The CAD Keeps Falling As

The rate of USD to CAD continues to surge higher after breaking above the channel and today it climbed further to 1.2847 after the inflation

The rate of USD to CAD continues to surge higher after breaking above the ascending channel and today it climbed further to 1.2847 after the Canada inflation numbers. The CPI (Consumer Price Index) report leaned on the soft side, which is weighing on the CAD while the USD continues to remain in demand, which is pushing this pair toward 1.40.

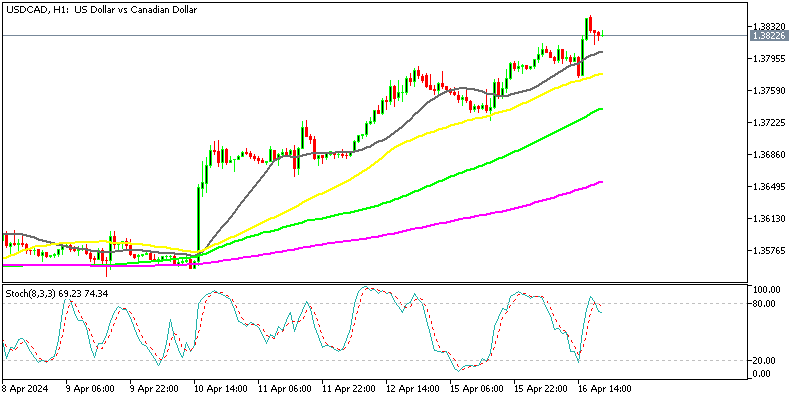

USD/CAD Chart H1 – The 50 SMA Is Now Acting As Support

The bullish channel on larger timeframes has been broken, while on the smaller timeframe charts moving averages are acting as support. Today the price bounced off the 50 SMA (yellow) on the H1 chart, with USD/CAD gaining around 70 pips higher. The headline CPI from Canada looked strong, but it’s a skew if we look at the details shown below. So, the Upside momentum continues for this pair.

Canada March Inflation Report

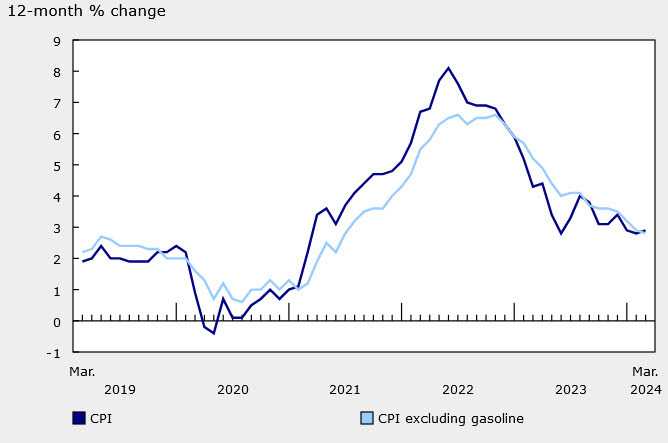

- March Canada’s Consumer Price Index (CPI) rose by 2.9% year-on-year, meeting expectations and up from the previous reading of 2.8% year-on-year

- CPI MoM increased by 0.6%, falling slightly short of the expected 0.7%.

Core Inflation Measures

- CPI Bank of Canada core year-on-year came in at +2.0%, lower than the previous reading of 2.1%.

- CPI Bank of Canada core month-on-month showed a notable increase of +0.5%, compared to the previous +0.1%.

- Core CPI month-on-month Seasonally Adjusted (SA) was -0.1%, consistent with the previous reading (revised from 0.0%).

- Trim CPI year-on-year was reported at 3.1%, slightly lower than the previous 3.2%.

- Median CPI year-on-year stood at 2.8%, down from the previous 3.1%.

- Common CPI year-on-year came in at 2.9%, also lower than the previous 3.1%.

- Full report

The increase in the headline CPI was largely expected due to the rise in petrol prices. However, excluding petrol, CPI actually declined year-on-year to 2.8% from 2.9%. This decline may provide the Bank of Canada with more confidence to consider decreasing interest rates. It’s worth noting that what remains of the CPI is primarily driven by increases in mortgage interest payments (+25.4% year-on-year) and rent (+8.5% year-on-year).

However, there are concerns about the services sector, which has seen an increase to +4.5% year-on-year from 4.2%. Conversely, prices for goods fell to 1.1% from 1.2%. This nuanced picture suggests that while there are inflationary pressures in certain areas, others are experiencing downward pressure on prices.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account