German30 Price Forecast: DAX Drops to 17,775 amid Soft Inflation News; Sell Now?

Despite a slight downturn, the German DAX remains buoyed by optimistic economic indicators and softer-than-expected inflation, hinting...

The German DAX closed at 17,774.64, down by 0.55% from the previous day, indicating a slight downturn in the market. Despite challenges regarding economic data and geopolitical tensions, the DAX index maintained its upward momentum, driven by positive market sentiment and expectations of monetary policy support.

Moreover, investors were buoyed by softer-than-expected German inflation numbers, which increased demand for DAX-listed stocks. The annual inflation rate fell from 2.9% to 2.5% in February, surpassing economists’ forecasts of 2.6%.

Additionally, German Final Manufacturing PMI figures showed resilience in the manufacturing sector, indicating economic strength and boosting investor confidence in DAX-listed companies.

Despite concerns raised by the unexpected decline in German retail sales by 0.4% in January, the DAX maintained its upward momentum.

However, the decrease in consumer spending suggested a possible economic downturn, but it also made some people think that the European Central Bank might lower interest rates to boost economic activity. This could potentially help stock markets like the DAX.

Impact of Economic Indicators on DAX Performance

The performance of the DAX index is closely tied to key economic indicators, including German Final Manufacturing PMI, retail sales data, and inflation figures. However, the release of German Final Manufacturing PMI, which reflects the health of the manufacturing sector, influences negative investor sentiment towards DAX-listed companies.

The decline in Germany’s manufacturing sector, indicated by lower PMI and Output Index readings, may negatively impact investor sentiment and confidence in DAX-listed companies, potentially leading to downward pressure on the DAX index.

On the data front, Germany’s manufacturing sector faced setbacks, with the latest readings hitting a four-month low. The IHS Markit Germany Manufacturing PMI dropped to 42.5, while the Output Index fell to 42.3, both marking the fastest decline since August 2020. Job losses in factories accelerated, reflecting worsening employment conditions.

The widespread downturn suggests a bleak outlook, contrasting with less depressed conditions in France, Italy, and Spain. The slump in Germany’s investment goods sector particularly contributed to the sharp decline in manufacturing output, indicating pessimism among managers regarding near-term recovery prospects.

Therefore, the unexpected decline in German retail sales in January and Germany’s manufacturing sector raised concerns about consumer spending and its impact on economic growth. However, softer-than-expected inflation numbers alleviated some of these concerns, driving demand for DAX-listed stocks.

Federal Reserve Rate Cut Speculation and US Economic Data

On the US front, the ongoing belief about a potential interest rate cut by the Federal Reserve also influenced DAX performance. However the softer inflation and a pullback in personal spending in the US supported bets on a rate cut in the first half of 2024.

The Core US PCE Price Index, the Fed’s preferred inflation gauge, climbed 0.4% in January, while the yearly rate eased to 2.4%.

On the other side, comments from several Fed officials, including Atlanta Fed President Raphael Bostic and New York Fed President John Williams, reaffirmed market expectations of a rate cut.

Bostic suggested that the Fed could start cutting interest rates in the summertime, while Williams noted that the next move for the central bank is likely to be a rate cut.

Investors closely monitored US economic data, including the ISM Manufacturing PMI, for insights into the Fed’s monetary policy stance and its potential impact on global markets, including the DAX index.

