Where Is AUD USD Headed After the RBA Meeting?

After declining approximately 3 cents early last month, the AUD USD rate reversed its course and started to climb, reclaiming the losses.

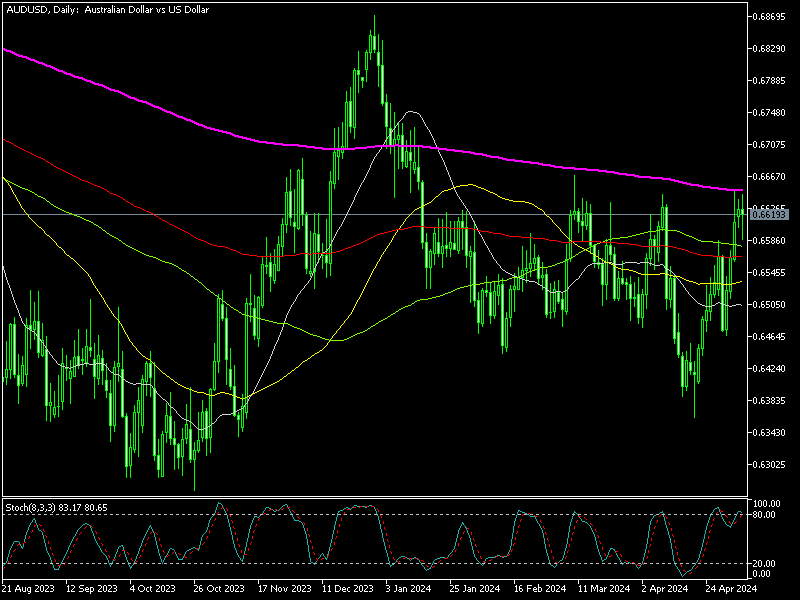

After declining approximately 3 cents early last month, the AUD USD rate reversed its course and started to climb by mid-April. Last week the exchange rate broke through most of the moving averages in the daily chart, which were situated below 0.66, following some negative news for the USD. Additionally, the improved risk sentiment led to a stronger Australian Dollar which contributed to the rise in this forex pair, propelling AUD/USD to the 200 daily SMA.

AUD/USD Chart Daily – Buyers Facing the 200 SMA Now

After last Tuesday’s fall, we saw three strong bullish daily candles, which suggest the potential for further upward movement in the AUD/USD pair, potentially indicating a higher trajectory above the 200 SMA (purple), which would be a strong sign of a bullish reversal in this timeframe chart. However, technical indicators such as the Stochastic indicator are overbought, so the bullish move is complete right now.

The US dollar faced challenges in regaining momentum yesterday as traders reacted to the latest FOMC meeting, where chairman Powell rejected the idea of a rate hike, coupled with the disappointing Non-Farm Payrolls (NFP) report for April. Bullish commodities such as copper played a role in driving the Australian dollar’s upward momentum as well yesterday.

Regarding the RBA meeting today, investors were keeping a close eye on it, particularly after last week’s inflation report came higher than anticipated. Market expectations indicated the likelihood of only one 25-basis-point interest rate cut in 2024, with almost 100% probability ahead of the meeting.

Reserve Bank of Australia Meeting May 7

- RBA leaves cash rate unchanged at 4.35%, as expected

- Prior cash rate was 4.35%

- Inflation continues to moderate, but is declining more slowly than expected

- The economic outlook remains uncertain

- Recent data have demonstrated that the process of returning inflation to target is unlikely to be smooth

- Persistence of services inflation is a key uncertainty

- Household consumption growth has been particularly weak

- There also remains a high level of uncertainty about the overseas outlook

- It will be some time yet before inflation is sustainably in the target range and will remain vigilant to upside risks

- Not ruling anything in or out on future decisions

- Full statement

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account