USD Higher As Unemployment Claims Calm Employment Worries

The main event for the day was the release of US Retail Sales, but Unemployment Claims were also important, as they show the state of the US

The main event for the day was the release of US Retail Sales, but Unemployment Claims were also important, as they show the state of the US jobs market. This sector has been quite strong throughout these turbulent times, but it has shown some signs of weakness recently, so today’s data was under scrutiny.

Despite the rise in layoffs, job growth remains robust in the US, with employers adding 275,000 jobs in February. This data was released by the Bureau of Labor Statistics (BLS) on Friday morning, along with an unemployment rate of 3.9%, which increased by 0.2% from January’s 3.7%. So, the initial impact in the USD which was to jump around 40 pips higher, was neutralized quickly by the jump in unemployment.

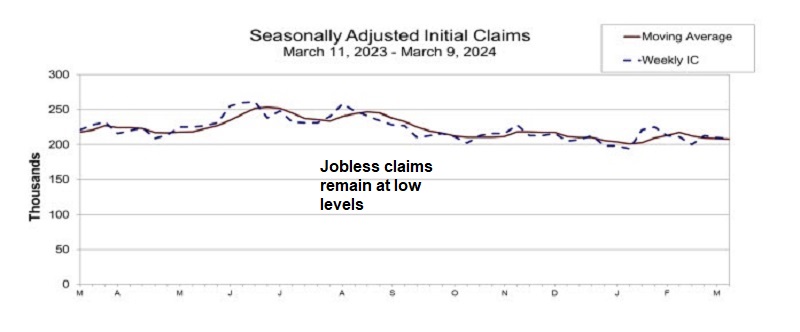

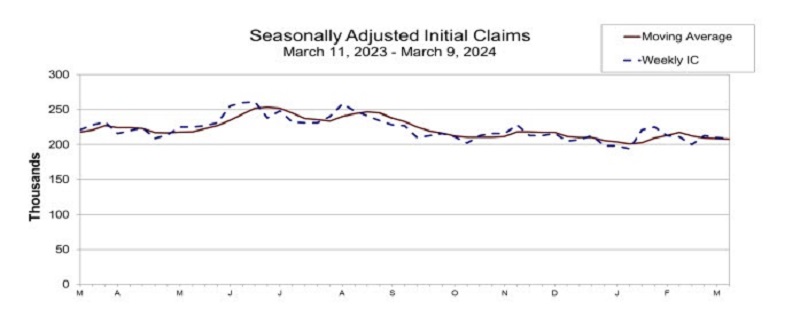

Remarkably, the unemployment rate despite jumping 2 points, has stayed below 4% for more than two years, marking the longest period in 6 decades. However, layoffs surged significantly last month, reaching their highest level since February 2009, representing a 9% increase from the previous year. Today’s unemployment claims were lower including revisions for last month, which has calmed some nerves, sending the USD 50 pips higher across the board.

The weekly initial and continuing jobless claims

- Initial jobless claims 209K vs 218K estimate.

- Prior 217K revised to 210K.

- 4-week moving average of initial claims 208K vs 208.5K last week

- Continuing claims prior week 1.906M revised to 1.794M.

- Continuing claims current week 1.811M vs 1.900M estimate.

- 4-week moving average of continuing claims 1.799M vs 1.797M last week

- The largest increases in initial claims for the week ending March 2 were in New York (+14,176), California (+5,549), Texas (+2,102), Michigan (+979), and Florida (+783),

- The largest decreases were in Massachusetts (-3,894), Rhode Island (-1,955), Oregon (-1,063), Georgia (-882), and Tennessee (-335).

The big revisions, especially to the continuing claims data, are noteworthy. The revisions could indeed be influenced by various factors, including benchmark revisions and changes in modeling techniques. Benchmark revisions typically involve updating historical data to reflect more accurate information or changes in methodology. Additionally, changes in modeling techniques could lead to adjustments in the way data is processed and reported.

The decline in continuing claims from 1.906 million to 1.794 million in the prior week does seem dramatic, and such fluctuations may not be typical. These revisions and fluctuations underscore the importance of understanding the methodologies behind the data and the potential impacts of any changes or revisions made by the reporting agencies.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account