AUD to USD Rate Sticks to 0.65 With Manufacturing Back in Contraction

The bearish reversing chart pattern in AUD/USD continues to unfold, with the AUD to USD falling 100 pips lower and breaking below 0.65

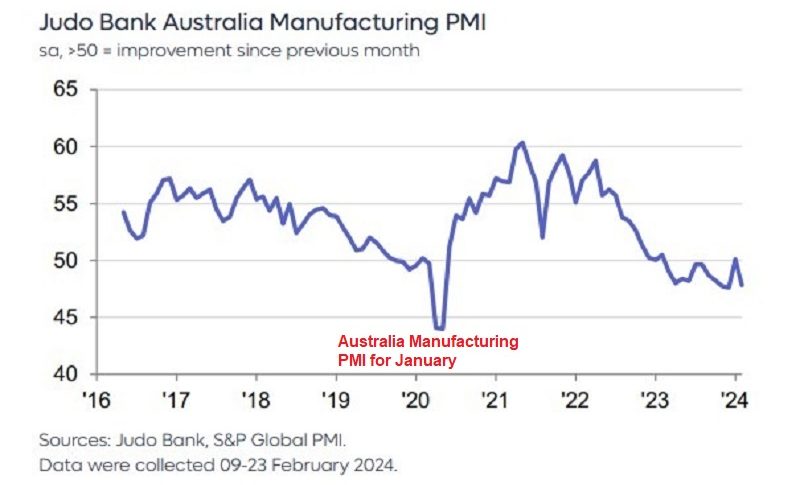

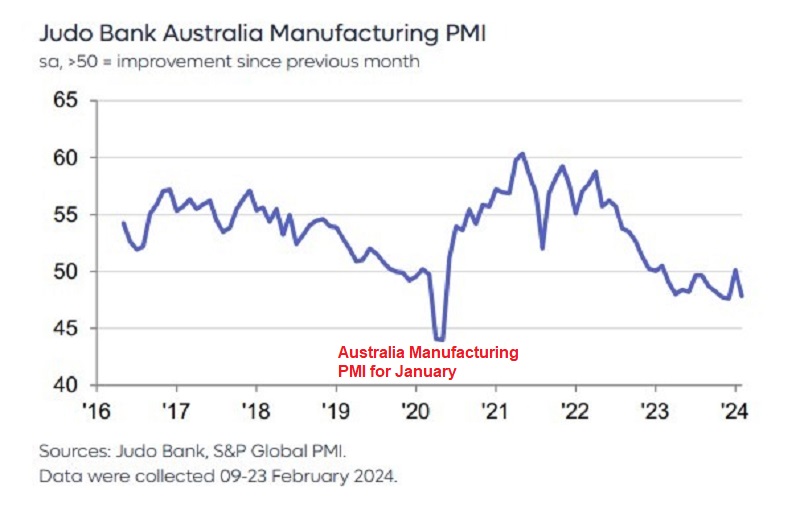

The bearish reversing chart pattern in AUD/USD continues to unfold, with the AUD falling around 100 pips lower and breaking below 0.65 yesterday. The economic data is showing an unstable picture of the economy, which is keeping the Australian dollar soft against the US dollar. Early this morning the Manufacturing PMI report showed that this sector fell into contraction again in January, after a short-lived jump in December, so fundamentals aren’t supporting the Aussie.

AUD/USD Daily Chart – MAs Are Acting As Resistance for AUD/USD

AUD/USD initially saw some support from yesterday’s US PCE inflation data, and is bounced 45 pips higher, but this uptick was short-lived as the US dollar regained strength. As a result, the pair fell back to 0.65 where it ended the day. Moreover, concerns about the post-pandemic economic recovery were amplified by the Australian manufacturing PMI slipping back into contraction territory. These factors combined have led to the AUD/USD pair hovering near its weekly low.

Australian February Manufacturing PMI

- The Australian Manufacturing Purchasing Managers’ Index (PMI) for February remained in contraction territory at 47.8 points, indicating a continued decline in manufacturing activity.

- This figure is lower than the January manufacturing reading of 50.1 points.

- The flash manufacturing PMI for February was also indicative of contraction, with a reading of 47.7 points. This data suggests ongoing challenges and weaknesses in the Australian manufacturing sector

Comments from the February Manufacturing PMI Report:

The February Manufacturing PMI report highlights an ongoing slowdown in the Australian manufacturing sector. While the PMI indicates a slowdown, it remains above levels historically associated with a recession. However, new orders and employment showed softer figures for February.

Demand for labor has been in contractionary territory for the past four months, suggesting weakening demand for manufacturing sector labor over the past six months. Supply chain disruptions are also impacting the sector, and output price pressures rose during February. Overall, the report suggests challenges and pressures facing the Australian manufacturing industry.

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account