Shorting NZD/USD After the Softer JOLTS Jobs Openings

The rate of NZD to USD has slipped below 0.60, and we have turned totally bearish on this pair.

The rate of NZD to USD has slipped below 0.60, and we have turned totally bearish on this pair. Today, the JOLTS job openings for February leanes slightly on the soft side, but the employment market remains stable overall, so it doesn’t change the outlook for the USD and for NZD/USD.

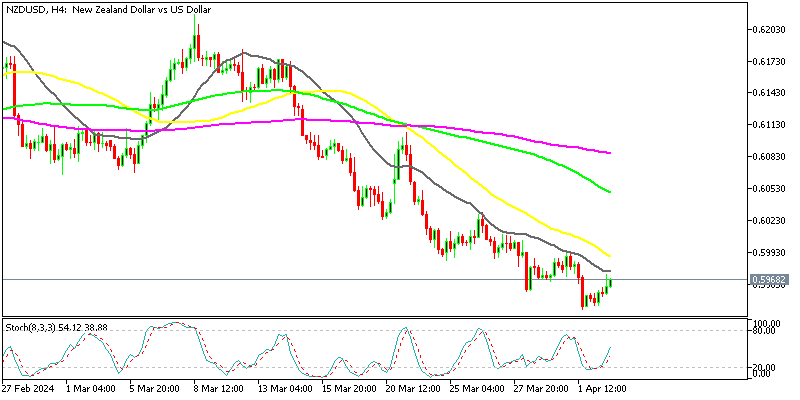

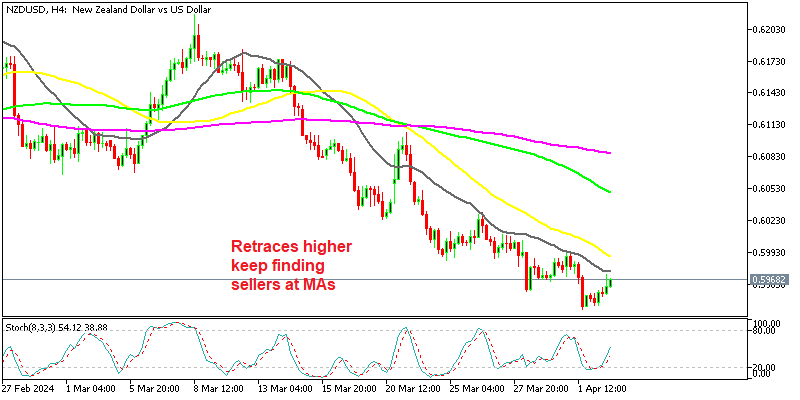

NZD/USD Chart H4 – The 20 SMA Pushing the Highs Lower

NZD/USD pair has experienced a significant decline of about 2 cents since the middle of March. The decline in the NZD/USD pair is attributed to market expectations of a less dovish Federal Reserve, which has propelled the US dollar higher. A less dovish Fed implies a potentially more aggressive stance on monetary policy with odds of a June FED cut continuing to fall, which is strengthening the USD.

Moving averages have been providing resistance for the NZD/USD pair, indicating a level where selling pressure increases, and where we decided to open a sell signal earlier today. The break of the 0.60 level suggests a bearish outlook for the pair, with an expectation of further downward movement. The current upward retrace appears to be complete, indicating that the pair may have finished its temporary upward movement and could resume its downward trend, hence shorting this pair.

US February JOLTS Job Openings

- Job Openings: The number of job openings in February stood at 8.756 million, slightly exceeding the consensus estimate of 8.750 million. However, this figure represents a decrease from the revised January level of 8.748 million.

- Quits Rate: The quits rate, which indicates the percentage of workers voluntarily leaving their jobs, rose to 2.2% in February from the revised January rate of 2.1%. The number of quits remained little changed at 3.5 million.

- Layoffs and Discharges: The number of layoffs and discharges increased to 1.7 million in February compared to 1.6 million reported in the previous month.

- Hires: There were 5.8 million hires in February, up from 5.7 million reported in January.

- Separations: The total number of separations, including quits, layoffs, and other reasons for employment termination, increased to 5.6 million from 5.4 million reported in January.

Overall, the February JOLTS report indicates a mixed picture of the US labor market. While job openings remained stable, there was an increase in both quits and layoffs, suggesting some fluidity in the labor market as workers leave their jobs voluntarily or due to layoffs while new hires continue.

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account