Ethereum Drops 30% From March Highs, ETH Losses $200 In 2 Days

Ethereum is down 30% from March highs, dumping $200 in two days as prices now crumble below the all-important $3,000 mark

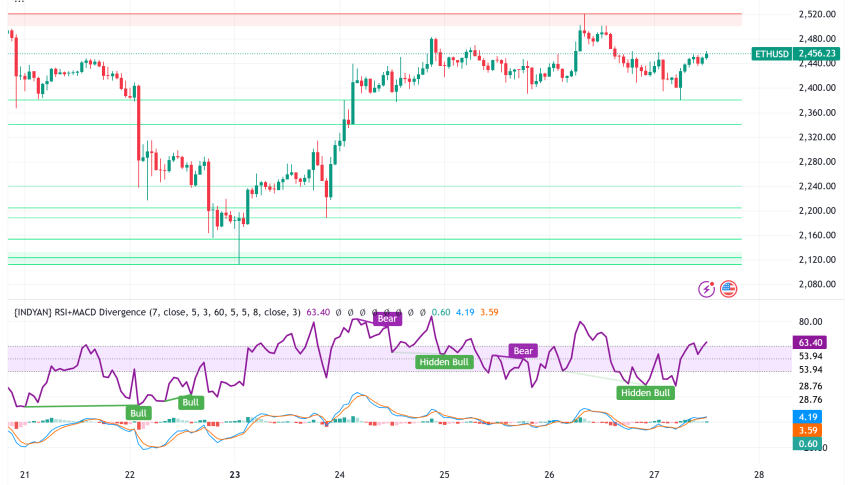

Ethereum is fast dropping, as shown in the daily chart. The coin has shaved over $200 in less than three trading days, which is discouraging and could further slow down the upside momentum. The recent sell-off is mostly driven by fundamental factors, mostly because of dashed hopes and the series of events surrounding spot Ethereum ETFs. Nonetheless, technical candlestick arrangements support buyers from a top-down preview.

Presently, Ethereum prices remain inside a narrow range, moving lower but within a consolidation. Since the caps are clear, ETH is stable on the previous day but up 2% in the last week. At the same time, participation is muted. To quantify, the average trading volume on the previous day is at $11 billion—way lower than March averages. This sentiment is affected by sustained bear pressure, forcing traders to exit and wait from the sidelines.

The following Ethereum news is worth monitoring:

- Grayscale has withdrawn its spot Ethereum ETF application with the United States SEC. The decision is when the regulator was to make a ruling on May 30. Their filing was submitted in September 2023. If approved, the product would have traded at the NYSE.

- In a recent post, the co-founder of Ethereum introduced EIP-7702, an enhanced improvement of another proposal, EIP-3074. The latter was being considered for inclusion in the Pectra Upgrade. This replacement, Vitalik said, would, among other things, enhance the user experience by allowing for better ways of abstracting gas fees and batching transactions.

Ethereum Price Analysis

ETH/USD is caving under pressure even with the network improving.

As of May 9, ETH is down roughly 30% from March 2023 highs.

With prices trickling below $3,000, sellers could look for opportunities to ride the bear trend. Technically, sellers remain in control and within a bear breakout formation set in motion on April 12 and 13.

Under the current setup, every high below $3,300 offers sellers entries to target $2,800. Any breach of this level will see ETH crash to $2,600 and $2,200.

The forecast will be nullified if ETH bulls break above $3,300.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account