Holding Long on USD/JPY As Japan Household Spending Falls

USD/JPY has been steadily climbing since the BOJ intervention and it will continue to remain bullish as economic data from Japan is weak

USD/JPY has been steadily climbing since the BOJ intervention, approaching the 156 level yesterday. However, we are seeing a retreat in the USD after the NFP employment and the the US unemployment claims yesterday, but the main trend remains bullish nonetheless.

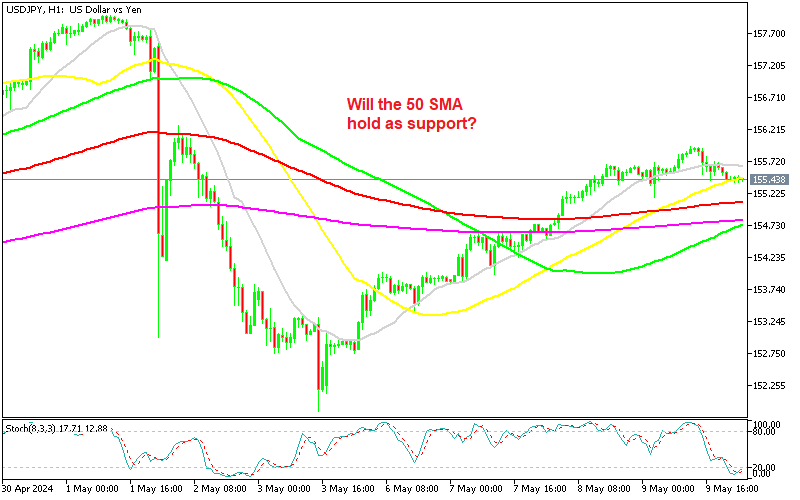

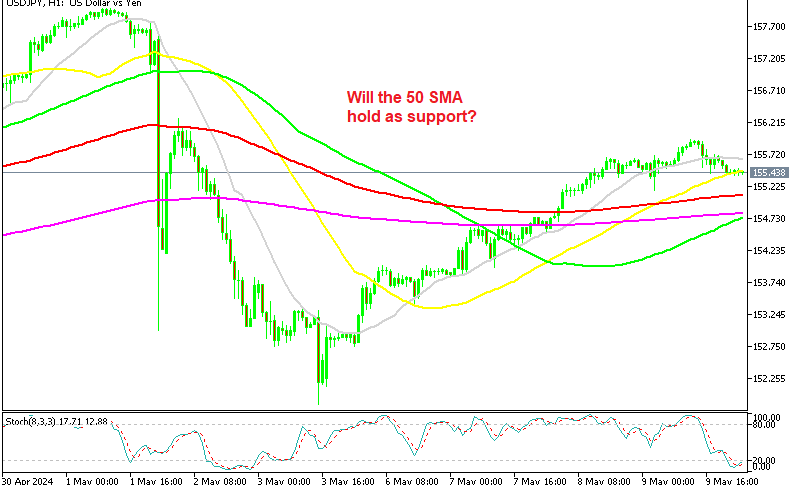

USD/JPY Chart H1 – The 50 SMA Continues to Provide Support

USD/JPY experienced a significant rise above 162 last month. However, last week, Japanese authorities intervened in the yen market, causing the USD/JPY pair to drop by 10 cents below 152, aiming to strengthen the yen and stabilize the currency market. But following the intervention, the USD/JPY pair recovered and formed a positive trend since Friday. However, recent US jobs reports have had a negative impact on this currency pair.

The recent gradual climb in the USD/JPY exchange rate suggests a weakening Japanese Yen after the BOJ intervention. Last night’s release of Japan’s Average Cash Earnings for March revealed some disappointing figure. The actual earnings of 0.6% fell short of the predicted 1.5%, indicating weaker-than-expected economic performance in terms of household earnings.

Moreover, the downward revision of February’s earnings from 1.8% to 1.4% further highlights the challenges facing Japan’s economy. These developments will contribute to the continued strength of the USD against the JPY, as weaker economic data from Japan will keep the BOJ accommodative and weigh on the yen’s value relative to the US dollar, hence bullish for USD/JPY. Earlier this morning we had the

Japan Household Spending for March

- Japanese household spending YoY came at -1.2%

- Spending is down for a 13th straight month

- That was better than the median market forecast for a 2.4% decline

- February household spending YoY was -0.5 per cent

- Seasonally adjusted month-on-month spending increased 1.2%, versus an estimated -0.3%

- February seasonally adjusted month-on-month spending was 1.4 per cent rise

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account