USD to CAD 1 Cent Higher After Softer Canada GDP

Today we are seeing a bullish reversal in USD/CAD, as soft Canadian GDP and strong US employment earnings push this pair 1 cent higher.

Today we are seeing a bullish reversal in USD/CAD, as soft Canadian GDP and strong US employment earnings push this pair 1 cent higher. Earlier this month, the USD-CAD rate breached above the rising channel, reaching 1.2850, but subsequently retreated back into the channel. The rally of USD/CAD was supported by Canada’s moderate inflation figures for March. However, towards the end of the month, as the USD started to decline, the price reversed direction lower, but it seems like the retreat of the last 2 weeks is over now.

USD/CAD Chart Daily – Bouncing Off the 20 SMA

The rate of the upswing was steady as the price was tracking within a bullish channel. However, two weeks ago, the upward momentum intensified, causing the price to surge above the channel. Nevertheless, last week, USD/CAD formed a doji candlestick, signaling a potential bearish reversal. This reversal has already commenced this week, with the price declining by approximately 200 pips from its peak.

Canada February Monthly GDP Report

- February Canada’s GDP increased by 0.2%, falling slightly short of the expected 0.3%.

- The previous reading was +0.6%, revised down to +0.5%.

- Growth in services industries was +0.2%, compared to +0.7% in the previous period.

- Goods production remained unchanged at 0.0%, compared to a previous growth of +0.2%.

- Manufacturing experienced a decline of -0.4%, contrasting with the previous growth of +0.9%.

- March’s advance GDP remained stagnant at 0.0%.

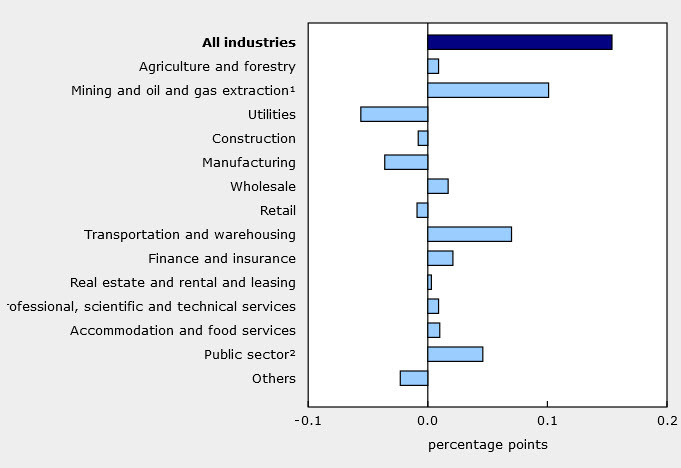

Following a 2.3% decline in January, mining, quarrying, and oil and gas extraction rebounded with a 2.5% increase in the next month. This marks the fourth rise in the past five months and contributes significantly to the overall improvement. Additionally, transportation and warehousing expanded too in February by the highest monthly growth rate in 2 years. The USD/CAD exchange rate has surged around 100 pips higher in response to this news, primarily driven by widespread purchasing of the US dollar following positive wage data.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account