NZD/USD Rejected by the 200 SMA Again

The USD to NZD rate experienced fluctuations last week, with NZD/USD trading in a 50-pip range, as traders await the US CPI inflation report

The USD to NZD rate experienced fluctuations last week, with NZD/USD trading in a 50-pip range, as traders await the US CPI inflation report this week. Early this morning we had the Inflation Expectations QoQ by the Reserve Bank of New Zealand, but they didn’t change the overall picture.

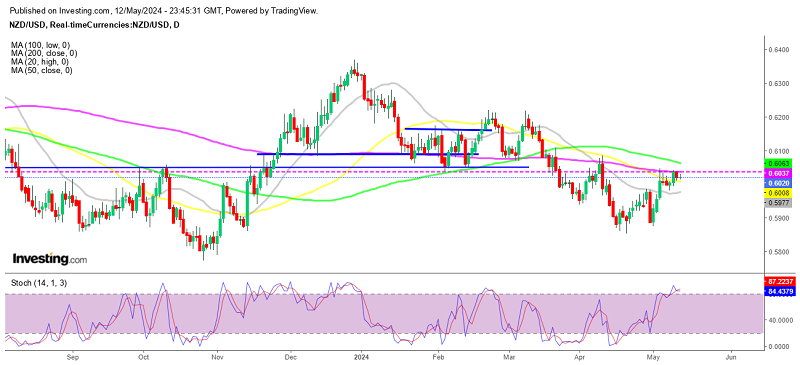

NZD/USD Chart Daily – MAs Are Keeping the Trend Bearish

Early this month, the exchange rate was trending upward as the USD started to tumble lower on weaker NFP, but last week, sellers reemerged around the 200-day simple moving average (purple), which has been acting as resistance on the daily chart for quite some time. Consequently, NZD/USD saw a retreat off this moving average early lay week and consolidated in a range, reflecting the uncertainty driven by fundamental factors.

The University of Michigan’s inflation outlook data had an impact on the foreign exchange market, leading to a strengthening of the US dollar, despite lower and subsequent downward pressure on NZD/USD. By the end of the week, the NZD/USD pair experienced a decline of approximately 0.2% as buyers seemed to lose momentum. This sluggish trend momentum suggests a potentially increasing bearish sentiment, as downward movements have extended the pair to 0.60 lows.

The retreat this pair was also partly due to expectations that the Reserve Bank of New Zealand (RBNZ) may reduce interest rates at its upcoming sooner than expected, possibly in the October meeting. Previously, markets had anticipated that the RBNZ would not pursue rate cuts until 2025. The shift in expectations reflects a more dovish outlook for monetary policy, influenced by risk-averse market sentiment and the resurgence of the US dollar. All this is collectively exerted downward pressure on the Kiwi.

Earlier today, we had the Inflation Expectations from the Reserve Bank of New Zealand (RBNZ).

Inflation Expectations From New Zealand

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account