JPY to USD Finally Breaks Above 152, After Hot US CPI Inflation

The rate of JPY to USD keeps weakening, as USD/JPY pushes higher, breaking the all-time high at 152 after strong March US CPI inflation.

The rate of JPY to USD keeps weakening, as USD/JPY pushes higher, breaking the all-time high at 152 after some strong US CPI inflation figures for March. This pair has jumped around 100 pips higher as the USD keeps surging across all major currencies, with the odds for a June FED rate cut falling below 50%.

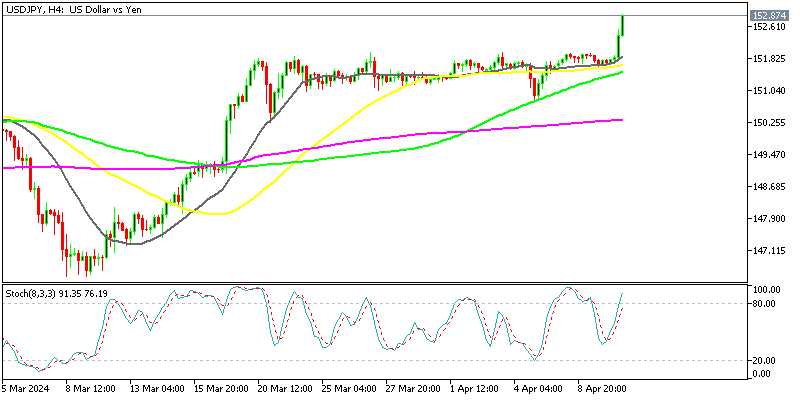

USD/JPY Chart H4 – New Record High

The recent weakness in the Japanese Yen has pushed the USD/JPY pair close to record highs near 152, marking the third time it has approached this level. There is speculation that this time, a breakout above 152 may occur. The Bank of Japan (BOJ) is not expected to take any further action today, following its recent decision to hike interest rates last week.

As a result, the risk premium associated with short positions on the Japanese Yen has diminished, leaving the currency vulnerable to further weakness from the USD side, such as today after the US CPI inflation report. Expectations were for a stable March reading, but the report was even stronger, as shown below. That has propelled USD/JPY to 152.80s. Now the 150 level should be a good support level to buy this pair.

US March CPI Inflation Report

Headline measures:

- CPI year-on-year (y/y): +3.5% versus expected +3.4%, with the previous year-on-year figure at +3.1%.

- CPI month-on-month (m/m): +0.4% versus expected +0.3%, with the unrounded month-on-month figure at +0.359%.

Core measures:

- Core CPI month-on-month (m/m): +0.4% versus expected +0.3%, with the previous month also at +0.4%. The unrounded core month-on-month figure is +0.359%.

- Core CPI year-on-year (y/y): +3.8% versus expected +3.7%, with the previous year-on-year figure at +3.8%.

Other details:

- Shelter m/m: +0.4% versus the previous month at +0.4%, and shelter y/y at +5.7%.

- Services less rent of shelter m/m: +0.65% versus the previous month at +0.6%, and services less rent of shelter y/y at +4.8%.

- Real weekly earnings: +0.3% versus the previous at 0.0%.

- Food m/m: +0.1% versus the previous month at +0.0%, and food y/y at +2.2%.

- Energy m/m: +1.1% versus the previous month at +2.3%, and energy y/y at +2.1%.

- Rents m/m: +0.4% versus the previous month at +0.5%.

- Owner’s equivalent rent: +0.4% versus the previous month at +0.4%.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account