USD/JPY Price Forecast: Navigates 151.60 Amid Key Economic Data Releases

The USD/JPY pair closed the week at 151.607, evidencing a modest increase of 0.19%. This subtle uptick suggests a market in contemplation,

The USD/JPY pair closed the week at 151.607, evidencing a modest increase of 0.19%. This subtle uptick suggests a market in contemplation, with traders eyeing critical financial indicators and geopolitical events for direction.

Anticipated Financial Releases

Imminent economic data will play a significant role in the currency’s trajectory. Japan’s Average Cash Earnings year-on-year are expected at 1.8%, with a slight decrease from the previous 2.0%. The Current Account is anticipated to show a balance of 1.99 trillion JPY, down from 2.73 trillion JPY.

In contrast, the U.S. will release the NFIB Small Business Index, forecasted at 90.2, slightly above the previous 89.4, indicating potential economic optimism.

Influential Economic Events

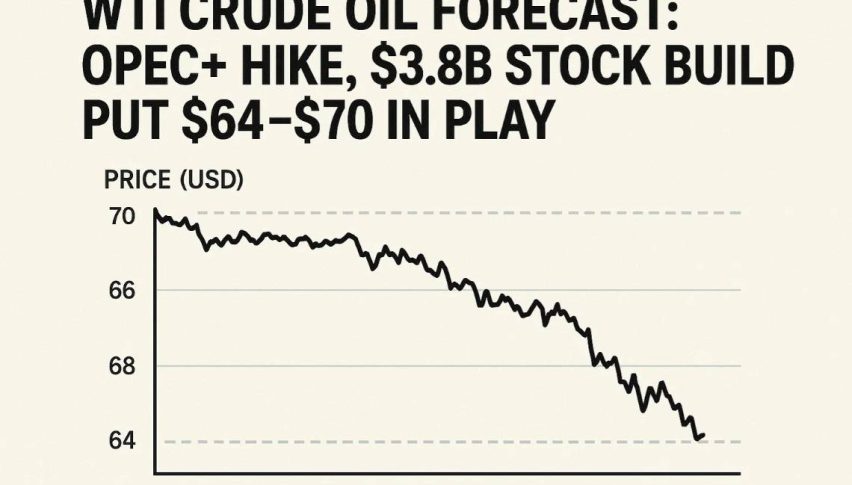

The market will also react to the U.S. Core CPI and CPI month-over-month, both expected at 0.3%, with a keen eye on any deviations that could influence Federal Reserve policy decisions. Additionally, the U.S. crude oil inventories report showing a 3.2 million barrel increase will be significant for broader market sentiment.

Key Figures to Watch

Among the crucial figures to monitor are Japan’s Prelim Machine Tool Orders year-over-year, anticipated at -8.0%, and the U.S. Core PPI month-over-month projected at 0.2%.

These indicators, coupled with speeches from FOMC members and other scheduled economic data releases, will provide valuable insights into the USD/JPY price forecast, guiding traders in their strategic decisions in the forex market.

USD/JPY Price Forecast: Technical Outlook

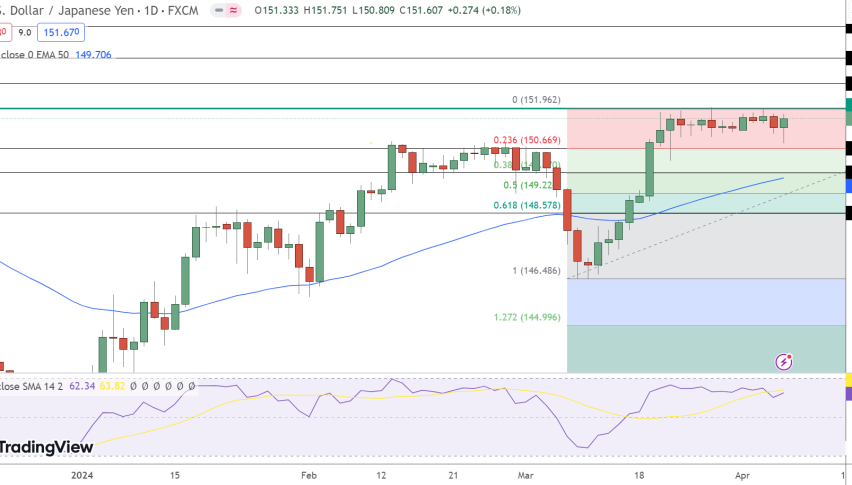

The USD/JPY ended the week at 151.607, marking a slight increase of 0.19%. The currency pair’s pivot point is at 151.94, with resistance levels positioned at 152.74, 153.55, and 154.57. Support is established at 150.67, followed by 149.89 and 148.59.

The Relative Strength Index (RSI) reading of 62 indicates a bullish momentum, while the 50-day Exponential Moving Average (EMA) at 149.71 supports the uptrend. USD/JPY is currently in a consolidation phase, fluctuating between 152 and 150.700.

A breakout from this range could significantly influence future price movements, with potential upside targets beyond 152.75. The trend remains bullish above 151.94, but falling below this level may trigger a strong sell-off.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account