EUR to USD Returns Back Down After ECB’s Lagarde

The EUR to USD rate has been falling in March, as we head into the start of easing policy by the ECB and the FED

The EUR to USD rate has been falling in March after climbing 3 cents in February, as we head into the start of easing policy by the ECB and the FED. The USD was suffering this fact more until March, but this month the Euro has been suffering it more than the USD, since the ECB is making it clear that they will cut rates in June. This has been weighing on EUR/USD this month.

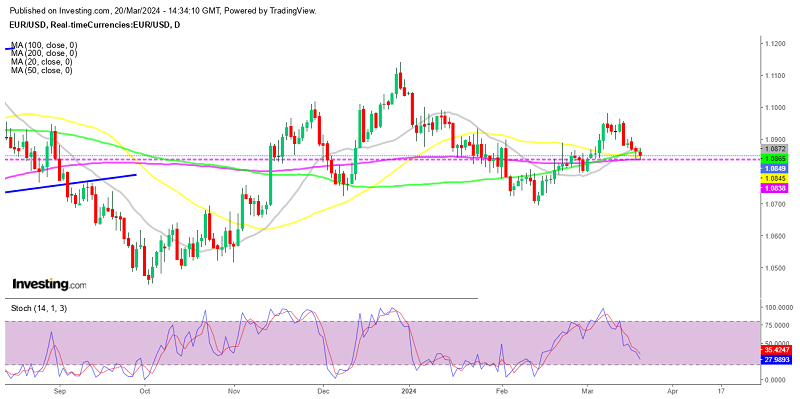

EUR/USD Daily Chart – The 200 SMA Held As Support Yesterday

In December, the consensus projection was for three to four interest rate cuts in 2024 from the FED. However, there has been adjustment in expectations which suggests that the FED might be cutting interest rates twice or three times this year, potentially supporting the US dollar during this period.

This contrasts with the European Central Bank, which is expected to reduce interest rates by 100 basis points this year, contributing to the Euro’s relative strength. Today the European Central Bank president Christine Lagarde made some comments at the ECB and its Watchers Conference, in Frankfurt.

Comments from ECB President Christine Lagarde

- Cannot commit to rate path even after first cut

- We need to move further along the disinflationary path

- Average wage growth in 2024 fell from 4.4% from January meeting to 4.2% in March meeting

- Latest data suggests wages are growing in a way that is compatible with inflation reaching the ECB’s target

- Will get a clearer picture in the coming months

- Expect to have two important pieces of evidence to raise confidence level sufficiently for first policy move

- If the data shows sufficient alignment between inflation path and ECB projections, then can dial back on current policy cycle

The upcoming release of negotiated wages data for Q1, expected in late May, will be crucial to monitor in this regard. The data from Q4 can serve as a reference point until then. The headline comment is not just for the ECB but also for all major central banks at the moment.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account