USD/CHF Support at 0.90 Holds After the Swiss CPI Inflation

We have seen weakness in the CHF to USD rate in 2024, which has sent USD/CHF in a steep uptrend, gaining nearly 8 cents since January

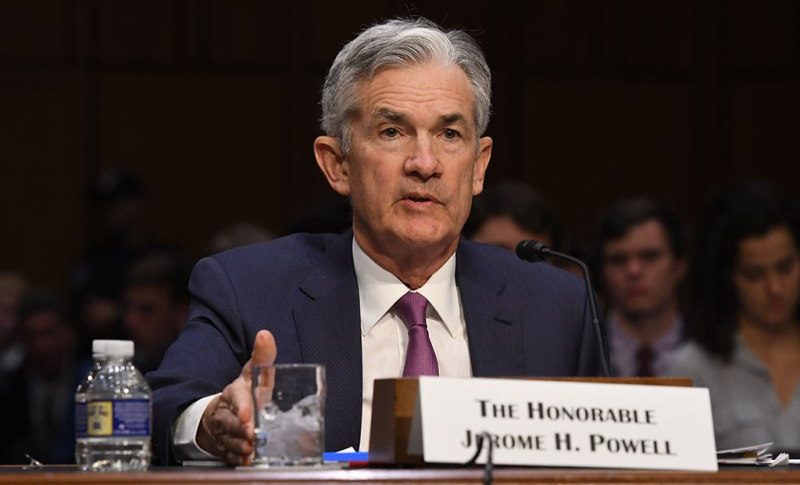

We have seen weakness in the CHF to USD rate in 2024, which has sent USD/CHF in a steep uptrend, gaining nearly 8 cents since the start of this year. However, we saw a strong retreat from below 0.91 yesterday after the soft US services PMI and prices paid, while Jerome Powell didn’t improve the situation for the USD in the evening.

USD/CHF Chart H4 – The 50 SMA Stood the Ground Yesterday

The recent movements in USD/CHF have been influenced by several factors, including the weaker-than-expected ISM non-manufacturing data and comments from Fed Chairman Powell yesterday, which led to a downward shift in this forex pair after reaching its highest level of the year. The previous highs from last week at 0.9070 and 0.9060 were broken, paving the way for a downside corrective move. So, this pair fell below its 20-period Simple Moving Average (SMA) on the H4 chart which stood at 0.9050 but stopped at the 50-period SMA around 0.9030, indicating that the bearish momentum had ended.

However, the mid-term bullish outlook for the pair is based on the Swiss National Bank starting to reduce rates already and the possibility of the Fed waiting longer to lower interest rates, possibly in late summer as the odds for a cut in the June meeting keep falling. So, the fundamental bias has shifted in favor of the US dollar over the Swiss franc (CHF) since the Swiss National Bank’s rate cut on March 21.

However, the key question is whether buyers will send the price back to 0.91. If so, the 0.9019 – 0.9025 swing area will be targeted, followed by swing areas above and below the 0.9000 level. Traders looking to buy on dips are targeting the 0.90 area which is last week’s low. If the price falls below 0.9000, it may signal a shift in the fundamental view.

USD/CHF Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account