Gold Price Forecast: Surge to $2158 Amid Powell’s Rate Cut Hints; More Upside Ahead?

Gold's price action today reveals a steadfast advance, registering a 0.47% increase within the four-hour chart, asserting a bullish

Gold‘s price action today reveals a steadfast advance, registering a 0.47% increase within the four-hour chart, asserting a bullish case above its pivot point at $2146.46.

The precious metal’s price surge is largely attributed to underwhelming U.S. economic indicators and Federal Reserve Chair Jerome Powell’s recent allusions to possible interest rate reductions, should inflation metrics retreat.

Commodity Markets Respond to Macro Data

The subtle downturn in U.S. economic figures has undoubtedly been a catalyst for gold’s impressive rally. Yet, the reaction in gold prices might be amplified by a significant influx of futures purchasing last week, suggests Marcus Garvey, lead strategist at Macquarie.

This volume of market activity could be distorting the market’s natural price discovery process.

Fed Chair Signals Rate Cut Potential

Powell’s testimony, hinting at a dovish pivot in monetary policy contingent on sustained inflation declines, has further buoyed gold’s allure. With Powell slated to provide additional commentary, investors are keenly monitoring the implications for bullion.

Concurrently, labor market softness has contributed to a depreciation in U.S. Treasury yields and the dollar, enhancing gold’s investment appeal.

Gold’s Price Forecast and Central Bank Influence

Anticipated labor market data and impending inflation reports could drive gold toward the $2,300 mark in the short run. However, according to Macquarie’s Garvey, this rally could be temporary, likely followed by a correction. Looking ahead, central bank acquisitions of gold are projected to persist amid geopolitical flux, with global growth prospects moderated by China’s economic deceleration.

Jigar Pandit from BNP Paribas’ Sharekhan emphasizes gold’s stature as a stabilizing asset for banks amidst financial turbulence, with notable purchasing activity from China, Turkey, Russia, and Poland.

As the week progresses, all eyes are on the forthcoming U.S. Non-Farm Payroll (NFP) figures, which hold significant sway over gold prices. These statistics, alongside inflation data, will prove decisive in directing gold’s short-term valuation, offering investors a measure of the metal’s safe-haven status against the backdrop of economic developments.

