USD-Yen Continues Steady Uptrend After FED’s Collins Comments

The USD to Yen rate has been steadily climbing, advancing approximately 1 cent today and claiming the 155 level again after the 10 cent dive

The USD to Yen rate has been steadily climbing today, advancing approximately 1 cent and surpassing the 155 level once again. This follows a brief dip triggered by the Bank of Japan (BOJ) intervention and the Federal Open Market Committee (FOMC) meeting. The recent release of the minutes from the BOJ meeting did not have a significant impact on market sentiment, as it reinforced the expectation that the Bank of Japan is unlikely to implement further changes in the near future.

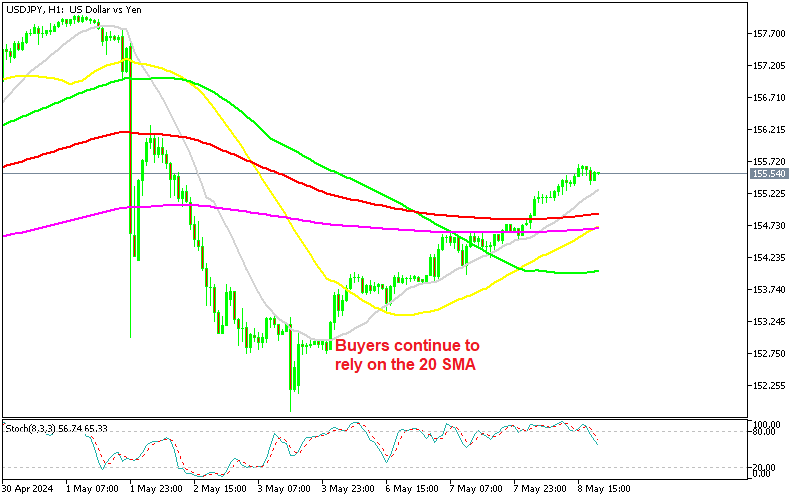

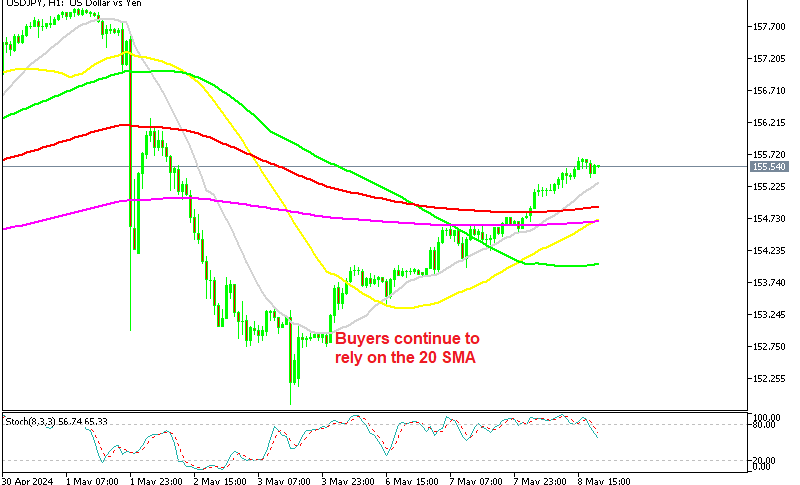

USD/JPY Chart H1 – The 20 SMA Keeping the Uptrend Steady

USD/JPY had surged to 162 previously, but Japanese authorities intervened in the yen market last week. This intervention caused USD/JPY to drop below 160 and briefly dip below 152 before recovering and climbing back above 155 today, potentially paving the way for a move towards 160.

However, in previous attempts by the BOJ and the Japanese Ministry of Finance to send the JPY higher, the Yen’s strength has dissipated rapidly following the intervention. Historical precedent suggests that such interventions by Tokyo strengthened the yen temporarily before a selloff ensued, and it seems that we’re seeing the same once again. Comments from FOMC members, such as those from Collins today are also helping in this bullish run, indicting that the FED will keep interest rates higher for longer.

Comments from Boston Fed President Susan Collins

- Inflation Target: Collins expects that demand will need to slow down to achieve the Federal Reserve’s inflation target of 2%.

- Fed Policy Position: She believes that the current stance of Fed policy is well-suited for the current economic conditions.

- Monetary Policy Restriction: Collins views monetary policy as moderately restrictive at present.

- Risks of Rate Cuts: She highlights the risks associated with cutting rates too soon, suggesting a cautious approach to policy adjustments.

- Productivity Jump: Collins does not anticipate the recent jump in productivity to be persistent.

- Wage Growth: She suggests that firms are well-prepared to absorb faster wage growth.

- Inflation Setbacks: Collins considers recent setbacks in inflation to be unsurprising.

- Optimism on Inflation Target: Despite challenges, Collins remains optimistic that the Fed can achieve its 2% inflation target within a reasonable timeframe.

- Robust Economy: She acknowledges the robustness of the economy, with the job market showing signs of improvement and consumer spending bolstered by a strong job market.

- Economic Resilience: While certain factors supporting economic resilience may diminish over time, Collins expects the economy to maintain its strength.

- Policy Impact on Economy: She suggests that current monetary policy should work to slow down the economy.

- Assessment of Policy Restriction: Collins indicates that it is too early to determine the exact level of restriction imposed by current monetary policy.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account