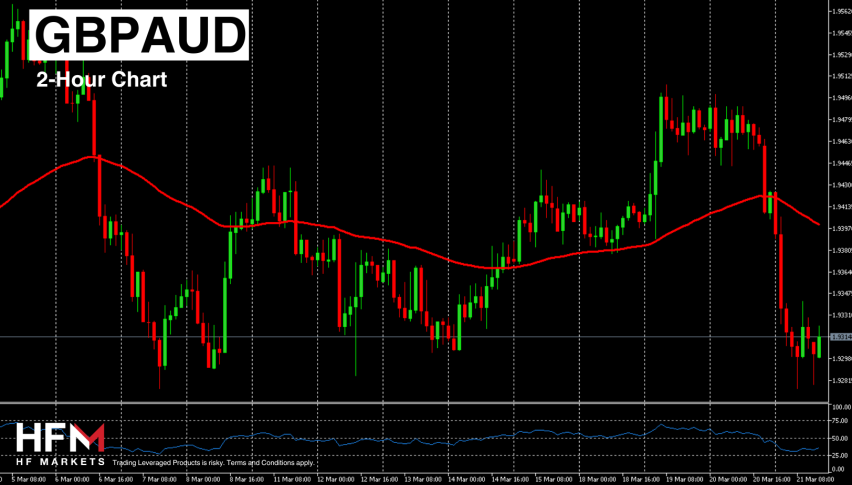

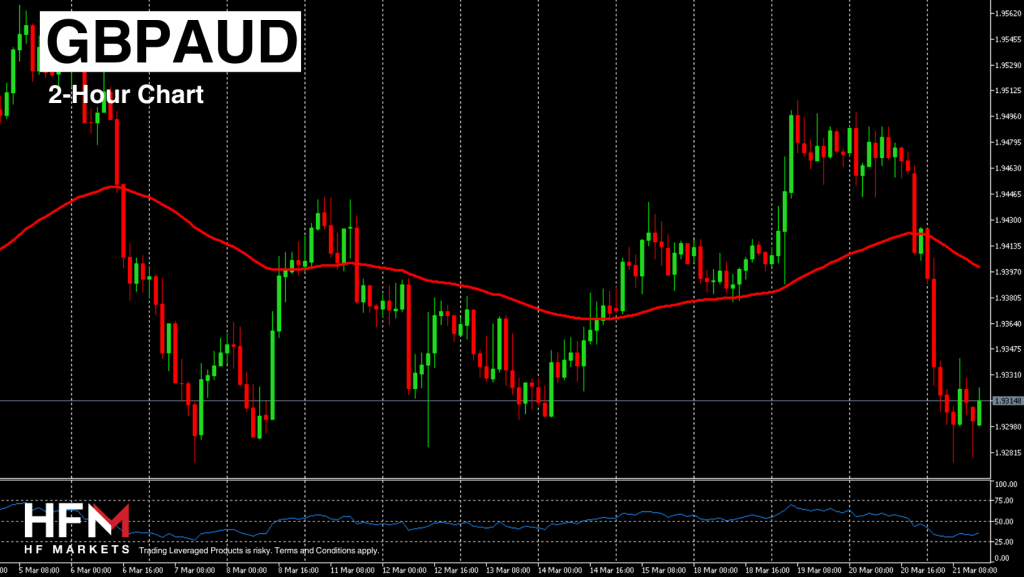

GBPAUD – BoE Members Don’t Vote For Hike For the First Time Since 2021!

The British Pound has been on a downward trend against the Australian Dollar for the second consecutive day, primarily driven by two factors. Firstly, the UK witnessed a notable decrease in inflation, with the rate dropping from 4.00% to 3.4%, surpassing previous forecasts and outpacing that of the US. Secondly, the Bank of England’s Monetary Policy Committee recorded no votes for a rate increase, marking the first instance since September 2021.

Despite the fact that only one of nine officials voted to cut interest rates by 25 basis points, no one supported raising them, while at the previous meeting there were two members, who were Jonathan Haskel and Catherine Mann. The Govornor of the Bank of England also gave encouraging comments on inflation, but are still less likely to cut rate before the Federal Reserve. According to economists, the Bank of England are likely to cut interest rates within the summer, most likely July or August depending on the resilience of the economy. Tomorrow the GBP will primarily be influenced by the UK’s Retail Sales data. If the UK Retail Sales is lower than -0.4%, the Pound is again likely to come under pressure from sellers in the short-medium term.

Meanwhile, the Australian Dollar has exhibited strong performance this week, reaching historic highs against several currencies. The hawkish stance of the Reserve Bank of Australia (RBA) and the latest employment figures have bolstered the Australian Dollar’s position. Australia recorded a significant increase in employment, with 116,500 more individuals employed within the economy compared to the previous month, surpassing analysts’ expectations and marking the highest surge since December 2021. Concurrently, the unemployment rate dropped from 4.00% to 3.7%, positioning Australia with a lower unemployment rate than the UK.

Consequently, fundamental analysis leans towards supporting a strengthening AUD. Correlations with Gold also lend support to the Australian Dollar and the AUDUSD pair, as a higher Gold price is believed to bolster the AUD to some extent. While technical analysis and indicators currently suggest a decline in the exchange rate, oscillators have yet to signal an oversold price. Nonetheless, investors are advised to exercise caution due to potential volatility.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account