Gold Price Within Reach of $2,300 After Powell’s Comments

XAU/USD continues to show resilience, with the Gold price approaching $2,300 as I write as the USD turns softer.

XAU/USD continues to show resilience, with the Gold price approaching $2,300 as I write as the USD turns softer. Powell kept a similar rhetoric to the comments he made on Friday, however, the USD is also under the effect of the softer ISM services and lower service prices in March.

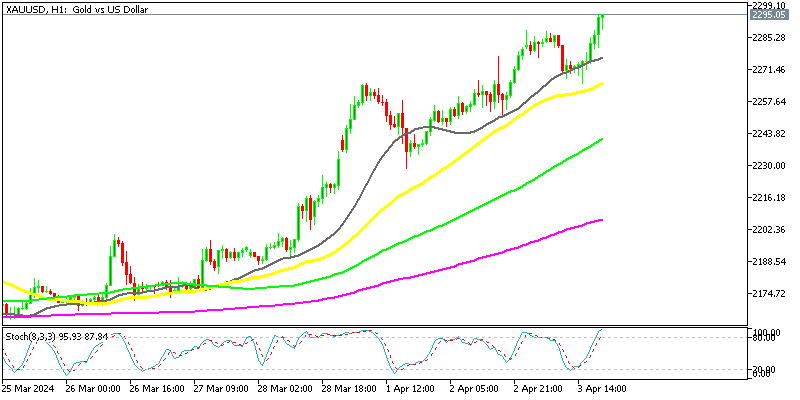

Gold Chart H1 – MAs Keeping XAU Supported

The upside momentum has gained immense strength since late March, sending the Gold price more than $100 higher, with smaller moving averages such as the 20 SMA (gray) acting as support on the H1 chart. Now the price of Gold bullion is very close to $2,300, so we’re almost there.

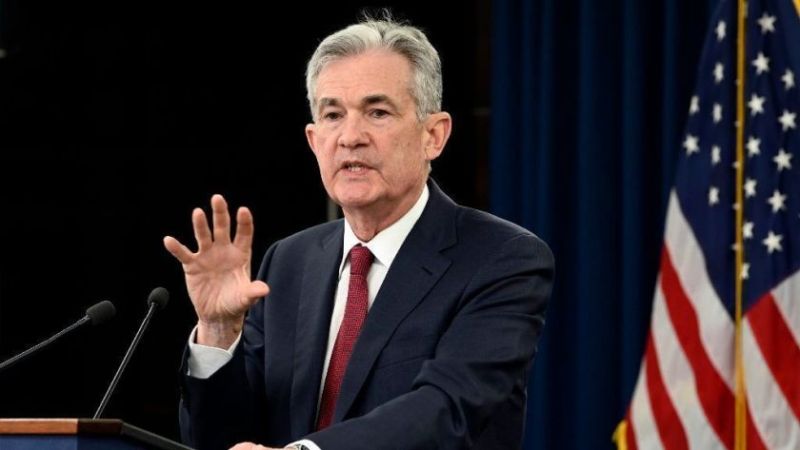

Comments from FED Chairman Jerome Powell

- Recent readings on job gains and inflation higher than expected but do not materially change overall picture

- If economy evolves as Fed expects, most FOMC participants see it likely appropriate to begin cutting rates this year

- Too soon to saw whether recent inflation readings are more than just a bump

- Fed has time to let incoming data guide its policy decisions, we’re deciding meeting by meeting

- Outlook is still uncertain, Fed faces risks on both sides of his mandate

- Labor market rebalancing seen in data on quits, job openings, employer and working survey and continued gradual decline in wage growth

- Economy still one of solid growth, strong but rebalancing labor market, inflation moving down to 2% on a sometimes bumpy path

Fed Chair Jerome Powell addresses the recent economic data and its implications for monetary policy. Powell acknowledges that while there have been fluctuations in the data, they do not materially alter the overall economic landscape, which remains characterized by solid growth, a robust but evolving labor market, and inflation gradually approaching the 2 percent target.

Powell points out evidence of labor market rebalancing, citing indicators such as quits, job openings, employer and worker surveys, and the ongoing gradual decline in wage growth. This suggests that while the labor market remains strong, there are signs of adjustments taking place. Regarding inflation, Powell notes the recent fluctuations but indicates that it is premature to determine whether they represent more than temporary disruptions.

Powell emphasizes the importance of achieving sustained inflation trends toward the 2 percent target. In terms of monetary policy, Powell adopts a cautious approach, stating that it will not be appropriate to lower the policy rate until there is greater confidence that inflation is moving sustainably toward the target. However, given the strength of the economy and progress made on inflation thus far, Powell suggests that there is flexibility to allow incoming data to guide policy decisions.

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account