USD/COP: Colombian Peso Trades in A Range as it Ventures into Oversold Territory

The Colombian peso halted its rally against the US dollar today, while the markets expect inflation data from the US on Wednesday.

The Colombian peso halted its rally against the US dollar today, while the markets expect inflation data from the US on Wednesday.

The recent rally in crude oil has been giving a big hand to the peso’s ascent. Crude oil represents the nation’s largest export. As the price of crude rises, more US dollars flow into the exporters’ hands, allowing them to sell dollars at increasingly lower rates.

The interest rate differential between these two currencies is also very wide and favors the Colombian peso. With BanRep’s main interest rate at 12.25%, the Colombian central bank has way more room to cut rates than the Federal Reserve.

The central bank is set to cut interest rates again at the next meeting on April 30. Expectations are for BanRep to cut rates again by 75 basis points to 11.50%. At the last monetary policy meeting the members stated they saw a continued decline in inflation.

The latest data from Abril 6, shows inflation declined from 7.74% to 7.34%. This is the most recent data the central bank will have to hand. So, it seems feasible that BanRep takes interest rates lower again.

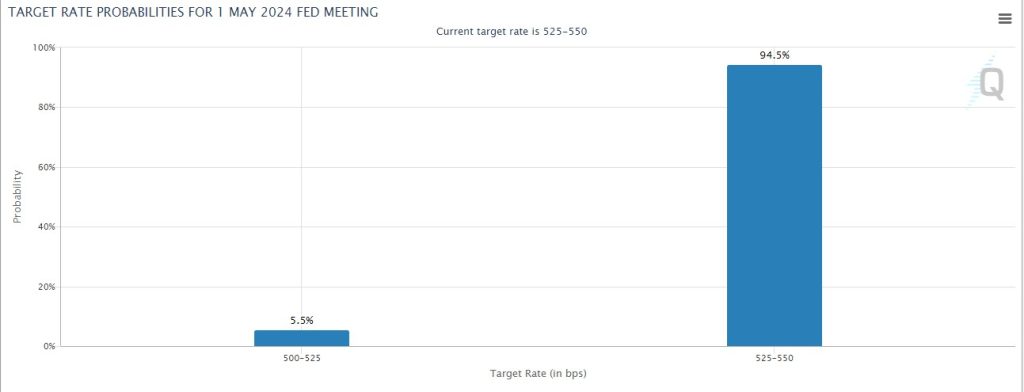

Source: CME Group

On the other hand, the Federal Reserve is set to meet on May 1, it seems unlikely we’ll be getting any surprises. The markets seems to have it very clear that the Fed will leave the main interest rate at the current range of 5%-5.25%. The temporary tightening of the rate spread may give way to some corrective price action higher for the USD/COP.

In the meantime, the US will be publishing inflation data on Wednesday and PPI and Jobless claims on Thursday. So, we may get some increased volatility that might help a correction in the trend.

Technical View

The day chart below for the USD/COP shows that we’re in a clear bear market, with price action well below the Ichimoku cloud. And a series of lower lows and highs. However, we’re also getting into oversold territory as indicated by the RSI indicator.

To have confirmation of an upcoming correction of a trend we would need the RSI to return above 30. However, from experience I would say markets rarely stay in such low RSI numbers. And given the inflation data coming from the US this week there may already be room for a correction higher.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account