Stable US Durable Goods Orders Push USD/JPY Above 155

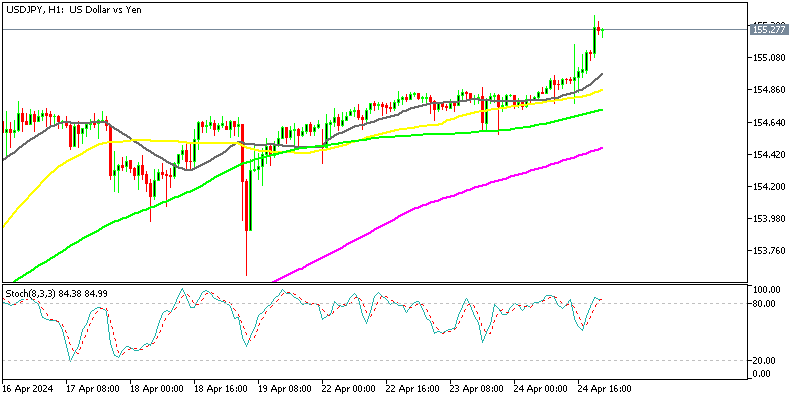

The rate of USD to JPY has finally surpassed the 155.00 level after trading below it for two weeks, helped by the US durable goods orders.

The rate of USD to JPY has finally surpassed the 155.00 level after trading below it for two weeks, helped by the US durable goods orders for March which remained stable. This breach suggests heightened volatility and the potential for intervention by the Ministry of Finance (MOF) though. However, the underlying strength of the USD driven by fundamentals may outweigh MOF intervention efforts in the long run.

USD/JPY Chart H1 – MAs Keeping the Price Supported

Now that USD/JPY has overcome the 155 resistance level, the market may target 160.00, prompting Japan to take a more assertive stance. Additionally, the upcoming decision by the Bank of Japan on Friday may influence market sentiment, potentially leading to a more hawkish stance.

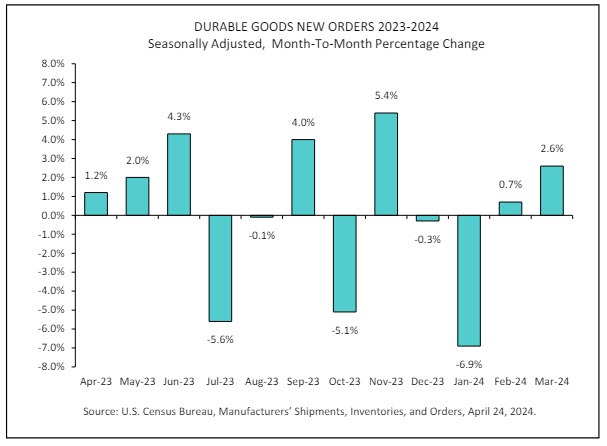

Durable Goods Orders for March 2024

- US market advanced durable goods orders 2.6% versus 2.5% expected

- Prior month 1.3% (revised). Revised even lower to 0.7%

- nondefense capital goods orders ex air 0.2% vs 0.2% expected.

- Prior nondefense capital goods orders ex-air 0.7% revised to 0.4%

- Ex transportation 0.2% versus 0.3% expected. Prior month revised to 0.1% from 0.3%

- Ex-Defense 2.3% versus 1.5% (revised from 2.1%)

- Shipments of manufactured durable goods in March decreased slightly by -$0.1 billion, remaining virtually unchanged at $282.4 billion.

- This minor decrease follows a 1.2% increase in February.

- Transportation equipment shipments decreased by $0.4 billion or 0.5%, totaling $89.4 billion, contributing significantly to the overall decrease.

- This decline in transportation equipment shipments marks a downturn in three of the last four months.

Capital Goods Orders details:

-

Nondefense new orders for capital goods in March:

- Increased by $4.5 billion or 5.4% to $87.6 billion.

- Shipments decreased by $1.3 billion or 1.5% to $80.5 billion.

- Unfilled orders increased by $7.1 billion or 0.8% to $851.1 billion.

- Inventories increased by $0.7 billion or 0.3% to $230.7 billion.

-

Defense new orders for capital goods in March:

- Increased by $1.2 billion or 10.6% to $12.9 billion.

- Shipments decreased by $0.1 billion or 0.4% to $14.1 billion.

- Unfilled orders decreased by $1.2 billion or 0.6% to $204.1 billion.

- Inventories increased by $0.1 billion or 0.3% to $25.2 billion.

Transportation is very volatile with Boeing numbers fluctuating wildly. The Nondefense orders though look solid.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account