Ethereum Bulls Target $4,000: Will The SEC Spoil The Party?

Ethereum bulls are optimistic. Even though ETH is technically bearish, the coin might rally, breaking above $4,000

Ethereum is firm when writing following the welcomed expansion on March 20. Thus far, the coin is up 10% in the previous 24 hours. Buyers look confident and might add to their gains in the sessions ahead.

Looking at coin trackers, ETH is up 10% on the last trading day but down 11% in the previous week. This is despite the recovery on March 20, suggesting that the dump in the last few trading days was sharp. To quantity, ETH fell roughly 25% from 2024 highs. While the market cap is up, trading volume remains low, dropping 7% in the last day despite firm prices.

Going forward, traders are looking at the following Ethereum news as possible drivers of price:

- According to reports, the Ethereum Foundation, the non-profit behind the development of the smart contracts platform, is being investigated by a state authority. Further news postulates that the United States Securities and Exchange Commission (SEC) plans to classify ETH as a security. If it comes to pass, this classification means the odds of the agency approving a spot Ethereum ETF is low.

- Despite reports of regulatory scrutiny, some experts believe Ethereum is not yet at its “institutional hype” level. At this level, they add that people will understand the complexity of the network. This realization will push prices to record highs.

Ethereum Price Analysis

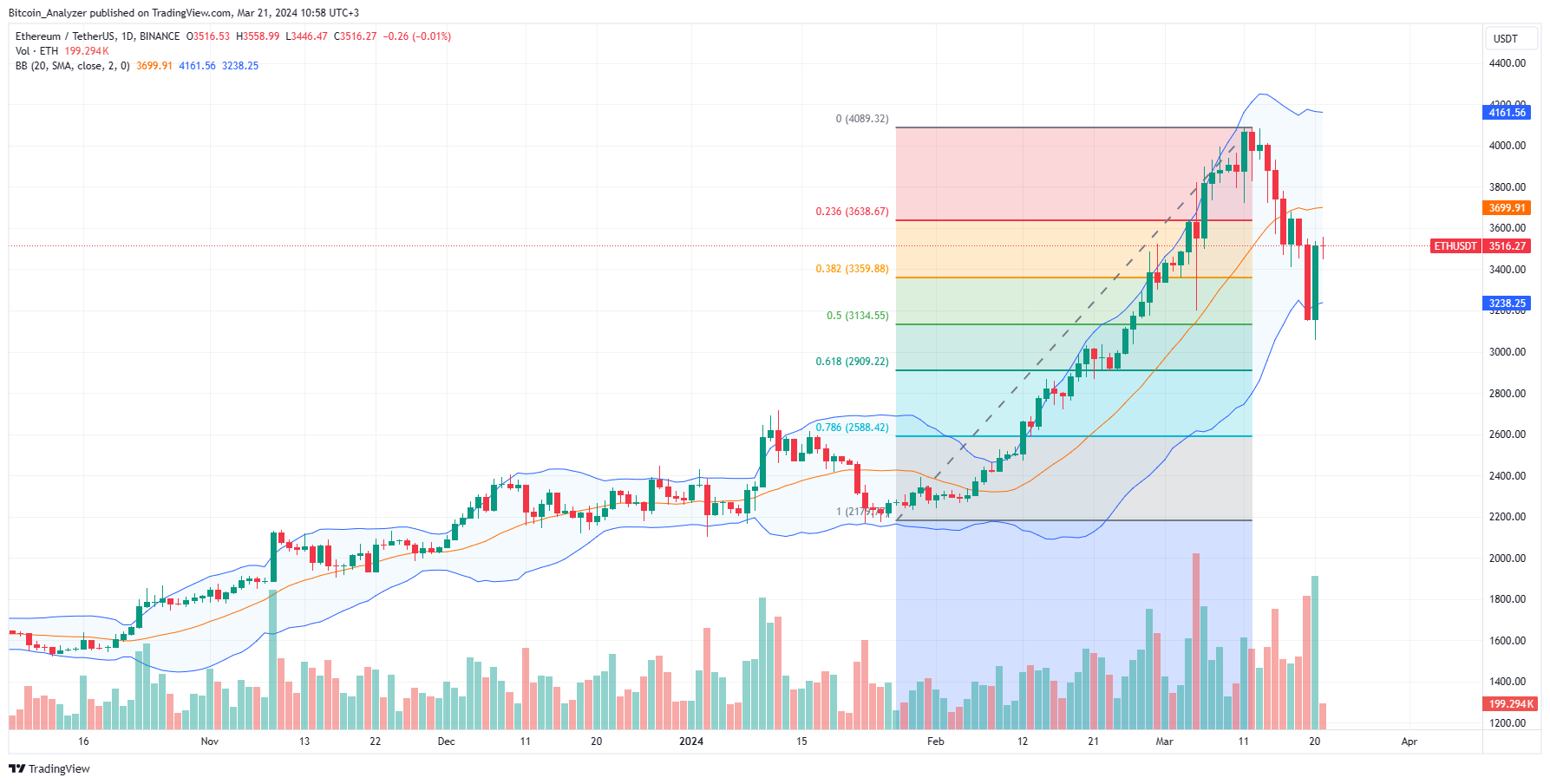

ETH/USD remains bullish, looking at the candlestick arrangement in the daily chart.

Even though sellers forced the coin lower, shaving 25% from 2024 highs, there are hints of strength.

The leg up on March 20 had higher trading volume, a show of conviction. Nonetheless, prices are below the 20-day moving average, signaling weakness.

For now, traders can search for entries at around spot levels.

Support lies between the $3,100 and $3,200 zone.

Optimistic buyers can target 2024 highs at $4,090.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account