USD/MXN: Mexican Peso Gets Some Relief as US Dollar Bullish Sentiment Weakens

Mexican data for business confidence (EMOE) was positive, giving the peso some extra tailwind. While the dollar has retreated against most

Mexican data for business confidence (EMOE) was positive, giving the peso some extra tailwind. While the dollar has retreated against most currencies, the DXY is down 0.25% on the day.

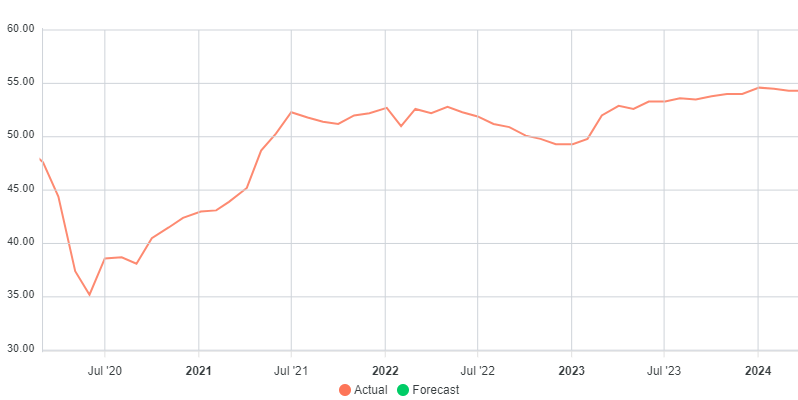

Today’s data for monthly business sentiment was published at 54.3, unchanged from last month. The significant point is the continuation in the strength of this reading. We can also add that expectations had been for a decrease to 53, giving an extra boost to this data.

The chart above shows the progression of the EMOE number. We can see how business confidence has been improving steadily since June 2020. The lack of any important data from the US today and the bullish run for the greenback last week means the market may be taking a breather.

However, during this week we have various data release from the US that should spark some volatility. Hopefully we get some unexpected number releases, and we’ll see some major market moves.

For the US this week we can expect the following high-impact events:

- Wednesday – ADP Employment Change

- Wednesday – ISM Services PMI

- Friday – Non-farm Payrolls

On Thursday we’ll also get Consumer confidence from Mexico. The forecast is for a number of 43, with a previous reading at 47. We’ll see if consumers can rise to the level of confidence shown by businesses at some point. Also, later on the same day Banxico release the monetary policy meeting minutes.

Technical View

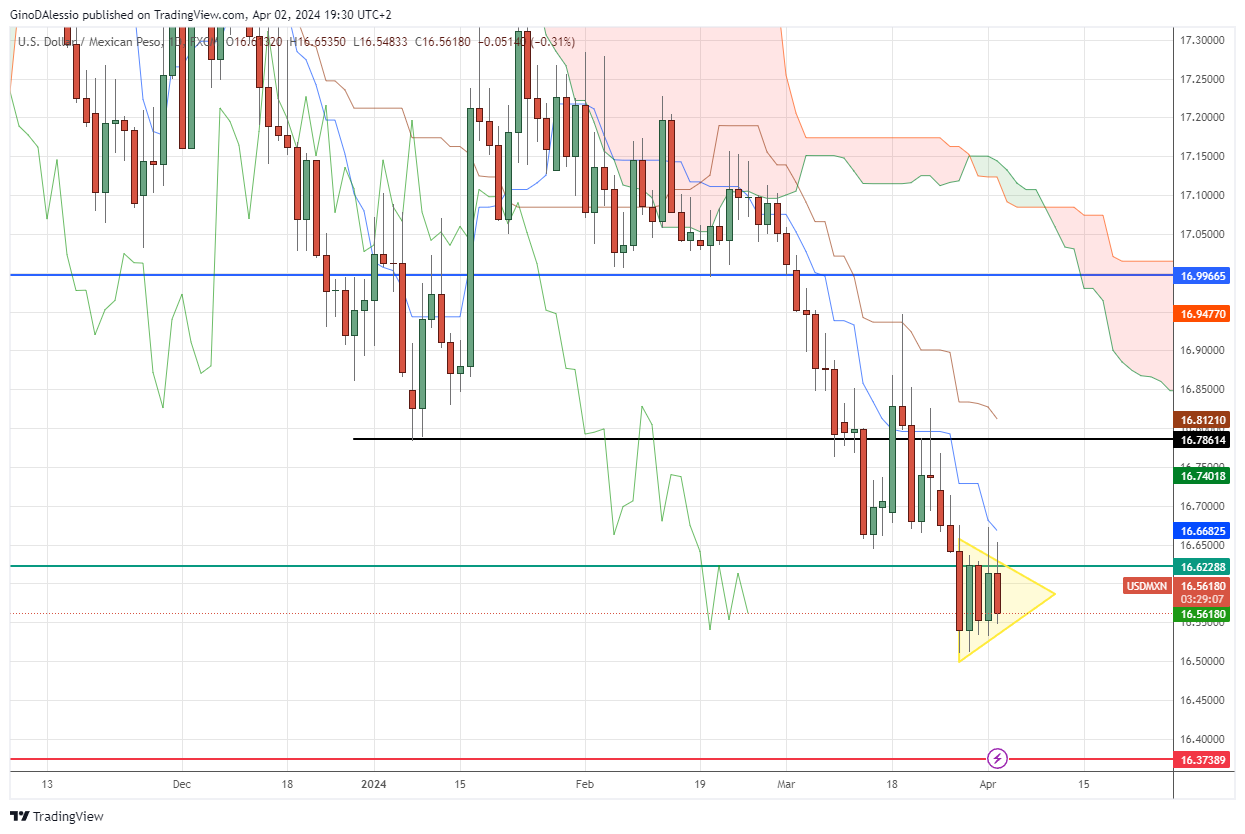

The chart below for USD/MXN shows a market in a sideways environment that’s creating a triangle. This is typical before another leg up or down. The market is consolidating and the direction it will take is still undecided.

A break above or below this rectangle (yellow area) will determine the most likely direction. In the case of a breakout lower, we have a strong support level (red line) at 16.3780. This level was set back in October and November 2015.

While a breakout higher would be met with initial resistance at 16.6228 (green line) and further resistance would be found at 16.7861. Given the current bear trend for this FX pair it would seem the most likely outcome is a breakout to the downside.

However, we’ll see as the week progresses and what data and news we have from the US in particular that might cause the USD/MXN to reverse its bear trend. At the moment, any higher levels should be taken as a market correction. Always until the price level remains below the Ichimoku cloud.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account