Gold Price Forecast: Navigates $2081 Amid Fed Rate Cut Speculation; Bearish Correction Ahead?

Gold prices have been trading within a tight range in the Asian session on Monday, maintaining the significant gains achieved last week,

Gold prices have been trading within a tight range in the Asian session on Monday, maintaining the significant gains achieved last week, with peaks touching the $2,088–2,089 area, marking the highest level since late December.

The non-yielding metal has benefited from the backdrop of a weakening US dollar as a result of the US ISM survey’s revelation of a sharper-than-expected contraction in manufacturing activity for February.

Furthermore, subdued tones from Federal Reserve officials regarding the future pace of interest rate hikes have amplified expectations of rate cuts starting from the June policy meeting, offering additional support to gold prices.

Market Caution Ahead of Federal Insights

Despite the bullish momentum, investors appear hesitant to initiate new positions in gold, opting to await further clarity on the Federal Reserve’s interest rate trajectory.

The optimism surrounding potential ceasefire discussions in Gaza also tempers the upward movement in gold prices, setting a cautious tone ahead of significant US economic reports due later in the week, including the highly anticipated monthly employment data and Federal Reserve Chair Jerome Powell’s congressional testimony.

USD’s Posture and Gold’s Short-Term Outlook

A dovish shift in Federal Reserve rhetoric and unsatisfactory domestic economic indicators have exposed the US dollar’s vulnerability, which has facilitated gold’s rise.

Nevertheless, the precious metal’s progress is constrained by broader market sentiment and upcoming economic data releases, which are poised to shape the USD’s valuation and, consequently, influence gold’s price trajectory.

In the interim, gold is likely to continue its consolidation phase, with investors keenly monitoring developments around the Federal Reserve’s policy direction and its implications for the metal’s value.

Overall, gold is getting mixed messages from economic data and Federal Reserve talks. Its immediate direction will depend on upcoming US macroeconomic data releases and central bank insights, which could cause the XAU/USD pair to be volatile.

