USD/JPY: Japanese Yen Loses Ground Again After Reports of BOJ Buying Yen in the Market Yesterday

After yesterday’s low of 160.21 for the yen, various reports emerged of the central Bank of Japan buying yen and selling dollars.

After yesterday’s low of 160.21 for the yen, various reports emerged of the central Bank of Japan buying yen and selling dollars.

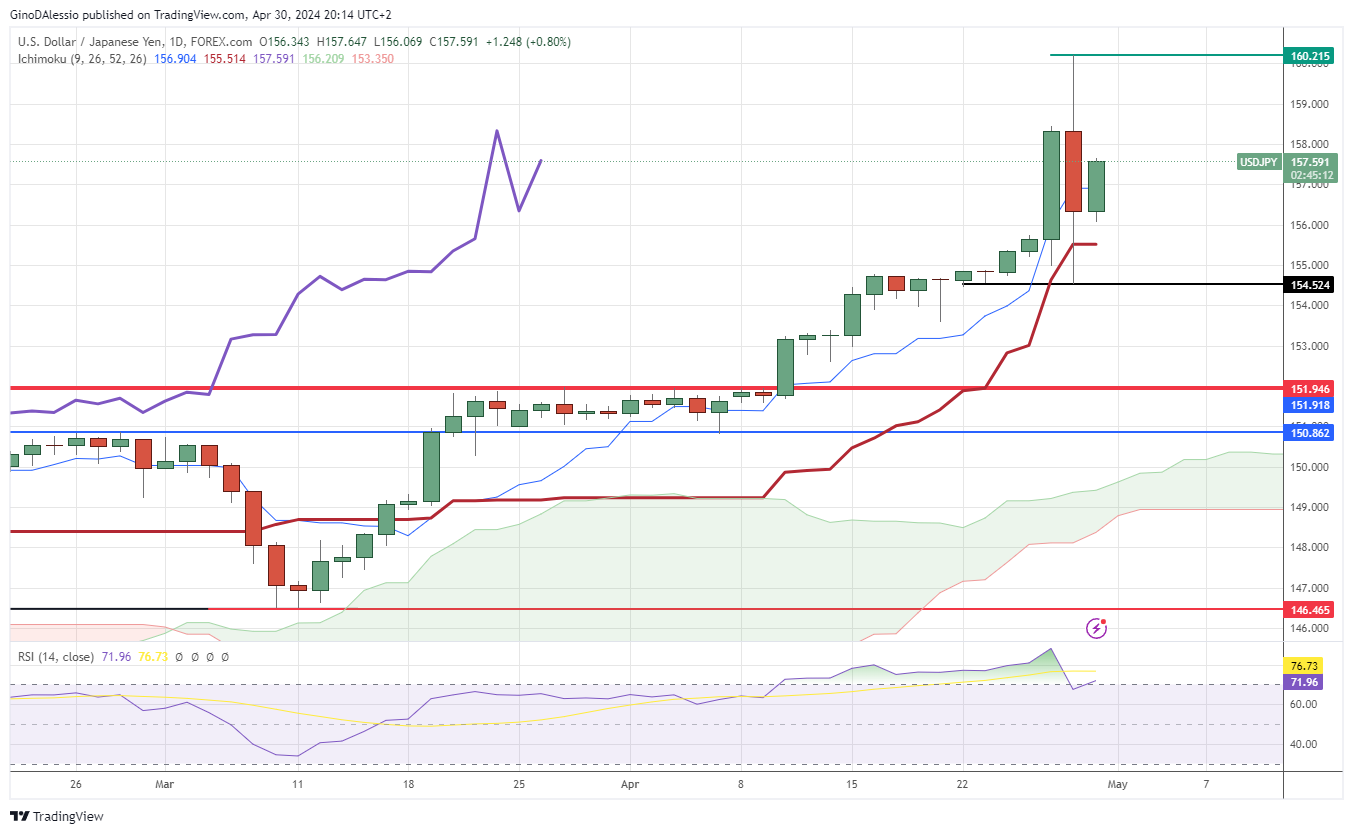

Something definitely happened yesterday, as the USD/JPY market started the day with a rally to 160.215 but then dropped to a low of 154.524 for the day. The range certainly suggests that there may have been some BOJ intervention.

We got clues from Masato Kanda a top Ministry of Finance official for foreign exchange. The official stated that it was difficult for the government to ignore the negative effects on the economy of abnormal currency fluctuations.

He also added that the government would continue to respond to excessive currency changes. This wouldn’t be the first time the BOJ has intervened in the currency markets, and it may be obliged to do so again given the current macro scenario.

The BOJ currently has its main interest rate at zero, while the Fed is poised to lower rates. But the gap is still large and creates a very lucrative carry trade opportunity. Among the driving macro factors, most of the weight falls on what is going to happen next with US interest rates.

So, if there is a change a of sentiment regarding how soon the Fed might cut rates, or policy easing takes longer to implement, then the yen will probably suffer. The Fed’s next FOMC meeting is tomorrow, and we could see an increase in volatility, depending on the post meeting conference message.

Technical View

The day chart below for the USD/JPY shows a clear bull trend that is also in overbought territory. Yesterday’s candle took the RSI below 70, which would have signaled a possible correction. However, with the central bank intervention out of the way, the market took back its bullish sentiment today.

The RSI is likely to close above 70 again, which means the bullish trend is still strong as the market has room to push higher. The current price level is beginning to be far away from the Ichimoku cloud. Currently approximately 5% away from the top side of the cloud.

The cloud acts like an elastic for the price level, when prices diverge excessively from the cloud they end up reverting back towards it. The current distance between price level and the cloud is still not one of its largest, but it’s a level that tends to show corrections.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account