German30 (DAX) Price Prediction: Technical Analysis

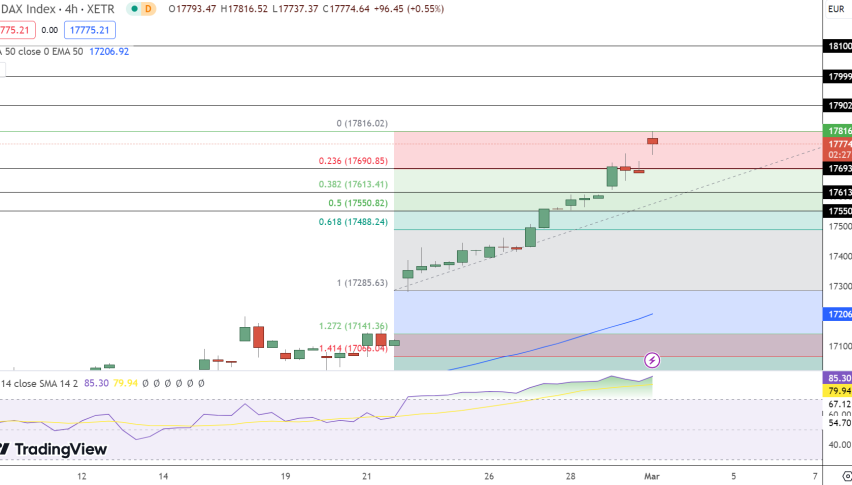

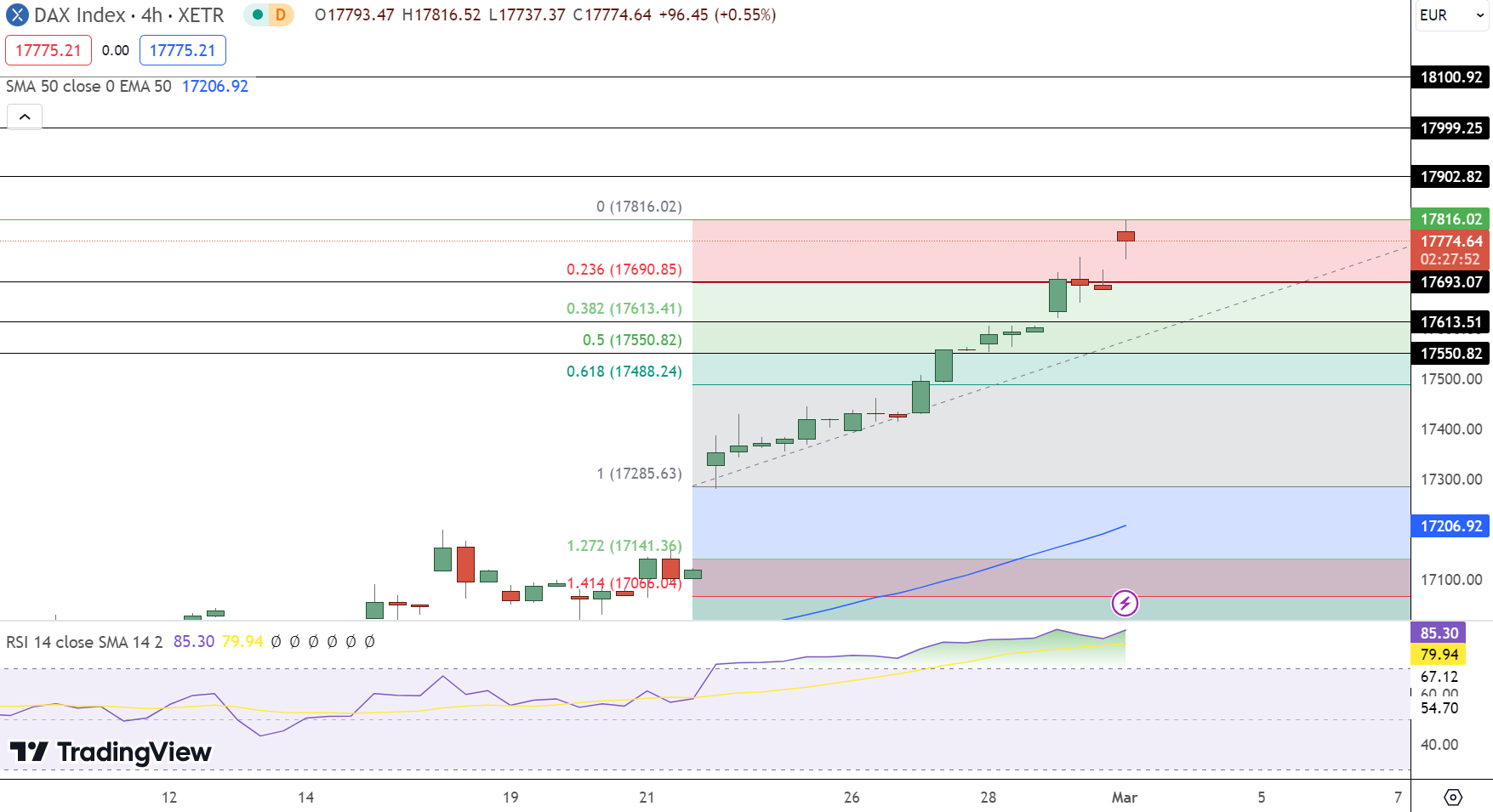

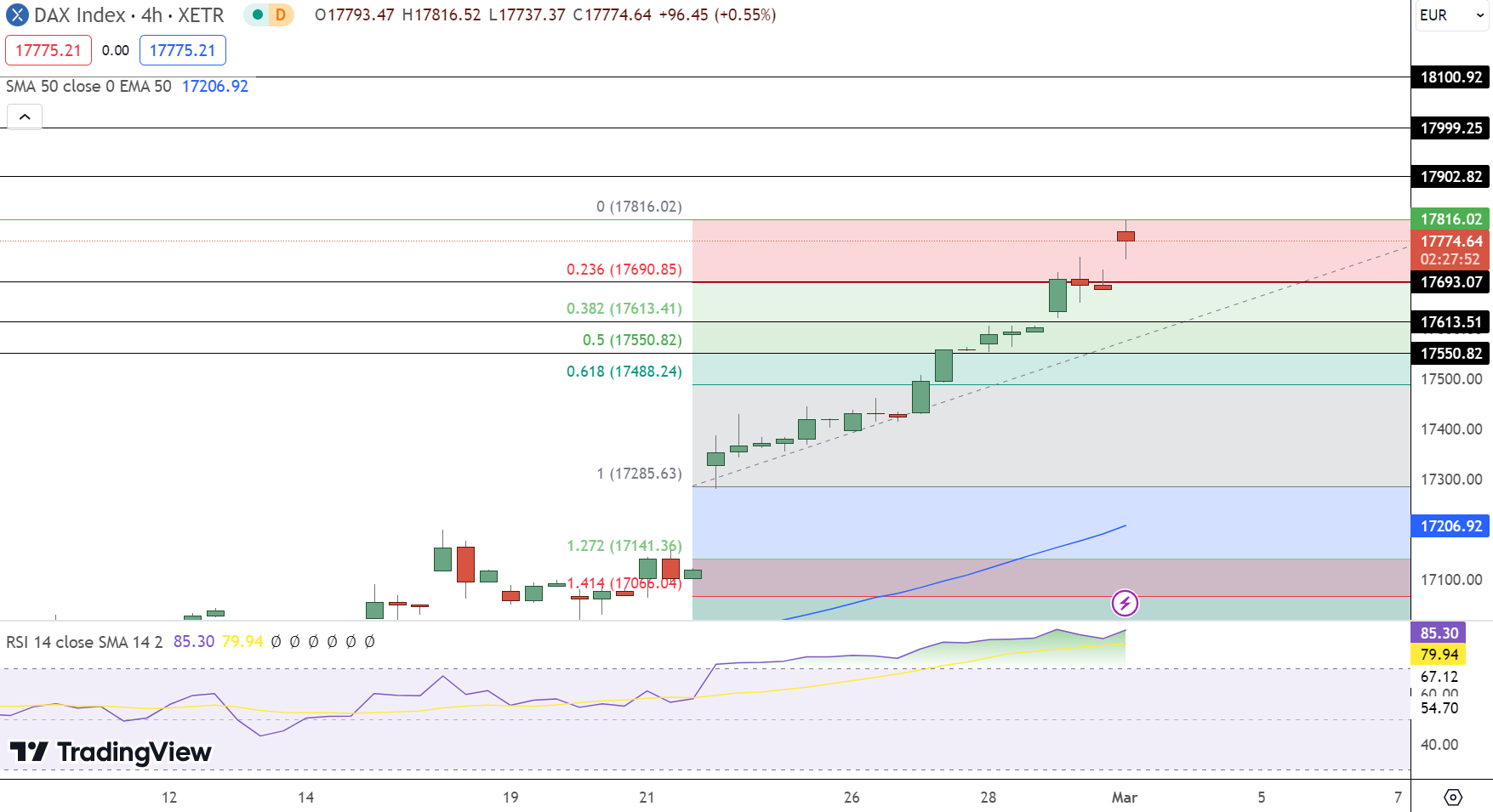

The index currently hovers just below a critical pivot point of $17,816, suggesting a potential shift in market dynamics.

With immediate resistance levels identified at $17,903, $17,999, and $18,101, and support levels firmly established at $17,693, $17,614, and $17,551, the DAX is positioned at a juncture that could dictate its short-term direction.

The RSI stands at an elevated 85, typically indicative of overbought conditions that could precede a pullback.

Additionally, the formation of a Doji candle right below the $17,816 level hints at indecision, potentially signaling a downward movement. Given these indicators, including a 50 EMA at 17,207, which the DAX trades above, suggesting longer-term bullish momentum, the immediate outlook appears bearish below $17,816.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account