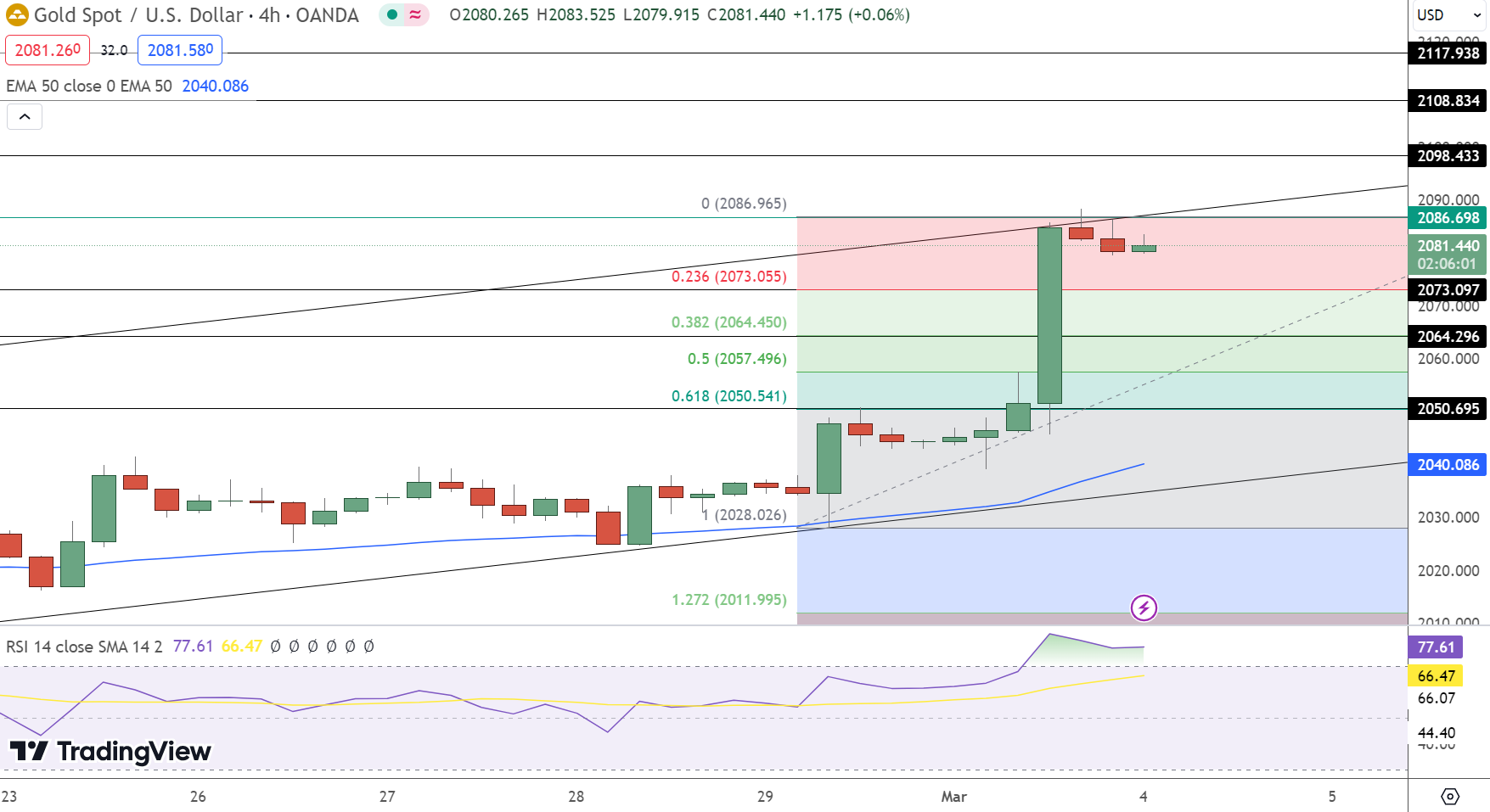

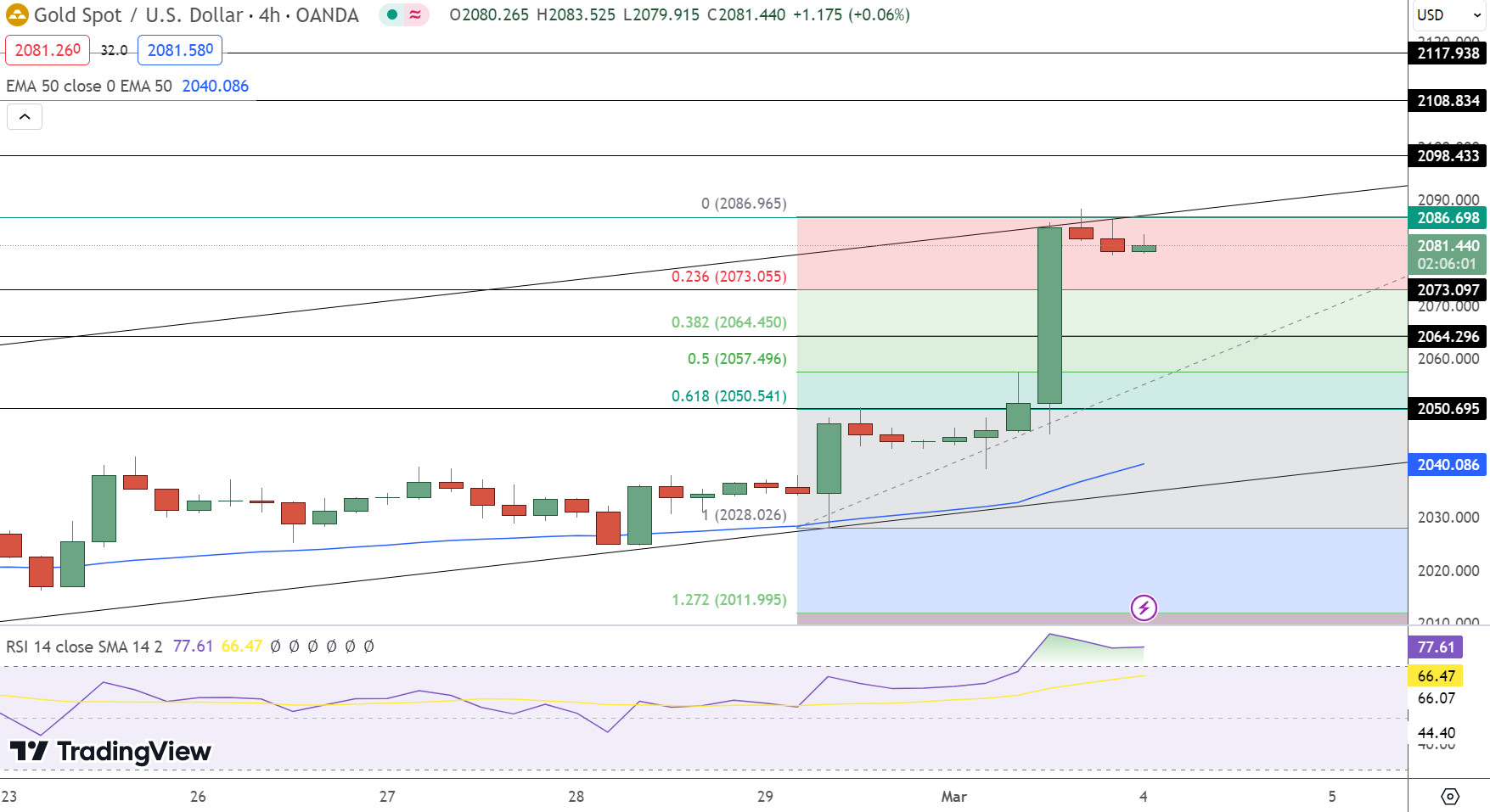

Gold (XAU/USD) Price Forecast: Technical Outlook

GOLD (XAU/USD) price experienced a slight decline of 0.09%, settling at $2081.44. Currently, it trades below the pivotal mark of $2086.70, suggesting a cautious market sentiment.

The metal confronts immediate resistance at $2098.43, with subsequent levels at $2108.83 and $2117.94 poised to test the bullish resolve. Conversely, support is established at $2073.10, with further safety nets at $2064.30 and $2050.70, potentially cushioning any downward movements.

The Relative Strength Index (RSI) stands at 77, indicating near-overbought conditions, while the 50-day Exponential Moving Average (EMA) at $2040.09 underscores a longer-term bullish trend. The presence of Doji candles near the resistance level signals the potential for a bearish correction.

Accordingly, the outlook for gold remains bearish below the $2087 threshold, with a decisive break above this level potentially signalling renewed bullish momentum.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account