GBPUSD Heads Toward Resistance After the Construction PMI

The ratio of GBP to USD declined last week after GBP/USD failed at the 50 SMA. But, this week the British Pound is finding some solid demand

The ratio of GBP to USD declined last week after GBP/USD failed at the 50 SMA. But, this week the British Pound is finding some solid demand, which has been pushing this pair higher, however, buyers are once again facing the 50 daily SMA. Today, traders will be waiting for FED’s Powell testimony and the JOLTS job openings from the US, before making any large moves.

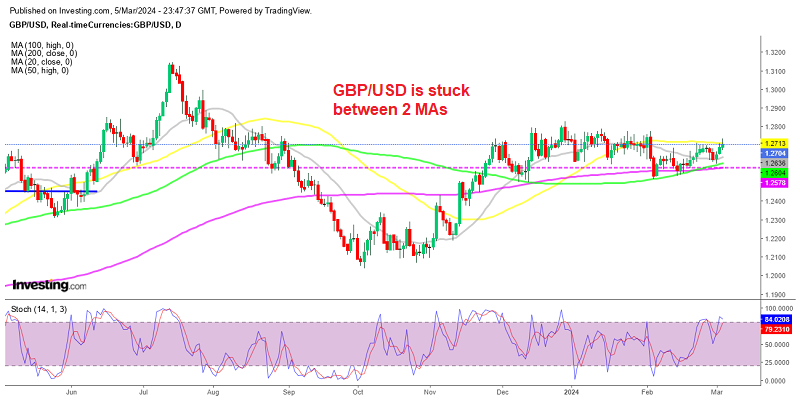

GBP/USD Daily Chart – Buyers Facing the 50 SMA Again

GBP/USD was finding support at the 100 SMA (green) during February, and in the last week we saw a bounce off this moving average, but that stopped right at the 50 SMA (yellow) which is acting as resistance now. However, the 100 SMA held again after the retreat last week and on Friday we saw another bounce off this moving average after the soft US and now buyers are back at this moving average. Yesterday’s services PMI numbers were revised lower from the first reading, but that didn’t affect the GBP too much. However February was better than January, so it was an improvement overall.

U.K. Final Services PMI for February

- February Final Services PMI prints below expectations at 53.8 points vs 54.3 points expected.

- Initial services PMI reading was 54.3 points

- January services PMI was 53.4 points

- Composite PMI Final prints at 53 points lower than the forecast 53.3 points

- January Composite PMI was 53.3 points

The PMI said that service providers in the UK experienced an improvement in business activity during February, driven by growth in new orders and a modest increase in employment figures. Although the index slightly missed expectations by printing at 53.8, it still reflects a higher level compared to any point in the second half of the previous year.

The fact that the index remains in expansionary territory, above the threshold of 50.0, suggests that there has been a notable rebound in business activity following a downturn experienced last autumn. This positive trend in the service sector bodes well for the overall economic outlook of the UK, indicating signs of recovery and resilience in the face of previous challenges.

UK Construction PMI for February

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account