Forex Signals Brief May 9: Will the BOE Signal A June Cut?

Today the BOE will hold it's meeting and they will give hints on upcoming rate cuts but the question is if they will start in June or August

Yesterday was a relatively quiet day in terms of economic data once again, with the focus mainly on the final wholesale inventory data for March. The dip of -0.4% mirrored the earlier report, indicating a reversal from a previous gain of 0.4%. In the Forex market, the USD showed strength against other major currencies, while the AUD edged out the JPY as the weakest among them.

Regarding the Federal Reserve, there were comments from Fed officials Collins and Cook. Collins, the president of the Boston Federal Reserve, discussed inflation dynamics, suggesting that a reduction in demand is necessary for inflation to fall below the 2% target. She expressed confidence in the current Fed policy, characterizing it as somewhat restrictive and cautioned against reducing interest rates prematurely, emphasizing the associated risks.

Lisa Cook of the Federal Reserve shared insights after the recent FOMC rate decision, noting resilience in consumer behavior but expressing concern about rising delinquency rates. She highlighted that businesses appear to have sufficient earnings to manage their debt obligations effectively, and financial institutions are well-prepared to handle potential shocks. These remarks shed light on the Fed’s outlook and considerations regarding monetary policy and economic conditions.

Today’s Market Expectations

Today the economic calendar is light again for most of the day, however, we have the Bank of England meeting later on. Earlier this morning the February Average Cash Earnings from Japan which revealed a concerning trend in real wages. In March, real earnings experienced a significant decline of 2.5% year-on-year, marking the 24th consecutive monthly decrease. This extended period of falling real wages indicates a prolonged period of reduced purchasing power for workers, which can impact their ability to maintain their standard of living. Total cash earnings showed only a marginal increase of 0.6% year-on-year, falling short of expectations of a 1.5% rise. The previous figure of 1.8% suggested a slowdown in earnings growth, further emphasizing the challenges faced by workers. Additionally, overtime compensation declined by 1.5% year-on-year, contributing to the overall reduction in real wages. These figures underscore the difficulties that workers encounter in sustaining their standard of living amidst stagnant or declining real wages.

The Bank of England (BoE) will maintain its interest rates at 5.25% during today’s meeting. The latest inflation report indicates that both headline and core inflation rates have moderated, but the services inflation indicator, which is of particular concern to the central bank, remains stubbornly high at 6%. On the labor market front, recent data has shown an uptick in the unemployment rate and job losses, alongside elevated salary growth rates. Interestingly, there’s been a shift in the voting dynamics at the most recent meeting, with the more hawkish members supporting the decision to hold rates steady. However, Dhingra remains the consistent dissenter, advocating for a rate cut.

The US Jobless Claims report remains a crucial weekly release, offering timely insights into the labor market’s health. A weakening labor market can increase the likelihood of disinflation, making it challenging for the Fed to meet its objectives. Conversely, a robust job market may pose challenges in achieving the Fed’s goals. Initial Claims have been hovering near cyclical lows, indicating overall stability, while Continuing Claims have remained steady around the 1800K mark. For the upcoming release, Initial Claims are predicted to be around 210K compared to the previous 208K. However, there’s no consensus on Continuing Claims yet, given the previous announcement showed a decline to 1774K against an expectation of 1797K and a previous figure of 1781K.

Yesterday the economic data was very light and therefore the volatility was low again in all markets. We opened several trading signals, but at the end of the day ended with four closed trades, three of which were winning forex signals and one was a losing signal, which is a good win/loss ratio.

The Range Tightens Further in Gold

Gold has been experiencing some fluctuations above the $2,300 region, initially falling from above $2,400 but then finding support between $2,310 and $2,350. However, the recent resumption of a downtrend has seen gold prices drop below $2,300. The decrease in geopolitical tensions has contributed to a reduction in risk sentiment across financial markets, leading to decreased demand for gold initially. However, following the recent Federal Open Market Committee (FOMC) meeting, gold prices managed to climb back above $2,300 where they have stabilized in range and this week the range is getting narrower.

XAU/USD – H4 chart

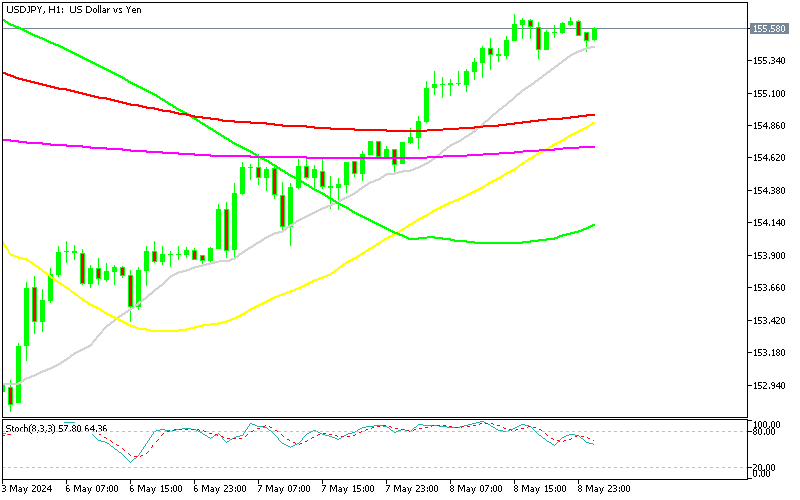

Closing the Buy USD/JPY Signal in Profit

There’s been a gradual climb in the USD/JPY exchange rate, surpassing 155 recently, suggesting a trend of the US dollar strengthening against the Japanese yen. Regarding economic data from Japan, the Average Cash Earnings were reported, with expectations of a rise to 1.5% in March. Yesterday the price moved above 155 and we closed our buy USD/JPY signal in profit.

USD/JPY – H1 Chart

Cryptocurrency Update

Bitcoin Heads for the 100 SMA Again

Bitcoin has experienced a reversal in its price movement, dropping from above $65,000 last week to approaching $60,000, marking its first dip below this level in recent times. Currently, Bitcoin is approaching the 100 Simple Moving Average (SMA) line, which is expected to provide daily support. Despite the decrease in the BTC/USD pair, there’s an intention to open a buy signal at the 100 SMA, with a target price of $70,000. This strategy appears to involve taking advantage of the potential support level provided by the 100 SMA and anticipating a rebound in Bitcoin’s price towards the $70,000 mark.

BTC/USD – Daily chart

Ethereum Falls Below $2,300

Ethereum (ETH) is experiencing some volatility, initially falling below $3,000 many times and crossing the daily Simple Moving Average (SMA) on the daily chart. However, it has managed to recover and surged back above the $3,000 threshold every time, but sellers keep returning and the highs keep getting lower. Despite these gains, the upward momentum of buyers slowed near the 50-day SMA (yellow line), leading to a reversal in price movement.

ETH/USD – Daily chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account