CAD to USD Rate Above1.36 After Soft Canada CPI Figures

The CAD to USD rate has been bouncing between moving averages in a 1-cent range but today's CPI (consumer price index) inflation report brok

The CAD to USD rate has been bouncing between moving averages in a 1-cent range but today’s CPI (consumer price index) inflation report broke that range. Both the FED and the BOC are expected to start easing the monetary policy, so the game in USD/CAD now is which one will start cutting interest rates first.

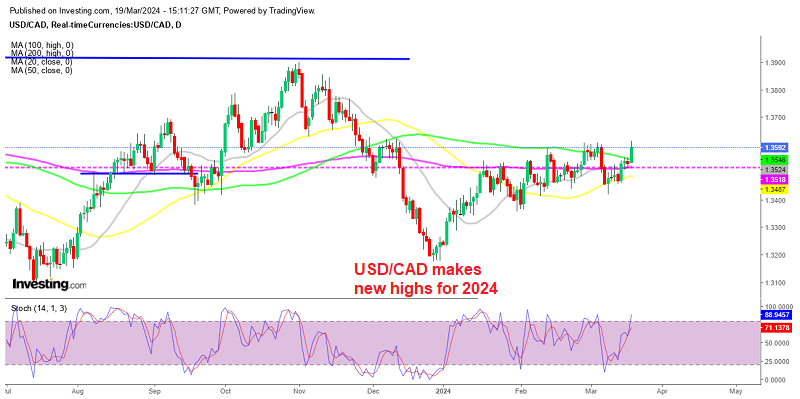

USD/CAD Daily Chart – New Highs for 2024

The Bank of Canada (BoC) closely monitors inflation figures, particularly the Consumer Price Index (CPI) year-over-year (YoY) and month-over-month (MoM) figures. Today’s report was predicted to show CPI YoY at 3.1%, indicating an increase from last month’s 2.9%, while the MoM figure was expected to show a 0.6% jump in February, compared to filling flat at 0.0% in January.

At its March meeting, the central bank acknowledged that inflation has continued to decline, but emphasized that progress in lowering prices will be slow and uneven, with remaining upside risks. Governor Macklem indicated that inflation is likely to remain close to 3% through the middle of the year, with an expected easing in the second half of the year. However, he did not foresee a return to 2% inflation in 2024.

Canada February CPI Inflation Report

- February CPI 2.8% y/y vs 3.1% expected

- January CPI was 2.9% y/y

- CPI m/m +0.3% vs +0.6% expected

Core measures

- CPI Bank of Canada core y/y +2.1% vs 2.4% prior

- CPI Bank of Canada core m/m +0.1% versus +0.1% prior

- Core CPI MoM SA -0.1% vs -0.1% prior (revised to 0.0%)

- Trim 3.2% versus 3.4% prior

- Median 3.1% versus 3.3% prior

- Common 3.1% versus 3.4% prior (revised to 3.3%)

- Full report

The previous report was also weaker, coupled with another notable undershoot in the latest data, suggests that inflationary pressures in Canada are weaker than expected. The declines in cell phone and internet prices, along with the moderation in food inflation, indicate that certain sectors of the economy are experiencing deflationary pressures.

This differing dynamic compared to the Federal Reserve implies that the Bank of Canada may need to take a more accommodative monetary policy stance, potentially lowering interest rates sooner and for a longer duration. The central bank may view the persistent undershoot in inflation as a signal that the economy requires additional stimulus to support growth and bring inflation closer to the target range.

USD/CAD Live Chart

USD/CAD

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account