US Employment Remains Solid, Keeping 2 FED Rate Cuts in Play

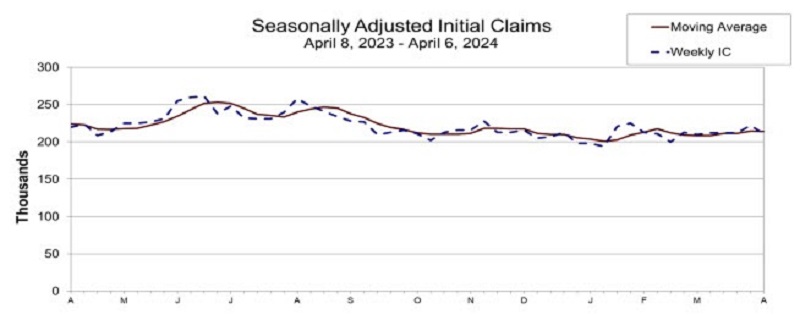

This week the CPI inflation report was strong, sending the USD higher as FED rate cut odds for June fell, helped by employment as well, as most employment reports have come up quite strong in 2024. The unemployment claims report came at 211K against 215K expected, confirming the solid shape of the labour market.

Initial Jobless Claims and Continuing Claims

- Initial Jobless Claims: 211K, slightly lower than the estimated 215K.

- 4-week Moving Average for Initial Jobless Claims: 214.25K, slightly lower than the previous week’s 214.50K.

- Continuing Claims: 1.817M, slightly higher than the estimated 1.800M.

- 4-week Moving Average for Continuing Claims: 1.803M, slightly higher than the previous week’s 1.799M.

In terms of state-level changes:

- The largest increases in initial claims were observed in California (+2,147), Pennsylvania (+1,913), Iowa (+1,383), New Jersey (+1,230), and Illinois (+1,195).

- The largest decreases were reported in Texas (-3,248), Missouri (-2,369), Georgia (-935), Arkansas (-459), and North Carolina (-400).

Overall, while initial jobless claims remained slightly below the estimate and continuing claims saw a modest increase, the labor market continues to show overall stability. However, there are some fluctuations at the state level, with some states experiencing increases in claims while others are seeing decreases.

The latest official government reports have presented a mixed picture of inflation, with differences noted between the consumer and producer price indexes. Consumer prices saw a higher-than-expected increase, sparking concerns and leading to a negative impact on the stock market.

In contrast, producer prices demonstrated a smaller-than-expected rise, contributing to market recovery. Despite the inflation concerns, the employment reports have been consistently strong, as evidenced by the positive trends in unemployment claims. This indicates resilience in the labor market, which could potentially mitigate some of the inflationary pressures.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account