FED interest Rate Cut Odds Lower Despite Weaker US Data

In the last two days, the economic data from the US has been mostly weak, but the odds of FED interest rate cuts have declined, helping USD

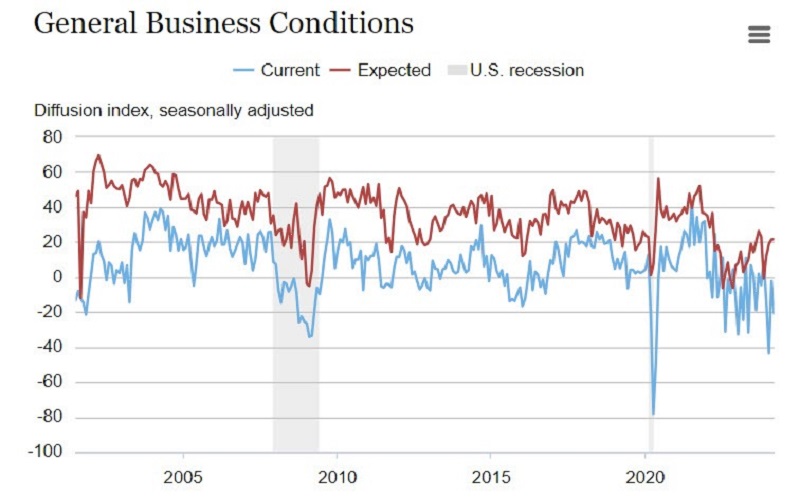

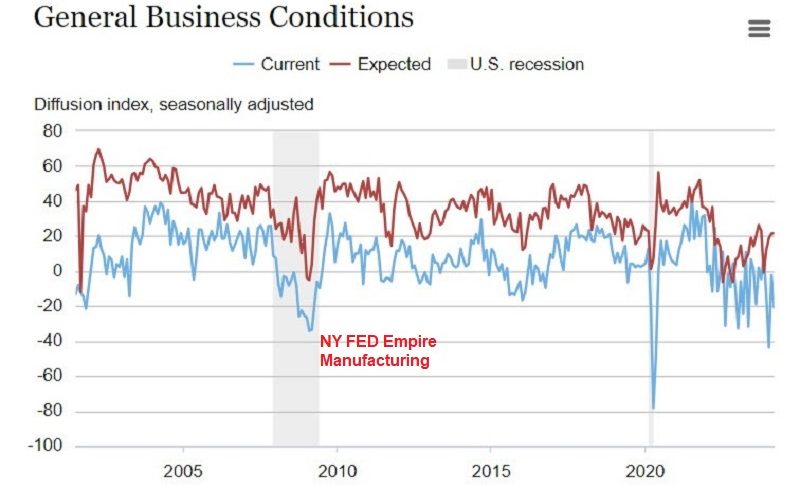

In the last two days, the economic data from the US has been mostly weak, but the odds of FED interest rate cuts have declined, which is helping the USD, while keeping risk sentiment subdued. Today we had the EmpireManufacturing Index which dived further in contraction, with new orders also declining even more, suggesting that the coming months will be tough too.

New York Empire State Manufacturing Index

The negative surprise in the Empire Manufacturing Index suggests a weaker-than-expected performance in manufacturing activity for the month of March. This data is closely watched as it provides insights into the health of the manufacturing sector in the New York Fed’s region, which can have broader implications for the national economy. Nonetheless, the USD has been going higher as the odds of a FED rate cut by June decline by 10 points compared to the start of the week.

The Empire Manufacturing Index for March 2024

- Empire Manufacturing: -20.9 (compared to -7.0 last month)

- New Orders: -17.2 (compared to -6.2 in the prior month)

- Employment: -7.1 (compared to -0.2 in the prior month)

- Prices Paid: +28.7 (compared to +33.0 in the prior month)

- Prices Received: 17.8 (compared to 17.0 in the prior month)

Other components of the index include:

- New orders: -17.2 (compared to -6.2 in the prior month)

- Employment: -7.1 (compared to -0.2 in the prior month)

- Prices paid: +28.7 (compared to +33.0 in the prior month)

- Prices received: 17.8 (compared to 17.0 in the prior month)

The high volatility of the Empire Manufacturing Index is well-known, and it’s not uncommon for the index to produce unexpected swings in market sentiment. While the March reading came in significantly below expectations, causing some analysts to reassess their outlook for monetary policy, the reaction in yields has been relatively muted thus far.

The likelihood of a June rate cut, which stood at 69% earlier in the week, has now decreased to 58.9%. However, it’s important to note that market expectations for interest rate moves can be influenced by a wide range of factors, including not only economic data releases but also statements from central bank officials, geopolitical events, and developments in financial markets.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account