Range Continues to Tighten in USDCAD As Triangle Closes

USDCAD has been quite volatile for about a month, making moves higher and then suddenly reversing back down.

USDCAD has been quite volatile for about a month, making moves higher and then suddenly reversing back down. Comments regarding the start of policy easing from both, the FED and the Bank of Canada, have been evasive, not indicating a clear date, while the economic data has also been mixed recently, which has left both currencies in a limbo.

The USD/CAD pair has been quiet today, following a doji candlestick formation yesterday which means a bullish move. However, there hasn’t been any such moves today, with the price bouncing in a tight range. The lack of data from Canada and the US contributed to this movement. Additionally, comments from Bank of Canada President Macklem, indicating an intention to start easing monetary policy soon. Despite these dovish statements, the uncertainty in the USD/CAD pair continues.

USD/CAD Chart Daily – The Triangle Is Closing Up

USD/CAD traders are currently trading the shorter-term technical levels, with the upside move being effectively stalled by the high price from Friday. So, buyers couldn’t keep the price above 1.08. On the downside, a swing range between 1.3650 and 1.36680 is preventing further decline. As support and resistance levels hold today, traders are awaiting the next directional move.

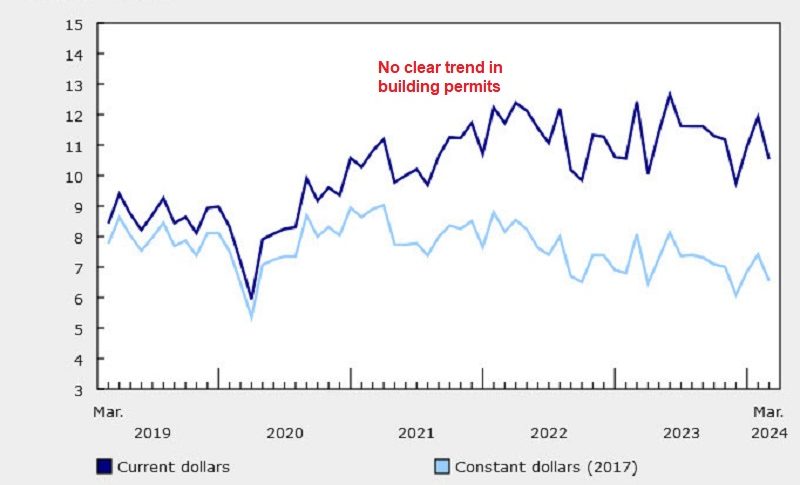

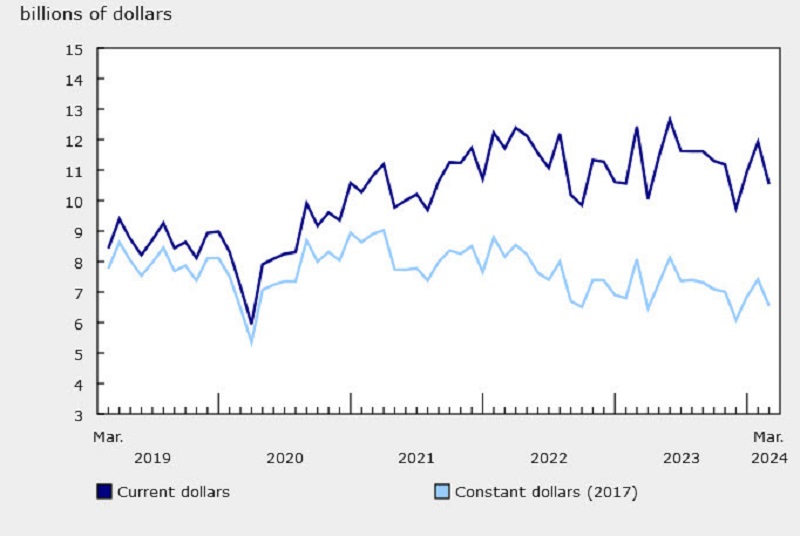

Canadian building permit data for March

- Canada March building permits -11.7% vs -3.3% expected

- Canada Febuary building permits were +9.3%

The non-residential component saw permits decline by 16.7% to $4.0 billion, while the residential sector experienced an 8.3% drop to $6.5 billion. This decline follows two months of consecutive gains, with the overall gain for Q1 amounting to +3.7% from Q4 2023.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account