Keeping Long in Gold As Uncertainty Keeps Buyers in Charge

The price of Gold has formed a top above $2,400, but it remains well supported by MAs on all charts, so we're using the dips to buy XAU.

The price of Gold has formed a top above $2,400, but it remains well supported by MAs on all charts, so we’re using the dips to buy XAU. The geopolitical concerns are keeping traders cautious, so they’re refraining from investing in other assets and are piling in on Gold.

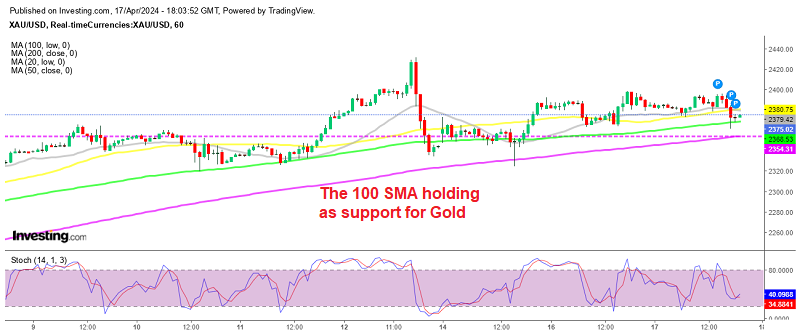

Gold Chart H1 – The Lows Keep Getting Higher

GOLD retreated lower to $2,362.93 this morning, representing a slight loss of around 0.35%. but moving averages held as support and from a technical standpoint, the precious metal remains pretty bullish. The 100 SMA (green) held as support on the H1 chart, and after forming a doji which is a bullish reversing signal after the retreat, the price is starting to bounce higher now.

The price of gold (XAU/USD) surged to $2,395 during the European session Today but has formed a short term top around there and the price retreated lower. Although, despite Federal Reserve Chair Jerome Powell’s indication of the need for a prolonged restrictive policy stance, the precious metal is still bullish and striving to reclaim fresh all-time highs above $2,430. So, we continue to remain long on Gold and opened a buy Gold signal at the 100 SMA a while ago.

With inflation persisting and the labor market remaining robust in the US, Powell and other FED members seem inclined to maintain higher interest rates for an extended period. Furthermore, concerns over geopolitical tensions, including Iran’s attack on Israel and the US warnings of penalties in response, as well as additional EU restrictions on Russia, are contributing to the positive momentum in Gold prices.

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account