GBPUSD Buyers Struggle at MAs After Retail Sales Monitor, Construction PMI

The USD to GBP exchange rate continues to trade within a range, with buyers attempting to push GBP/USD higher but facing resistance.

The USD to GBP exchange rate continues to trade within a range, with buyers attempting to push GBP/USD higher but facing resistance. Earlier today, we received the final reading for the services sector, which suggested that activity remains robust in the UK economy’s largest sector

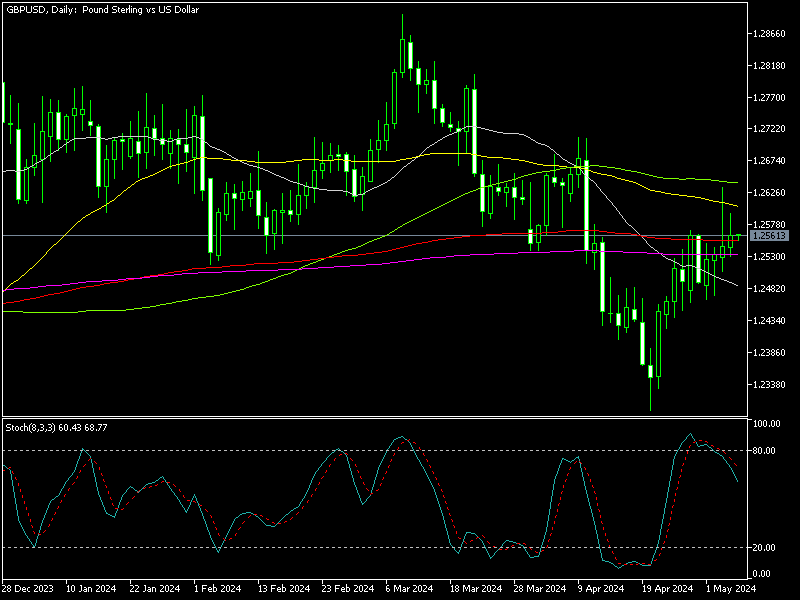

GBP/USD Chart Daily – Buyers Face Several MAs Above 1.25

GBP/USD experienced significant selling pressure during Marchand most of April , with the price dropping to a low of $1.23. This decline was largely driven by growing expectations that the Bank of England (BoE) would implement more aggressive monetary easing measures, while the FED kept pushing back rate cut expectations, with markets now expecting a September cut from them.

However, the BOE shifted in April, and last week, the USD started to weaken following the FOMC meeting and the soft NFP jobs report, leading to a recovery in GBP/USD. However, in the last two weeks buyers have been finding it hard to make decent gains, and the price has been hovering close to 1.25, with moving averages acting as resistance above. Today we had the UK Construction PMI which remained close to stagnation, and the BRC Retail Sales Monitor, none of which offered much price action for the British pound.

British Retail Consortium (BRC) April 2024 data:

Total Sales:

- Total sales decreased by 4.0% year-on-year, contrasting with March’s 3.5% increase.

Like-for-Like Sales:

- Like-for-like sales also saw a decline, down by 4.4% year-on-year, compared to March’s 3.2% growth.

Commentary from BRC:

- The BRC attributed the dismal sales to unfavorable weather conditions and disappointing consumer activity, even considering the shift in Easter timing.

Barclays UK April Consumer Spending:

- Barclays reported a 1.6% year-on-year increase in consumer spending for April, down from March’s 1.9% growth.

Barclays Analysis:

-

- Barclays highlighted that the annual growth in consumer spending on its payment cards slowed to its weakest level since February 2021.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account