XRP Flying As Sentiment Improves Ahead Of Ruling: Next Stop $0.66?

XRP has broken above two key resistance levels at $0.52 and $0.55. Bulls are now targeting $0.66 if the current momentum increases

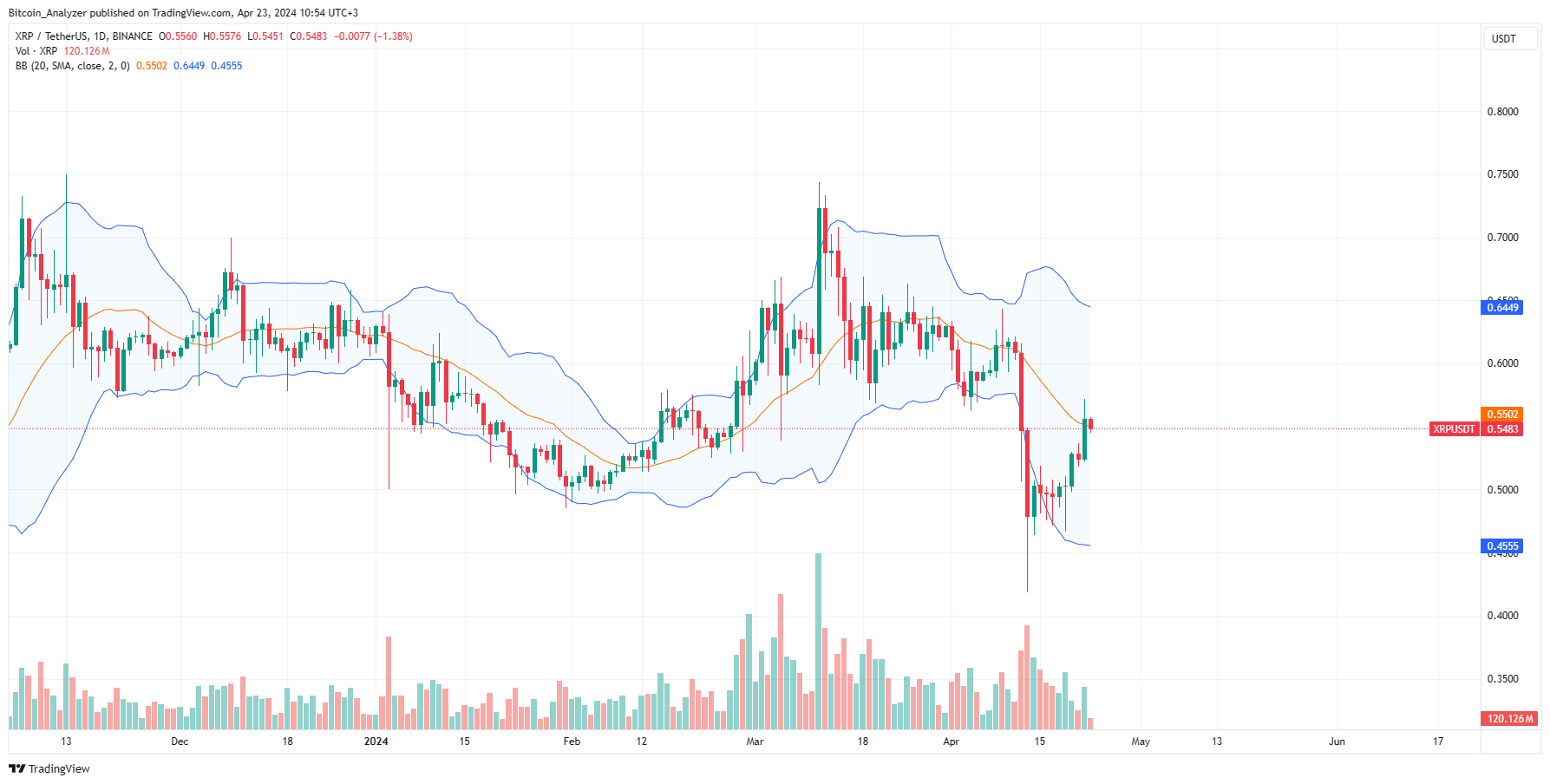

XRP has been one of the top performers in the past trading day. Looking at the daily chart, the coin has not only broken above $0.52 but is currently trading above $0.55, backed by decent trading volume. For the uptrend to continue, bulls must confirm yesterday’s gains. Accordingly, prices will likely close decisively above the dynamic resistance level or the 20-day moving average.

As it is, XRP is up 3% in the past trading day and a massive 11% in the previous week. Bulls are upbeat, looking at trading volume which is up by over 45% to over $1.5 billion in the last 24 hours. If prices continue floating higher, participation will likely expand, an indicator that traders are positioning for even more gains.

The upside momentum will be sparked by the following XRP and Ripple news in the sessions ahead:

- XRP is rallying after Ripple filed its response to the United States SEC’s remedies-related opening brief. This response was highly anticipated since it reveals to the community how the blockchain company thinks about the $2 billion penalty the regulator wants paid. The report will be made public on April 24.

- Ahead of the report, two United States SEC lawyers who handle the Debt Box case have resigned after being reprimanded by a federal judge. The judge claims the case presented lacked solid evidence to back their allegations.

XRP Price Analysis

XRP/USD is tracking higher, buoyed by expectations of a favorable settlement in the multi-year case pitting Ripple with the strict United States regulator.

From the daily chart, XRP is within a bullish breakout pattern with clear support levels at $0.55 and $0.52.

Since losses of April 13 have been reversed, traders can look for entries on dips. Their first targets will be $0.60 and $0.66 in the days ahead.

Any uptick above these resistance levels should ideally be with above-average trading volume.

If there is an unexpected contraction, losses below $0.46 will invalidate this bullish outlook.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account