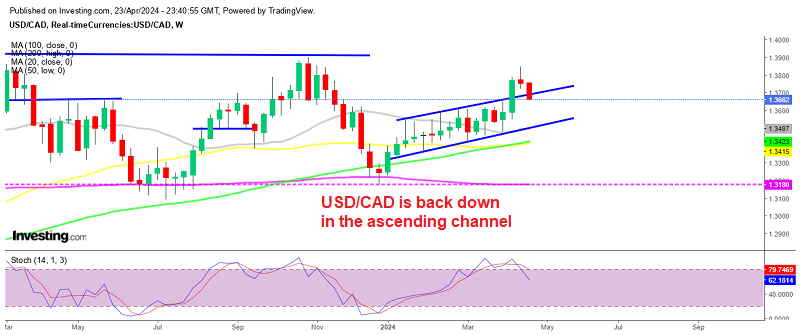

USD/CAD Falls Inside Bullish Channel After Canadian Retail Sales

Earlier this month, the USD to CAD exchange rate broke above the ascending channel, reaching 1.2850, but has returned back down.

Earlier this month, the USD to CAD exchange rate broke above the ascending channel, reaching 1.2850, but has returned back down into the channel. The upside momentum in USD/CAD was buoyed by Canada’s moderate inflation figures for March. However, in the latter part of the month, the price reversed lower as the USD started to retreat.

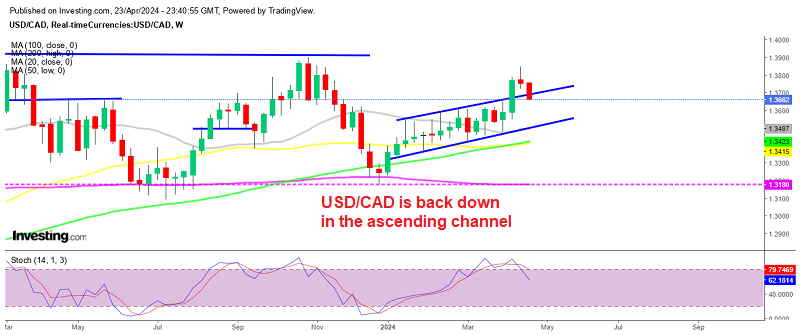

USD/CAD Chart Daily – Falling into the Channel After Last Week’s Doji Candlestick

The bullish momentum started in the first week of January for this forex pair, after the price dipped below the 200 SMA (purple) on the weekly chart which stood at 1.32 in the last week of December, but pulled back up and formed a doji candlestick, This was a bullish reversing signal after the decline and the uptrend began.

The pace of the uptrend was steady as the price was following a bullish channel, but two weeks ago the upside picked up momentum and we saw a surge above the channel. However, last week USD/CAD formed a doji candlestick which signaled a bearish reversal, and this week the reversal has already started, with the price falling around 200 pips off the highs.

Yesterday’s weak US manufacturing and services PMI figures helped in this decline, as they sent the USD tumbling lower across the board. But the decline stalled as traders geared for today’s US durable goods orders and particularly the Canadian retail sales, which are a bit outdated since they are for February, but they would show the shape of the Canadian consumer.

Canadian Retail Sales for February

- February retail sales -0.1% vs +0.1% expected

- January retail sales -0.3%

- The February advance estimate was +0.1%

- Ex autos -0.3% vs 0.0% expected

- Prior month ex-auto +0.5% (revised to +0.4%)

- Ex auto and gas 0.0% vs +0.4% prior

- Sales down in 5 of 9 subsectors led by fuel stations

- Advance March retail sales 0.0%

The advance number for retail sales suggests a second consecutive month of lackluster performance in the market, despite increasing petrol prices in March. This trend may further support the likelihood of the Bank of Canada cutting rates in June. In February, retailers of general items reported higher sales (+1.1%), while retailers of health and personal care products reported lower sales (+0.4%).

However, these gains were offset by decreased sales at shops selling electronics, appliances, apparel, shoes, jewellery, luggage, and leather goods (-1.0%), building materials and garden equipment and supplies (-0.4%), and furniture, home furnishings, electronics, and luggage (-1.5%).

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account