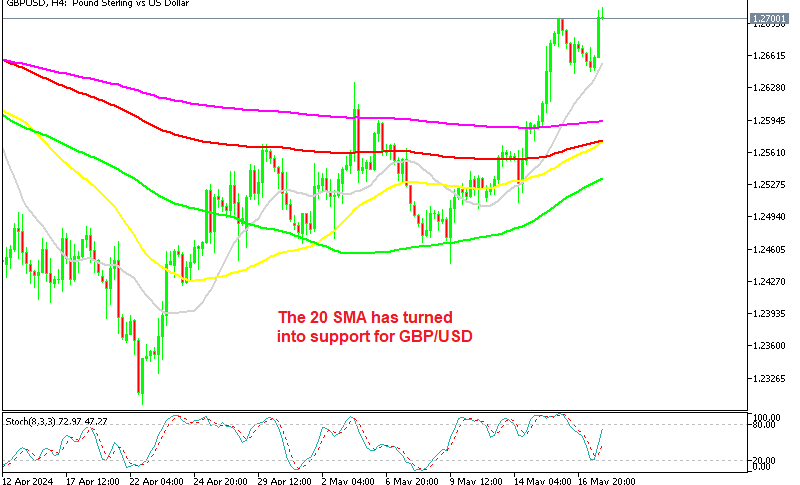

Triangle Forming in USDCAD, BOC Macklem Hints at Lower Rates

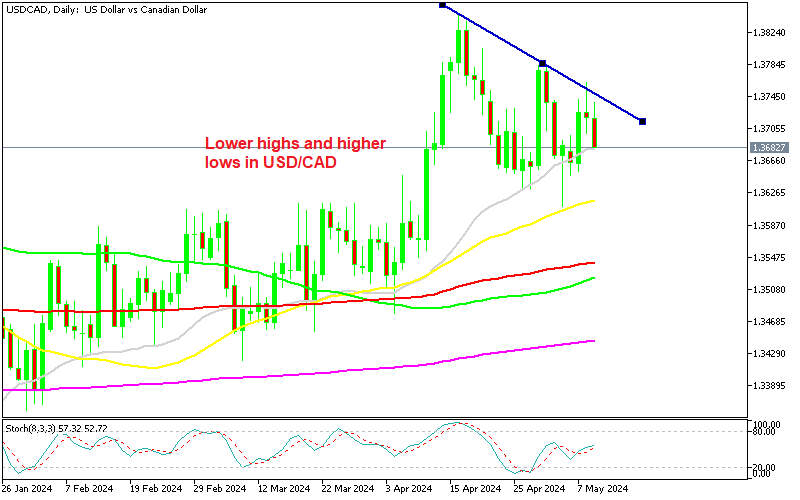

USDCAD turned bearish today after forming a doji candlestick yesterday, with the US softer unemployment claims helping along the way. We also had the financial stability report from Bank of Canada, with president Macklem making some dovish comments, indicating they want to start easing the monetary policy soon, but that didn’t stop the decline in this forex pair.

USD/CAD Chart Daily – Returning Back Down to the 20 SMA

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | CySEC, MISA, FSCA | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

The focus today has been on the USD as it has declined after the US initial jobless claims showed some weakness, which revived the fears after the soft NFP report on Friday. However, there are two currencies in every forex pair, so the CAD has had its say in this game. USD/CAD failed to break above the declining trendline yesterday, forming a doji candlestick which is a bearish reversing signal, and today the price dived below 1.37.

However, the decline has stalled at the 20 daily SMA (gray) so let’s see if sellers can break below this moving average, or whether the upside momentum will resume. The Bank of Canada is tilting further toward a dovish stance which might send this pair higher in the near future. Below are the comments from the BOC chair Macklem:

Comments From the BOCs Tiff Macklem

- Resilience of Canada’s Financial System: Macklem emphasized that Canada’s financial system remains resilient despite ongoing challenges and risks.

- Volatility in Global Markets: He highlighted the potential for volatility in global markets as expectations shift regarding the timing and scope of rate cuts.

- Adjustment to Higher Rates: Financial institutions are still in the process of adjusting to higher interest rates and potential shocks, which poses risks to financial stability.

- Indicators of Financial Stress: Macklem noted that some indicators of financial stress have risen, and valuations of certain financial assets appear stretched.

- Impact of Higher Rates on Household Spending: Higher interest rates will continue to restrain household spending, which is being considered in the Bank of Canada’s assessment of the appropriate monetary policy stance.

Overall, Macklem’s comments reflect a cautious stance, acknowledging both the resilience of Canada’s financial system and the challenges posed by ongoing higher interest rates. This suggests that the Bank of Canada is thinking about stating to lower rates.

The Bank of Canada’s Financial Stability Report Highlights

- Debt Serviceability and Asset Valuations: The report identifies debt serviceability and asset valuations as key risks to stability. Valuations of some financial assets have become stretched, increasing the risk of a sharp correction.

- Resilience of the Financial System: Despite these risks, the financial system appears resilient. Over the past year, financial system participants have proactively adjusted to higher interest rates.

- Potential for Large and Abrupt Price Corrections: Price corrections could be significant and abrupt if there are substantial changes to expectations regarding interest rate paths or economic outlooks. Stretched asset valuations may not accurately reflect the risks to the economic outlook, thus increasing the likelihood of an orderly price correction.

- Commercial Real Estate Sector Pressures: Valuations remain under pressure in parts of the commercial real estate sector. Not all asset managers have fully reflected these reduced valuations on their balance sheets.

- Mortgage Lenders and Household Arrears: Smaller mortgage lenders have experienced a sharp uptick in credit arrears. Signs of financial stress are primarily observed among households without mortgages.

- Limited Exposure of Largest Financial Entities: The largest entities within the financial system generally have limited exposure to commercial real estate, mitigating some risks in this sector.

- Global Market Uncertainty: While global markets have continued to function well, uncertainty remains elevated, reflecting broader global economic and geopolitical concerns.

USD/CAD Live Chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |