Will Today’s UK Employment Warrant A BOE June Rate Cut?

The recent price action in the GBP to USD exchange rate has been showing uncertainty, as BOE remains uncertain about the first rate cut.

The recent price action in the GBP to USD exchange rate has been showing uncertainty, as BOE remains uncertain about the first rate cut. After experiencing a decline in the first week of May, GBP/USD managed to rebound following disappointing Non-Farm Payrolls (NFP) data released last week. Today, the market closely analyzed the UK March employment and earnings figures, especially in light of the Bank of England’s decision to link the potential for rate cuts to key economic data such as inflation and earnings.

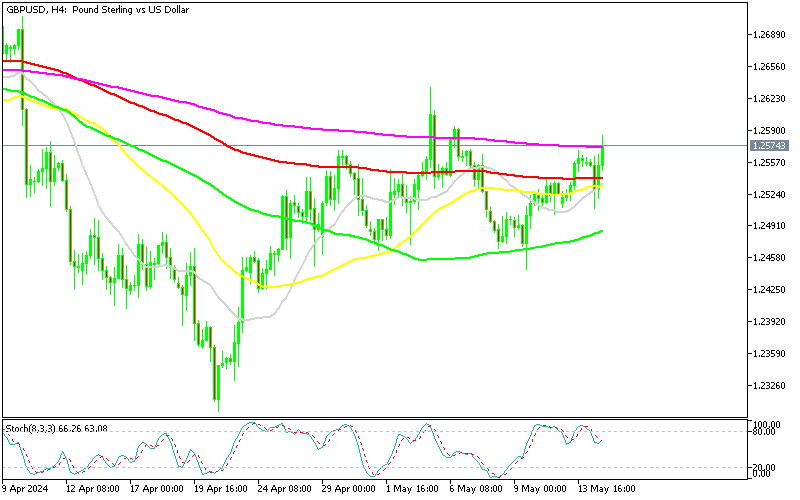

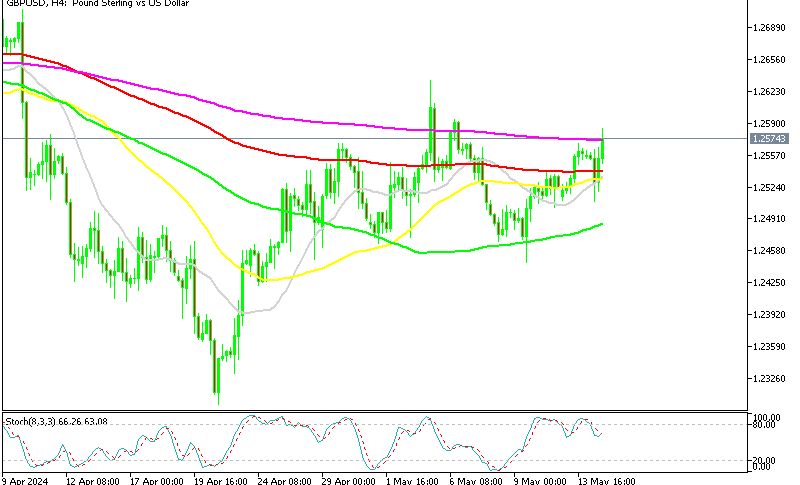

GBP/USD Chart Daily – The 200 SMA Continues to Act As Resistance

Following the Bank of England’s announcement last week, markets are expressing mixed sentiments regarding the possibility of an interest rate cut from them. While there’s a slight inclination towards a cut in June which would be bearish for GBP/USD , the situation remains highly uncertain. Ultimately, the decision may hinge on the upcoming UK consumer inflation report, as well as the employment and earnings figures released this morning.

The recent uptick in the National Living Wage may be causing policymakers to pause and carefully consider their next policy decision. Before committing to a rate cut, decision-makers will likely want to thoroughly assess the potential impact and ensure they fully understand the implications.

UK March ILO Unemployment Released by ONS – 14 May 2024

- ILO Unemployment Rate: Came in at 4.3%, matching expectations and slightly higher than the previous reading of 4.2%.

- Employment Change: Showed a decrease of 177,000, better than the expected decrease of 220,000. The previous figure was a decrease of 156,000.

- April Payrolls Change: Indicated a decrease of 85,000, worse than the previous reading of -67,000, which was revised to -5,000.

- Average Weekly Earnings (Including Bonuses): Increased by 5.7% year-on-year, surpassing the expected 5.5%. The previous figure was also 5.7%, revised from 5.6%.

- Average Weekly Earnings (Excluding Bonuses): Rose by 6.0% year-on-year, beating the anticipated 5.9%. The previous reading was also 6.0%.

Overall, while the unemployment rate remained steady, there was a decrease in employment, although not as severe as expected. Earnings showed positive growth, with both including and excluding bonuses exceeding expectations.

The UK’s unemployment rate has risen marginally, meeting forecasts, as employment fell again in March. Payrolls in April remained negative, despite a large upward revision to March statistics. Overall, the data is not especially useful to the Bank of England (BOE), as it implies that job growth is slowing, while pay pressures remain high for the time being. The pound fell 50 pips following that, but it recovered, with GBP/USD remaining flat at 1.2570s for the day.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account