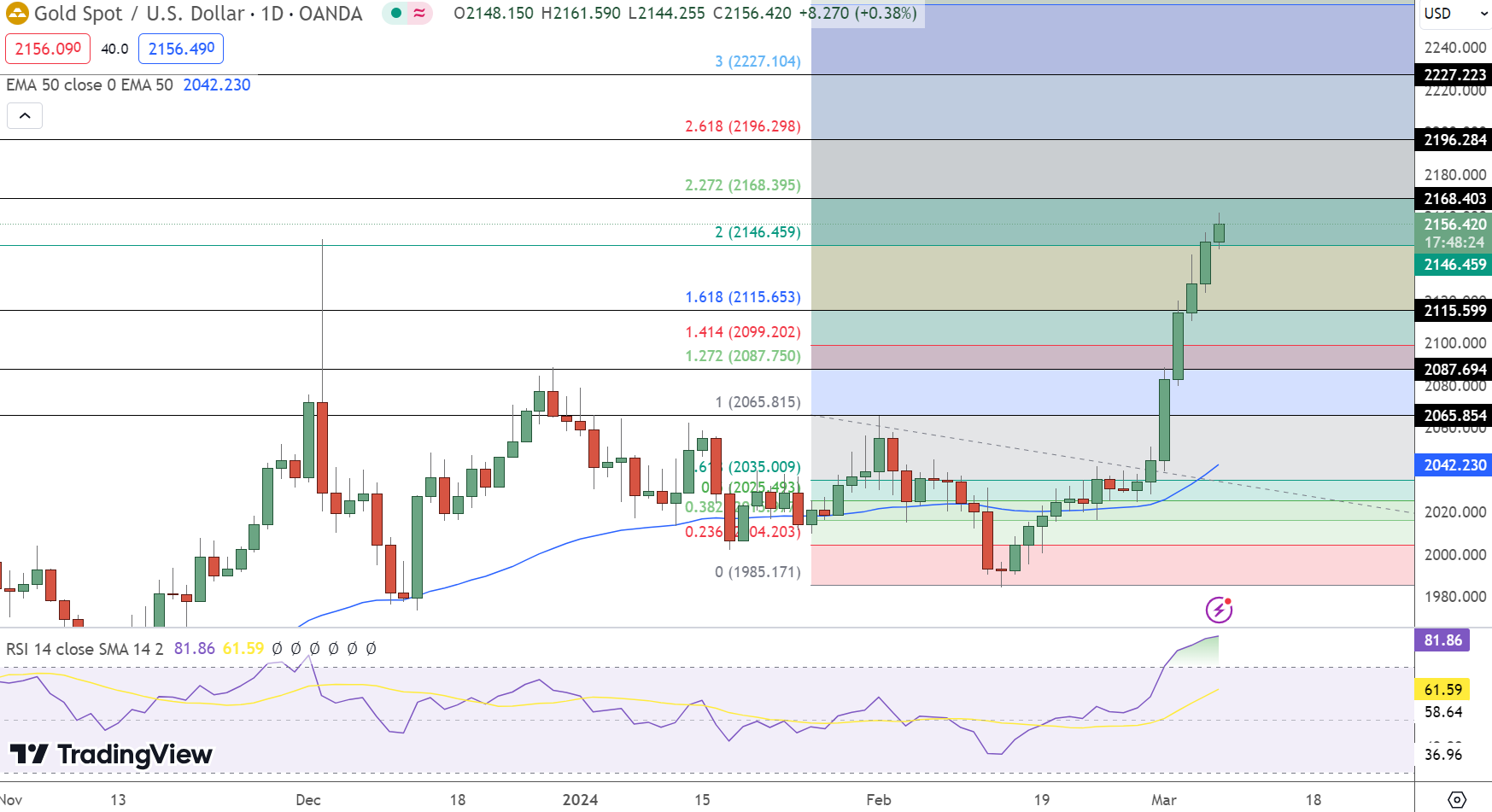

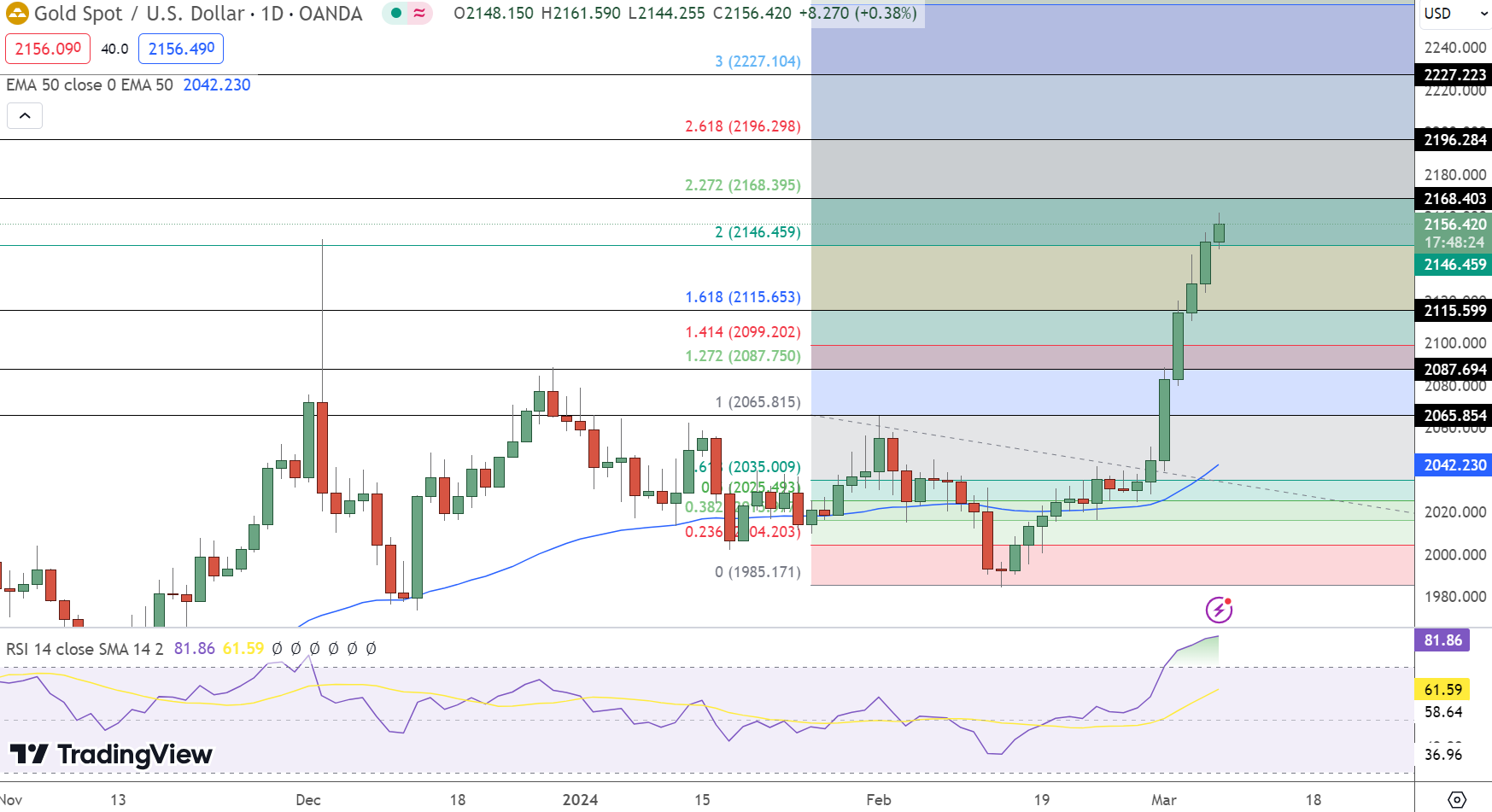

Gold (XAU/USD) Price Forecast: Technical Outlook

Gold’s resistance levels manifest at $2168.40 and further north at $2227.22, serving as potential headwinds to its ascension. In contrast, support forms near $2115.60, with additional backstops at $2087.69 and $2065.85, poised to absorb any downward pressures.

The Relative Strength Index (RSI) perches at an elevated 81, possibly indicating overbought conditions, while the 50-day Exponential Moving Average (EMA) at $2042.23 provides a substantial underpinning to the ongoing uptrend.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account