EURUSD Heading for 1.07 as EU and US Economies Diverge

EUR/USD has turned bearish since Thursday, as the FED is looking less dovish than the ECB now and the EU economy will keep dragging the Euro

The EUR to USD rate has turned bearish since Thursday, as the FED is looking less dovish than the ECB now, with the economic situation in the Eurozone not favoring the Euro. Today we had the GfK Consumer Climate from Germany which continues to remain deeply negative, indicating that the Eurozone economy is warranting a dovish European Central Bank.

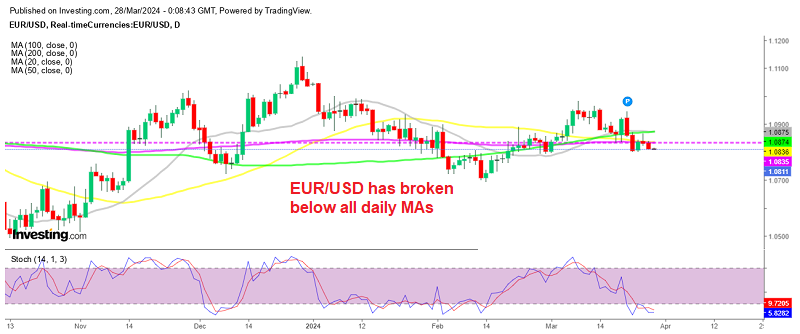

EUR/USD Daily Chart – MAs Have All Been Broken

EUR/USD failed to reach the 1.10 level this month, which means that buyers are getting weaker in the longer run, and after reversing this pair is facing the 1.08 level. Early this week we saw an attempt to reverse the decline which came after the market reevaluated the FOMC decision, but it was a weak attempt and it failed, with FED members confirming the higher-for-longer policy regarding interest rates.

During an event organized by the Economic Club of New York, Waller noted that economic growth and the labor market continue to strengthen, while progress in reducing inflation has stalled. Based on these indicators, Waller sees no immediate need to rush into easing monetary policy.

For those anticipating a rate cut in June or multiple rate cuts throughout the year, Waller advised against such expectations. He suggested caution, urging individuals not to repeat the fervor for multiple rate cuts that characterized early discussions in the new year. Waller’s remarks suggest a cautious approach to monetary policy, balancing the need to support economic growth with the need to manage inflationary pressures. His comments also indicate a willingness to adapt policy decisions based on evolving economic conditions, which at the moment don’t look too bad, so this will continue to keep the USD bullish. Below are some of his main comments:

Remarks by the Federal Reserve Board Governor Christopher Waller

- No Rush to Cut Rates: Waller emphasized that there is still no urgency to cut interest rates given the current state of the economy.

- Possibility of Maintaining Current Rate Target Longer: He suggested that the Fed may need to maintain its current rate target for a longer duration than previously anticipated.

- More Inflation Progress Needed: Waller highlighted the importance of seeing further progress in inflation before considering supporting a rate cut.

- Data Analysis Required: He expressed the need for at least a couple of months of data to confirm if inflation is trending towards the Fed’s target of 2%.

- Expectation of Rate Cut Later in the Year: Despite the cautious approach, Waller still expects the Fed to cut rates later this year.

- Economic Strength Provides Flexibility: He noted that the strength of the economy allows the Fed to assess incoming data more thoroughly.

- Possibility of Fewer Rate Cuts: Waller suggested that the data implies there may be fewer rate cuts this year than previously anticipated.

- Mixed Signals on Jobs and Inflation: Recent data has presented mixed messages, particularly concerning job growth and inflation.

- Progress in Lowering Inflation: Waller acknowledged the progress made in reducing inflation but noted recent disappointments.

- Uncertainty Regarding Wage Pressures and Productivity: He expressed uncertainty about whether wage pressures will continue and if productivity will maintain its current strong pace.

- Need for Further Inflation Data: Waller stressed the importance of analyzing up to five months of good inflation data, as only two months’ worth of data are currently available.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account