Where Is the GBP Headed After the BOE Meeting?

The USD to GBP rate climbed above 1.26 last week, but retreated lower this week, particularly ahead of the Bank of England (BOE) meeting.

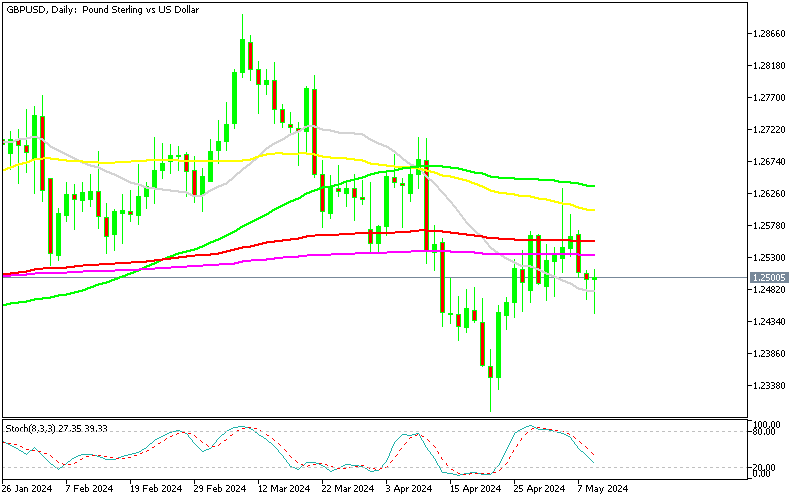

The USD to GBP exchange rate experienced some fluctuations recently. Last week, it climbed above 1.26 but retreated lower this week, particularly ahead of the Bank of England (BOE) meeting. Following the release of soft Non-Farm Payrolls (NFP) numbers on Friday, buyers attempted to push GBP/USD higher but encountered resistance from moving averages (MAs). Today, the BOE meeting occurred, with interest rates left unchanged as expected. However, the focus was on the projection for the timing of the first rate cut, potentially either in June or August. This indicates that market participants are closely monitoring central bank actions and statements for signals regarding future monetary policy decisions, which can significantly impact currency exchange rates.

GBP/USD Chart Daily – Making Higher Lows

GBP/USD experienced significant selling pressure throughout March and most of April, resulting in the price falling to a low of $1.23. This downward trend was largely fueled by increased expectations that the Bank of England (BoE) would implement more aggressive monetary easing measures.

Meanwhile, the Federal Reserve (Fed) kept pushing back expectations for rate cuts, with markets currently anticipating a rate cut from them in September. However, there was a shift in the BoE’s stance in April, leading to a recovery in GBP/USD above 1.26. The US dollar weakened following the disappointing Non-Farm Payrolls (NFP) jobs report, but buyers couldn’t sustain the gains ahead of today’s BoE meeting.

Bank of England Monetary Policy Meeting for May

- BOE leaves bank rate unchanged at 5.25%, as expected

- Prior rates were 5.25%

- Bank rate vote 7-0-2 vs 8-0-1 expected (Dhingra, Ramsden voted to cut by 25 bps)

- CPI inflation is expected to return to close to the 2% target in the near-term

- But it is to increase slightly in the second half of this year, owing to the unwinding of base effects

- There continue to be upside risks to the near-term inflation outlook from geopolitical factors

- Key indicators of inflation persistence are moderating broadly as expected, although they remain elevated

- Monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target

- Monetary policy needs to be restrictive for an extended period of time until the risk of inflation becoming embedded above the 2% target dissipates

- Prepared to adjust monetary policy as warranted by economic data to return inflation to the 2% target sustainably

- Will consider forthcoming data releases and how these inform the assessment that the risks from inflation persistence are receding

- Will keep under review for how long Bank Rate should be maintained at its current level

- Full statement

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account