GBPUSD Returns Above 1.25, With UK Services In Decent Shape

The USD to GBP exchange rate has been trading in a 100 pips range this week, with GBP/USD falling below 1.25 but returning above every day.

The USD to GBP exchange rate has been trading in a 100 pips range this week, with GBP/USD falling below 1.25 but returning above it every day. Earlier today we had the final reading for the services sector, which showed that activity remains solid in the largest sector of the UK economy.

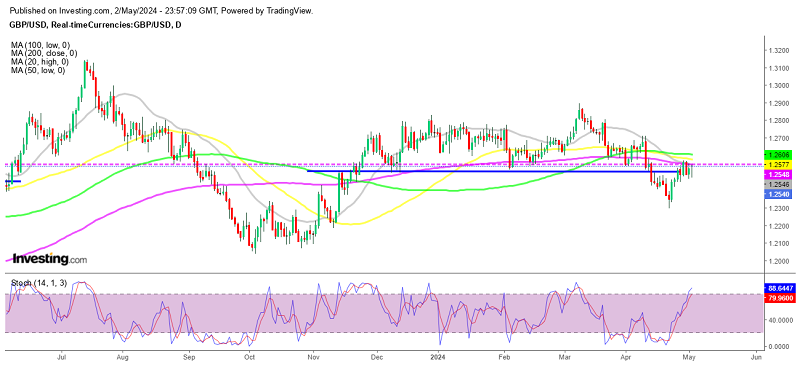

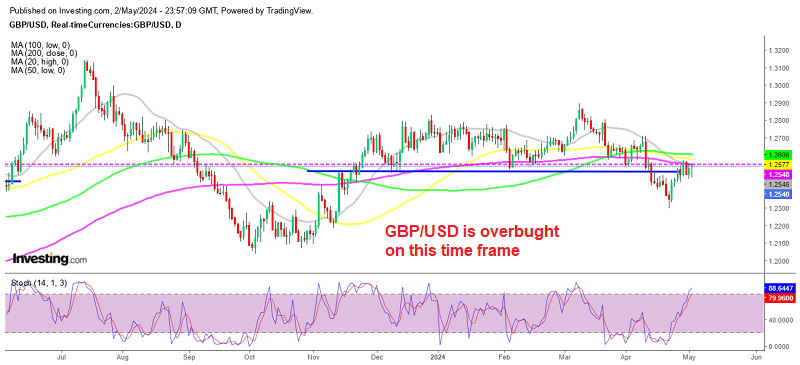

GBP/USD Chart Daily – Facing Several MAs Above 1.25

GBP/USD has faced significant selling pressure since March, with the price dropping to a low of $1.23 by the middle of April. This decline was primarily attributed to increasing expectations that the Bank of England (BoE) will implement more aggressive monetary easing measures. However, the BOE retreated from that stance and there was a rebound last week when the USD started to weaken.

GBP/USD lost 6 cents since the first week of March. This drop occurred after encountering resistance at the 200-weekly Simple Moving Average (SMA), while in the daily chart, MAs are also acting as resistance. The decline was swift, but in the last two weeks GBP/USD buyers have resurfaced, pushing the price higher, however, they’re encountering resistance at the 200 daily SMA (purple) after the pair fell reversed following the FOMC meeting, which was not as hawkish as traders were fearing.

So, this rise is largely attributed to the weakening US dollar, which is facing challenges in gaining momentum amidst a risk-on market environment. Currency the market is still trading the Federal Open Market Committee (FOMC)’s interest rate announcement and press conference which took place on Wednesday. However, the figures from the services sector is also helping the GBP somewhat.

UK Final Services Report for April

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account