Bitcoin Price Action Indicates New Record Highs Soon

Bitcoin has shown incredible resilience in 2025 and the price action of recent weeks shows that BTC is poised to reach a new all-time high.

Bitcoin has shown incredible resilience in 2024 and the price action of recent weeks shows that BTC is poised to reach a new all-time high this month, with the potential for $100,000 later in the year, if stop orders get triggered above the current record high, which would also accelerate the bullish momentum.

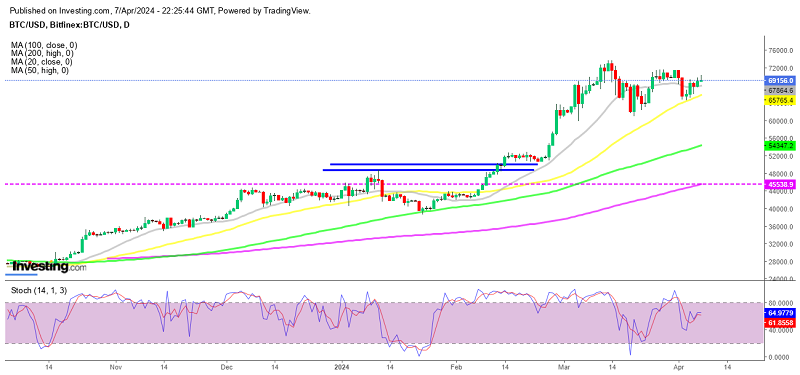

Bitcoin Chart Daily – MAs Continue to Push Lows Higher, Keeping BTC Bullish

Last week the 50 SMA (yellow) caught up with the price and sent BTC higher above $70,000 again, helping BTC/USD keep the bullish trend. So, short sellers should exercise caution, as placing stops above the record high could contribute to upward momentum and trigger weak stops. However, trading cryptocurrency carries inherent risks, and individuals should be mindful of these risks when participating in the market.

Upon examining the daily BITCOIN chart, the positive momentum is evident, and the first target comes at $80k. The chart indicates that the $70K level has been quite magnetic during pullbacks lower, attracting BTC back up towards it, indicating strong demand on dips. Despite recent declines, Bitcoin has managed to reclaim the $70k level time and time again, suggesting robust buying demand and rejection of lower prices.

Key Observations in the Crypto Market Behavior

- The bullish trend in 2024 highlights persistent positive momentum

- Continuously higher lows indicate a strong uptrend, suggesting further upward movement

- Moving Averages are acting as support, holding the price during pullbacks

- Attention is focused on the resistance line, which is being tested for the third time. A breakout above this level could lead to further gains

In terms of crypto market behavior, optimism still prevails, as evidenced by the higher lows on the chart, indicating a sustained upward trend. Bitcoin continues to find support at MAs, signaling a strong uptrend that is likely to persist, with the global economic and political situation diverting funds to the digital coin market. Currently, the focus is on the upside, which is being tested for the third time, with the potential for a breakout this week.

However, we suggest waiting for a clear break above the current record high before considering going long. So, we should exercise patience and caution, closely monitoring market developments and technical indicators, and in case we see a retreat lower, the 50 SMA will be a good place to look for longs as well.

Bitcoin Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account