’s 2.1%, the growth rate has moderated.

US Prelim GDP for Q4 2023

- US Q4 GDP (second reading) +3.2% vs +3.3% expected

- Advance Q4 reading was +3.2% annualized

- Final Q3 reading was +5.2% annualized

- Q2 was +2.1% annualized

Key details from the report include:

- Consumer spending increased by 3.0%, surpassing the advance estimate of 2.8%. However, consumer spending on durables was weaker than expected, growing by 3.2% compared to the advance estimate of 4.6%.

- GDP final sales rose by 3.5%, outpacing the advance estimate of 3.2%.

- The GDP deflator, which measures inflation, was reported at 1.7%, higher than the advance estimate of 1.5%.

- Core PCE, a key inflation indicator, rose by 2.1%, in line with the advance estimate of 2.0%.

- Business investment expanded by 0.9%, below the advance estimate of 2.1%.

The report also highlighted changes in percentage points in various components:

- Net trade contributed 0.32 percentage points to GDP growth, lower than the advance estimate of 0.43 percentage points.

- Inventory building added 0.27 percentage points, higher than the advance estimate of 0.07 percentage points.

- Government spending contributed 0.73 percentage points to growth, exceeding the advance estimate of 0.56 percentage points.

Overall, the weaker business investment and consumer spending, coupled with stronger-than-expected contributions from government spending and inventory building, pose downside risks to growth in 2024. Consequently, the US dollar softened in response to the report.

The picture in the GDP report is of weaker business investment and consumer spending with a stronger-than-believed contribution from government spending and inventory building. Those are downside risks for 2024 growth and that’s why the US dollar softened on the report.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account