US PPI Inflation Surges, USD Jumps but Ends Up Lower

The April US PPI inflation MoM came higher than expected, giving the USD a boost initially, but it soon gave back the gains and is now lower

The US PPI inflation MoM figures were a bit higher than expected, giving the USD a boost initially, but it soon gave back the gains and is now lower. As always, the first reaction was due to algo trading, with a spike in the USD after the jump in the PPI MoM reading sending stock markets and bonds lower.

When we look at the news or data in general though we must see how that changes the future expectations. If it doesn’t, then you will often see the price fading the spike. Anyway, the market is more focused on the US CPI report because that’s what the Fed cares most about now, even though they put a strong emphasis on the PCE inflation report as well. So, after this brief algos party which sent the USD up nd then down, we are seeing the market consolidating now until we get the US CPI which will be released tomorrow.

US April 2024 US Producer Price Index Inflation Report

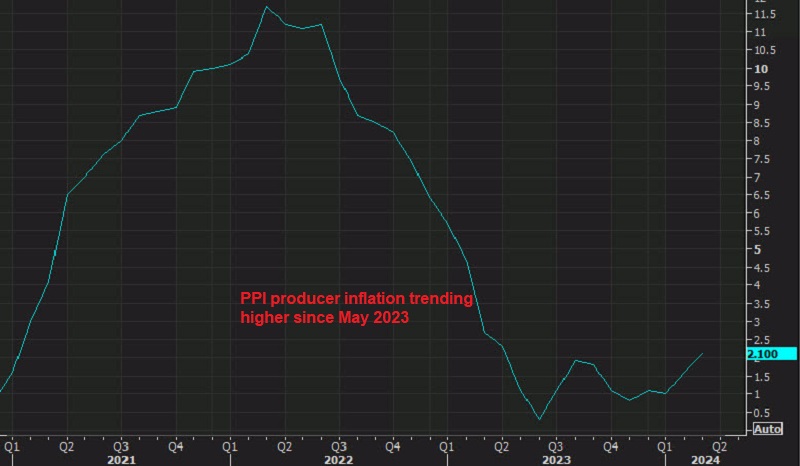

- Year-on-year (YoY) PPI: +2.2%, in line with expectations and up from March’s +2.1%.

- PPI for final demand: Increased by 0.5% month-on-month (MoM), beating expectations of +0.3%. The previous figure was revised from +0.2% to -0.1%.

- PPI excluding food and energy: YoY rate remained at +2.4%, meeting expectations. MoM increase was +0.5%, surpassing expectations of +0.2%. The previous figure, excluding food and energy, was revised from +0.2% to -0.1%.

The market reacted to the m/m reading but the hot number was entirely due to a revision lower to the March data. If you net those out, it’s right in line and that’s reflected in the year-over-year numbers. Ultimately, the price level is where economists thought it was. Now, you can argue there is some acceleration there but this is mostly commodity prices and oil has given some back this month.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account