Silver Price Resumes Decline Following Gold, As It Heads to $26

Silver (XAG) reversed its recent upward trend earlier this month and yesterday it closed at an intraday low of $26.33.

Silver (XAG) reversed its recent upward trend earlier this month and yesterday it closed at an intraday low of $26.33. This decline coincided with Gold (XAU), which closed below $2,300 yesterday. The downturn in precious metals is attributed to a stronger US dollar, driven by diminishing expectations of an imminent Federal Reserve rate cut and an overall increase in global risk appetite.

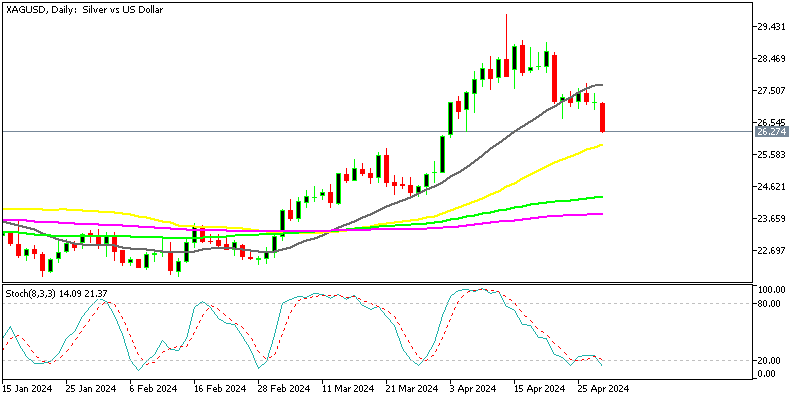

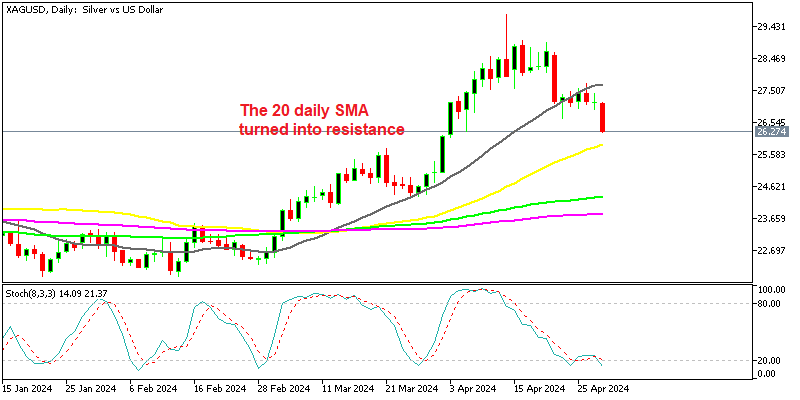

Silver Chart Daily – The 20 SMA Turned Into Resistance

During the first half of this month, the strong bullish momentum in silver (XAG) was notable, with the uptrend gaining strength and buyers pushing the price to $29.79. The 20-period Simple Moving Average (SMA) on the daily chart acted as support, indicating the robustness of the uptrend.

The rise in industrial demand for silver is primarily driven by investments in the green energy initiative. This trend is anticipated to persist, leading to further increases in industrial Silver demand in 2024 and beyond. Notably, Chinese demand is projected to surge by about half, surpassing 250 million ounces. However, last week, the upward momentum paused, and the price fell below the 20 simple moving average.

The USD Makes A Comeback Ahead of the FOMC

The USD has made a rebound in April which has played a significant role in the decline of silver prices. This resurgence is partially attributed to hints from the Federal Reserve indicating that higher interest rates will be sustained for an extended period, with the odds of a September cut now at 50/50.

This increases the attractiveness of the dollar while reducing the appeal of dollar-denominated assets like Gold and Silver. Gold itself also made a strong decline yesterday, closing below $2,300. Additionally, the easing of geopolitical tensions, particularly in the Middle East, has diminished demand for silver as a safe-haven asset. This has further pressured silver prices downward.

Silver Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account