GBP/USD Still Faces the 100 Weekly SMA After Services PMI

The rate of GBP to USD has declined by 6 cents since the first week of March after failing at the 200 weekly SMA, but the 100 SMA is holding

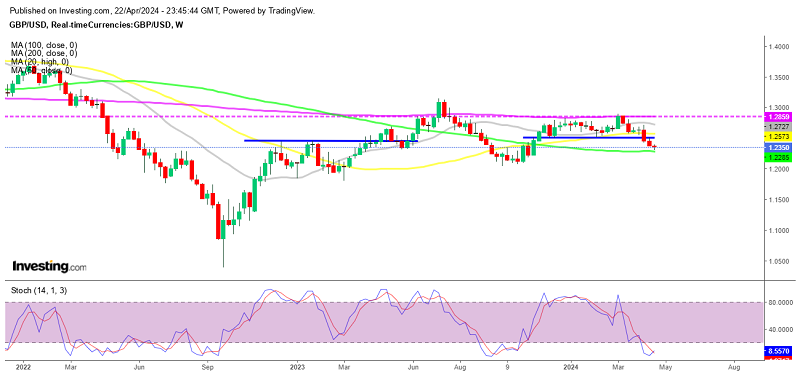

The rate of GBP to USD has declined by 6 cents since the first week of March after failing at the 200 weekly SMA, but the 100 SMA is holding as support at the moment. The pace of the decline has been quite strong but the 100 SMA might be a hassle for GBP sellers, especially with the services and manufacturing reports we saw earlier today.

GBP/USD Chart Weekly – Bouncing Between 2 MAs

GBP/USD has intensified its selling pressure since Friday after it broke the 1-cent range, with the price dropping to an intraday low of $1.2299 yesterday. This decline is driven by increasing anticipation that the Bank of England (BoE) may implement more aggressive monetary easing measures, with markets anticipating a June rate cut, which has put downward pressure on the pound and exacerbated the pair’s downward trend.

The pound has become the most bearish among major currencies as a result. The downward momentum for GBP/USD started earlier this month when the USD regained strength, leading to a significant drop below the key psychological level of 1.2500. Despite a brief period of stability below this level, selling pressure resumed, driving the pair below 1.24 and closing the week at that level. Yesterday, the selling pressure persisted, resulting in a decline to 1.2299. From a technical perspective, the 100-weekly SMA at 1.23 provides some support and led to a brief rally yesterday during the US session. The next significant support level is around the October low of 1.2000-1.2050.

Bank of England Prepares to Cut Interest Rates

Late last week, Dave Ramsden who is the deputy gov. of the Bank of England (BoE), indicated on Friday that there were reduced risks to the persistence of elevated inflation in the UK. When asked about the interest rate outlook of the Federal Reserve, Ramsden noted that certain aspects of US economic dynamics differed from those of the UK, suggesting that the BoE would pursue its own policy objectives and start the rate cut cycle in June most likely. These comments suggest that even if the Federal Reserve opts to keep its policy rate unchanged in June as most analysts expect, the BoE is unlikely to delay a policy adjustment of its own.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account